Blog: Affordability and Supply Among Top Homebuying Challenges

The lack of affordable housing continues to be a focal point for the mortgage finance community as low- to-moderate income (LMI) and first-time homebuyers continue to report challenges in buying starter homes. In fact, today, the Federal Housing Finance Agency (FHFA) released its Home Price Index and reported that home prices were up 1.7 percent in May, and up an astonishing 18 percent year over year. This significant home price appreciation is largely driven by the lack of housing supply in today’s market and is impacting borrowers’ access to homeownership across the country. Therefore, it is no surprise this topic has become an elevated policy concern, as the “underbuilt” gap has dramatically increased over the last decade, and between 2018 and 2020, the housing stock deficit increased by more than 50 percent according to a recent Freddie Mac report.

The National Association of REALTORS® (NAR) recently released a report that highlights the dire housing supply situation our nation currently faces. “The state of America’s housing stock […] is dire, with a chronic shortage of affordable and available homes [needed to support] the nation’s population,” and adds that “[a] severe lack of new construction and prolonged underinvestment [have led] to an acute shortage of available housing […] to the detriment of the health of the public and the economy.” In addition to finding an underbuilt gap of 5.5 to 6.8 million housing units since 2001, the report notes that unbuilt single-family homes account for 2 million of those units. This shortage of available and affordable homes, coupled with a robust demand, is fueling the rise of housing prices for potential homebuyers, putting the goal of homeownership further out of reach. NAR’s Chief Economist Lawrence Yun stated in the report, “[t]here is a strong desire for homeownership across this country, but the lack of supply is preventing too many Americans from achieving that dream.” In late June, USMI released its 2021 National Homeownership Market Survey, fielded by ClearPath Strategies among 1,000 U.S. adults in the general population, which found that Americans understand the importance of owning a home: more than 7 in 10 respondents see this as important for stability and financial security.

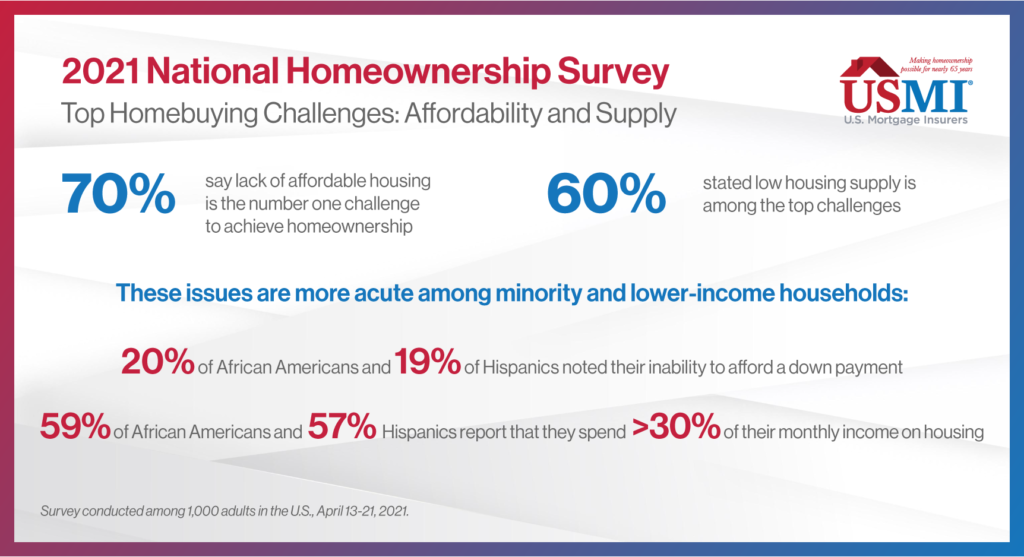

USMI, in representing a sector of the industry that is dedicated to facilitating affordable low down payment lending and promoting sustainable homeownership, explored this topic in our recent survey, which found that lack of affordable housing and low supply of housing ranked among the top homebuying challenges. In fact, nearly 7 in 10 respondents ranked the lack of affordable housing as the number one housing challenge and nearly 6 in 10 stated that low housing supply is another top issue. These issues were more acute among minority and lower income homebuyers as 20 percent of African American and 19 percent of Hispanic respondents note their inability to afford a down payment. Further, more than half of African Americans (59 percent) and Hispanics (57 percent) reported spending over 30 percent of their monthly income on housing, the threshold for a household to be considered “housing-cost burdened.” The complete findings from USMI’s national survey are available here.

These challenges are front and center of the nation’s housing agencies, FHFA and the Federal Housing Administration (FHA). Last month, President Biden appointed Sandra L. Thompson as FHFA’s Acting Director, having previously served as the Deputy Director of the Division of Housing Mission and Goals since 2013. In her accepting remarks, Thompson stated that “[t]here is a widespread lack of affordable housing and access to credit, especially in communities of color,” adding that “[i]t is FHFA’s duty through our regulated entities to ensure that all Americans have equal access to safe, decent, and affordable housing.” President Biden also recently nominated Julia Gordon to be the Assistant Secretary for Housing and FHA Commissioner.

USMI continues to urge policymakers and the housing finance industry to focus on addressing this historic shortage of affordable homes to help balance housing prices and ensure access to homeownership. In a letter directed to the Department of Housing and Urban Development (HUD) Secretary Marcia Fudge, USMI urged HUD to avoid policies that would stoke more demand in the marketplace without addressing the supply issues, as not doing so will only worsen the affordability challenges. And while addressing supply and the shortage of affordable homes is imperative, policymakers must also not lose sight of addressing the issues that unnecessarily increase costs or create barriers for minority and lower income homebuyers. Importantly, expanding homeownership opportunities for these borrowers does not have to be at the expense of reforms made over the last decade that have strengthened the system to reduce risk, protect borrowers, and avoid another housing market collapse.

We appreciate that policymakers recognize the role of low down payment mortgage options in facilitating homeownership. USMI’s survey found that consumers view mortgage insurance (MI) as an important piece of the homeownership puzzle, specifically because MI levels the playing field by helping LMI and first-time buyers access home financing. In fact, 73 percent of all respondents view MI as needed and positive to obtaining homeownership, and nearly 70 percent of respondents citing that it is important to have access to these low down payment loans through both the conventional market backed by private MI and government-backed loans through FHA.