As the August recess approaches, there have been several notable developments in the housing finance industry. Policymakers and industry leaders continue to focus on top priorities including new homeowner protections, the bipartisan infrastructure deal, housing affordability and supply, and down payment assistance (DPA), among others. Further, during the past month, U.S. Mortgage Insurers (USMI) released its latest Member Spotlight highlighting a Q&A with Enact’s President and CEO, Rohit Gupta; a statement congratulating Julia Gordon on her nomination to serve as Federal Housing Administration (FHA) Commissioner; and published two blog posts noting and discussing the top findings from USMI’s 2021 National Homeownership Market Survey. Below are some of the key developments USMI has been following over the last month.

Bipartisan Infrastructure Deal

USMI’s 2021 National Homeownership Market Survey

USMI Member Spotlight: Enact CEO Rohit Gupta Talks About First-Time Homebuyers

USMI Joins Coalition Letter to Infrastructure Bipartisan Senate Group on Usage of G-Fees

USMI’s Statement on Julia Gordon’s Nomination as FHA Commissioner

Biden Administration Announces New Homeowner Protections

FHFA Dropping Fee Introduced During COVID-19

House Financial Services Committee Holds Hearing with HUD Secretary Marcia Fudge

What We’re Reading: Congressional Proposals to Increase Homeownership

Bipartisan Infrastructure Deal. On July 28, the $1.2 trillion infrastructure deal cleared a major procedural vote in the Senate. The 67-32 vote passed with support from all 50 Democrats and 17 Republicans. This vote allows the Senate to start the debate and amendment process to resolve outstanding issues. Draft legislative text of the bill circulated on Thursday; however, the bill’s authors noted today that the text has not yet been finalized. According to the draft text, the bill would provide about $550 billion in new federal money for roads, bridges, and other physical infrastructure programs. While agreement on final text and clearing final votes in the House and Senate remain, if passed, the bill would mean the largest infusion of federal money into public works in more than a decade.

