Blog: Key Takeaways from National Homeownership Market Survey

On June 22, USMI released the results of its 2021 National Homeownership Market Survey. ClearPath Strategies fielded the national survey among 1,000 U.S. adults in the general population from April 13-21. Quotas were set to ensure a cross sample of age, gender, race, region, and education as well as homeowners, first-time homebuyers, and prospective homebuyers. The purpose was to understand the perceptions around homeownership, the mortgage process, and the challenges people face when trying to purchase a home.

This blog is the first in a series that will explore the findings from this comprehensive survey around the housing and mortgage markets in the United States. We kick off the series with the seven key takeaways from the national survey. The complete findings from USMI’s national survey are available here.

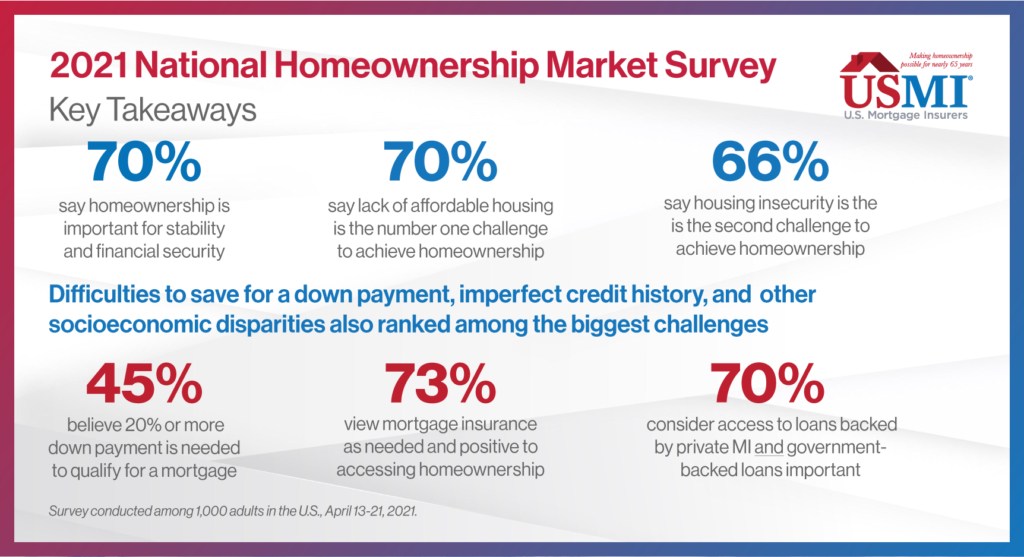

- Owning a home matters. More than 7 in 10 respondents see owning a home as important for stability and financial security. However, as we dig into the other key findings, economic and access gaps lead to challenges to buying a home.

- Lack of affordable housing and low supply of housing ranked among the top homebuying challenges. In fact, nearly 7 in 10 respondents ranked the lack of affordable housing as the number one housing challenge and nearly 6 in 10 stated that low housing supply is another top issue. This is contextualized by the current historically low housing supply, which is most acute in the “starter home” segment of the market.

- Housing insecurity during the pandemic was also a significant concern for Americans, particularly among minorities. Sixty-six percent of all respondents ranked housing insecurity, including concerns about the ability to make mortgage and rental payments, as the second highest housing challenge. A further dive into the survey findings underscores these economic concerns are particularly acute among minorities. African Americans and Hispanics said that falling behind on rent or mortgage payments was their number one concern. Twice the number of African American respondents (20 percent) and more than one-half times the number of Hispanic respondents (16 percent) reported this concern compared to white respondents (10 percent).

- The inability to save for a down payment and imperfect credit history also ranked among the biggest challenges to buying a home. African American (74 percent) and Hispanic (66 percent) respondents reported that in addition to the lack of affordable homes or lack of supply on the market, the inability to save for a down payment (39 percent of all minorities) and imperfect credit history (37 percent of all minorities) are the biggest challenges they face when it comes to buying a home. Of all adults surveyed, 60 percent view “credit score” as having the most impact on the cost of a mortgage, while 81 percent said they understand the factors that impact one’s credit score and 79 percent view credit scores as being fair.

- Socioeconomic disparities – such as lower income, lack of intergenerational wealth, limited savings, and the percentage of monthly income dedicated to housing costs – only add to the challenges to buying a home. These factors can lead to lower credit scores and higher overall debt loads to manage, which all can contribute to greater challenges to achieving homeownership. African American and Hispanic respondents rank these issues as more significant challenges compared to white respondents.

- Many Americans still do not realize that low down payment mortgages are widely available. Up to 45 percent of all respondents mistakenly believe that you need a down payment of 20 percent or more to qualify for a mortgage. Thirty percent of all adults surveyed indicate that they are not familiar with down payment requirements. In truth, homebuyers can qualify with a down payment as low as 3 percent with private mortgage insurance, and as low as 3.5 percent with a loan backed by the Federal Housing Administration (FHA).

- While down payments continue to be a significant challenge, mortgage insurance (MI) is seen as leveling the playing field and respondents express strong support for access to mortgages with MI in both the conventional and government-backed markets. Seventy-three percent of all respondents view mortgage insurance as needed and positive to accessing homeownership. MI provides access to home financing for those who might not otherwise be able to purchase a home due to limited funds for a down payment. Nearly 70 percent of respondents cited that it was important to have access to loans through the conventional market backed by private MI and government-backed loans through the FHA.