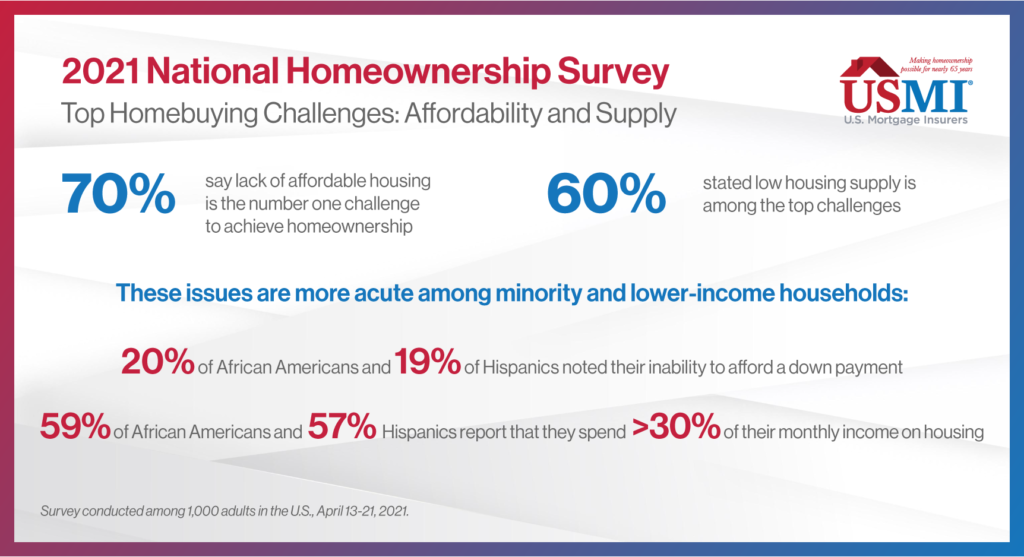

USMI’s 2021 National Homeownership Market Survey. Following the June release of USMI’s 2021 National Homeownership Market Survey, fielded by ClearPath Strategies to 1,000 adults in the U.S., USMI published two blog posts titled, “National Homeownership Market Survey: Key Takeaways,” and “Top Homebuying Challenges: Affordability and Supply.” In these posts, USMI highlights that more than 7 in 10 respondents view owning a home as important for stability and financial security. In addition, nearly 7 in 10 respondents ranked the lack of affordable housing as the number one housing challenge, while nearly 6 in 10 stated that low housing supply is another top issue, all of which become more acute among minority and lower income homebuyers. The latest blog notes that just this week, “the Federal Housing Finance Agency (FHFA) released its Home Price Index and reported that home prices were up 1.7 percent in May, and up an astonishing 18 percent year over year. This significant home price appreciation is largely driven by the lack of housing supply in today’s market and is impacting borrowers’ access to homeownership across the country.”

USMI Member Spotlight: Enact CEO Rohit Gupta Talks About First-Time Homebuyers. Earlier this month, USMI talked with Rohit Gupta, President and CEO of Enact, formerly Genworth Mortgage Insurance (MI), about the company’s new brand as well as how it is better positioned to serve low down payment borrowers and the first-time homebuyer market. Gupta said that private MI “is imperative in order for borrowers with low down payments to have access to home mortgage financing options,” and noted that Enact’s First-Time Homebuyer Market Report shows how the housing finance system continues to perform well with the private MI industry ensuring access to credit for first-time homebuyers.

USMI Joins Coalition Letter to Bipartisan Senate Infrastructure Group on Usage of G-Fees. Last week,USMI joined a coalition of housing finance organizations, including Mortgage Bankers Association (MBA), National Association of REALTORS®, and National Housing Conference, in sending a letter to the bipartisan Senate group negotiating infrastructure legislation. In this letter, the coalition requested that lawmakers refrain from utilizing guarantee fees (g-fees) charged by the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, as a source of funding offsets. G-fees are charged by the GSEs and intended to cover the credit risk and other costs that the GSEs incur when they acquire single-family loans from lenders, and the consumer ultimately pays for these fees in their mortgage costs. It is important that future homeowners not be saddled with additional cost burdens, especially those from spending that is not housing-related. As representatives of institutions that span the entire housing finance ecosystem, the coalition reaffirmed the belief that g-fees should only be used as originally intended: “a critical risk management tool to protect against potential mortgage credit losses and to support the GSEs’ charter duties.”

USMI Statement on Julia Gordon’s Nomination as FHA Commissioner. On June 28, USMI released a statement on President Biden’s nomination of Julia Gordon to serve as FHA Commissioner. Gordon has broad experience in the housing finance system, specializing in supporting affordable homeownership and promoting consumer protection policies for underserved markets. USMI President Lindsey Johnson said, “[w]e look forward to working closely with Gordon in seeking to promote a complementary, collaborative, and consistent housing finance system that enables sustainable homeownership for American families while also protecting taxpayers.”

Biden Administration Announces New Homeowner Protections. Last week, the Biden Administration unveiled additional actions to prevent foreclosures, offering loan modifications and payment reductions for homeowners with government-backed mortgages to help them stay in their homes, as the federal ban on foreclosures is set to end on July 31. The Biden Administration said about 1.8 million Americans remain in forbearance today, more than a year after emergency safeguards were put in place due to the COVID-19 crisis. The new loan modification programs for mortgages backed by the FHA, Department of Agriculture (USDA), and Department of Veterans Affairs will “aim to provide homeowners with a roughly 25 percent reduction in borrowers’ monthly principal and interest (P&I) payments to ensure they can afford to remain in their homes and build equity long-term.”

Additionally, on Thursday, the White House called on Congress to extend the eviction moratorium and announced that President Biden has “asked the U.S. Departments of Housing and Urban Development, Agriculture, and Veterans Affairs to extend their respective eviction moratoria through the end of September, which will provide continued protection for households living in federally-insured, single-family properties.” Today, FHA announced an extension of its single family eviction moratorium through September 30, and FHFA announced that it will be extending its COVID-19 real estate owned (REO) Eviction Moratorium through September 30, 2021. The REO eviction moratorium applies to properties that have been acquired by an Enterprise through foreclosure or deed-in-lieu of foreclosure transactions. The current moratorium was set to expire on July 31, 2021.

Lastly, late Thursday evening, U.S. House Financial Services Committee (HFSC) Chairwoman Maxine Waters (D-CA) and 100 Democratic cosponsors introduced H.R. 4791, the “Protecting Renters from Evictions Act of 2021,” which would extend the moratorium on residential evictions through December 31, 2021.

FHFA Dropping Fee Introduced During COVID-19. On July 16, the FHFA announced that the GSEs will eliminate the Adverse Market Refinance Fee for loan deliveries effective August 1, 2021. At the direction of FHFA, the GSEs implemented a 50-basis point refinance fee for mortgages at or above $125,000 to cover potential losses due to the COVID-19 pandemic. The fee took effect December 1, 2020 and, according to the MBA, added approximately $1,400 to the cost of refinancing most mortgages. “The COVID-19 pandemic financially exacerbated America’s affordable housing crisis,” said FHFA Acting Director Sandra L. Thompson, adding, “[e]liminating the Adverse Market Refinance Fee will help families take advantage of the low-rate environment to save more money.”

House Financial Services Committee Holds Hearing with HUD Secretary Marcia Fudge. On July 20, the HSFC held a hearing titled, “Building Back A Better, More Equitable Housing Infrastructure for America: Oversight of the Department of Housing and Urban Development,” (HUD) in which Secretary Marcia Fudge participated as a witness. During the hearing, legislators demonstrated bipartisan agreement on housing affordability becoming a growing challenge. Secretary Fudge indicated in her opening remarks that housing affordability “keeps families awake at night,” and said that housing is “the number one crisis in this country today.” Committee members discussed several facets of the issue and a variety of approaches to address it, particularly in support of first-time homebuyers finding themselves priced out of a competitive market. Representatives Blaine Luetkemeyer (R-MO) and Ted Budd (R-NC) inquired about HUD’s potential tools to combat the impacts of regulations on housing costs. Secretary Fudge conveyed that HUD is exploring tools at the federal level to incentivize localities to update their zoning policies and remove other statutory barriers to affordable housing. Representative Ted Budd (R-NC) asked Secretary Fudge about how the $213 billion in funding proposed in President Biden’s infrastructure plan for new and rehabilitation of existing affordable housing would be divided. Fudge noted that dollar amounts had not been decided but the administration is targeting the development of 2 million new units and rehabilitation of 500,000 existing units. Other topics discussed included accessibility and affordability of FHA credit, GSE lending to minority borrowers, HUD appraisal task force, climate risks, and Property Assessed Clean Energy (PACE) loans.

What We’re Reading: Congressional Proposals to Increase Homeownership. On July 19, USMI published a blog post titled, “Washington Focuses on Infrastructure and Equity with an Eye Toward Homeownership.” The blog notes that as policymakers shift their focus from the COVID-19 pandemic to negotiating and drafting legislative text for President Biden’s infrastructure proposals, Congressional Democrats are championing housing policies intended to promote equitable communities and give traditionally underserved Americans a stake in those communities. In this sense, the piece outlines and details the various legislative proposals put forth by Democratic legislators to help these underserved communities. Many of these proposals seek to address issues such as the critical housing supply shortage, first-time/first-generation DPA proposals, tax incentives to support homeownership, and home equity building opportunities.

USMI released principles for Access and Affordability in January, in which it suggests that “existing DPA programs— and any expansions – should balance responsible underwriting that promotes sustainable homeownership and access to affordable low down payment mortgages. DPA programs should be targeted to serve the creditworthy borrowers who are unable to attain even a 3 [percent] or 3.5 [percent] down payment. It is important that DPA programs are structured and operated in a sustainable manner so as to not create excessive leverage and risk within the mortgage finance system, or pose undue risk to taxpayers and the economy, which will ultimately hurt vulnerable homeowners most.” Further, USMI encouraged policymakers, including HUD Secretary Marcia Fudge, to pursue policies that promote affordable and sustainable access to mortgage finance credit, but that do not add fuel to the fire in terms of artificially lowering what is already relatively affordable mortgage finance credit as such actions would inject more “demand” into the market without addressing the “supply” side—which will only drive-up home prices further, hurting affordability at the lower end of the market most.