USMI submitted a comment letter to the Consumer Financial Protection Bureau (CFPB) in response to its Request for Information (RFI) on the assessment of the 2015 Home Mortgage Disclosure Act (HMDA) Rule. In the letter, USMI discusses the importance of the HMDA Rule in eliminating lender discrimination and its value in monitoring how regulatory changes impact who receives mortgages. USMI believes that the benefits of the HMDA Rule’s expanded reporting requirements, including for compliance personnel and technology systems, outweigh the incremental costs for mortgage lenders to comply with the rule. We encourage the CFPB to work with the FHFA to expand analytical capabilities by publicly releasing more granular loan-level mortgage origination data. Click here to read the full letter.

Author: dcadmin

Member Spotlight: Q&A with Brad Shuster of National MI

USMI’s member spotlight series focuses on how the private mortgage insurance (MI) industry works to address several critical issues within the housing finance system, including expanding access to affordable mortgage credit for first-time and minority homebuyers, protecting taxpayers from mortgage credit risk, and recommendations on ways to reform and enhance the housing finance system to put it on a more sustainable path for the long-term.

This month we chat with Brad M. Shuster, National MI’s Founder, Executive Chairman of NMI Holdings, Inc., and Immediate Past Chairman of USMI’s Board. Founded in 2012, National MI was built to serve borrowers, mortgage lenders, and the housing industry by helping more families achieve affordable and sustainable homeownership. The company continues to implement innovative risk management strategies to ensure lenders’ confidence and help borrowers qualify for low down payment mortgages. National MI consistently demonstrates a track record of strong performance and growth while delivering innovative mortgage solutions.

Below, Mr. Shuster discusses National MI’s views on what the housing finance industry should focus on to ensure access for first-time homebuyers as home prices continue to rise and demand remains robust. He also talks about the findings of the 2021 NextGen Homebuyer Report and how demographic changes are shaping the mortgage industry.

(1) Home-price growth reached a record high in the third quarter of 2021, and demand from homebuyers remains robust despite rapidly increasing home prices. What do you think the housing finance industry should do or focus on to improve first-time homebuyers’ access to the housing market?

We are seeing more and more first-time homebuyers enter the housing market. Housing continues to remain strong and as a result, we are seeing an imbalance of supply and demand in the market, creating entry barriers to prospective homebuyers.

While strong House Price Appreciation (HPA) is great for current homeowners, it creates a moving target for those looking to transition from renting to owning. We see historically low supply, especially in the starter home segment of the market. According to the National Association of Home Builders (NAHB) there was only 2.1 months of supply for existing homes as of November 2021. And a recent National Association of REALTORS® (NAR) report said that housing affordability will be an increasingly important consideration for buyers, but with rents rising by 18.5 percent, buying may be the relatively more affordable housing option for some.

Now more than ever, there is a societal need to help qualified borrowers use private mortgage insurance to achieve the dream of homeownership affordably, responsibly and sustainably, and we take that role very seriously.

The housing finance industry should focus on educating homebuyers about all of the options available for mortgage financing. It is critical that younger, first-time and minority homebuyers – who often lack the resources or intergenerational wealth to afford a 20 percent down payment – are aware of the availability of lower down payment mortgages made possible by the support of private MI.

The industry also needs to educate potential homebuyers on the significant benefits of purchasing a home sooner with a low-down payment, rather than waiting many years to save up for a bigger down payment. Buying a home earlier means that the homeowner can begin to build equity and long-term wealth rather than waiting to enter the market.

The increase to the government-sponsored enterprises (GSEs) conforming loan limits for 2022 recently announced by the Federal Housing Finance Agency (FHFA) will also help open up the market, particularly in high-cost areas.

The private MI industry is well-positioned to help meet the needs of consumers and to drive responsible growth in the mortgage market by facilitating access to sustainable low down payment loans for millions of mortgage-ready borrowers. As part of that effort, our industry is working to raise consumers’ awareness of all mortgage financing options available.

(2) In October 2021, National MI collaborated with Cultural Outreach and the Mortgage Bankers Association (MBA) to study NextGen (ages 22-37) homebuying and economic trends. The 2021 NextGen Homebuyer Report found that this generation exhibits different spending patterns and has a lack of understanding about the homebuying process, especially around down payment and income requirements. Could you tell us more about these trends? What patterns are this generation following when it comes to buying a home? Why do you think that is the case?

National MI is committed to expanding homeownership to all segments of the market, and our work with Cultural Outreach and the MBA on the NextGen Homebuyer Report is an important step in that direction. The NextGen population is significant: it accounts for one out of every three home purchases. The report uncovers the challenges and concerns this group of consumers has about entering the housing market.

The 2021 survey revealed that many NextGen future buyers are unsure whether purchasing a home is a good investment. NextGen buyers also indicate that COVID-19 has had a significant impact on their plans to purchase a house. They perceive a lack of information on personal finance and mortgage loans, so they increasingly are performing their own research, turning to their personal networks as one source.

That provides further evidence that the mortgage finance industry needs to do more to educate the NextGen segment of potential homebuyers on what it takes to be “mortgage-ready” and about their different low down payment options. In particular, we need to dispel the myth that to purchase a home, you must have a 20 percent down payment. In fact, the report indicates that more than half of the survey respondents mistakenly believe that they need to save 20 percent for a down payment. By raising awareness of mortgage financing options available with private MI, many NextGen consumers could come to realize that that homeownership may be closer than they think.

USMI’s most recent “MI In Your State Report” provides an analysis of how long it could take for a borrower to save 20 percent compared to a 5 percent down payment. The report found that saving for a 20 percent down payment could take potential homebuyers 21 years — three times the length of time it could take to save for a 5 percent down payment with private MI. For example, for a household earning the 2019 national median income of $68,703, it would take 21 years to save 20 percent, plus closing costs, for a single-family home. That number increases to 26 years for a Hispanic household and to 32 years for a Black household. Private MI can help reduce that timeframe to seven years. That is quite a difference.

(3) National MI hosted two webinars (here and here) on what diversity means in the mortgage industry, which you presented in collaboration with Tony Thompson from the National Association of Minority Mortgage Bankers of America (NAMMBA). Can you share insights into where our industry is today and how it can leverage diversity as a competitive marketplace advantage?

The newest generation of homebuyers is more diverse than previous generations in terms of race, gender, and socioeconomic status. National MI’s training platform offers relevant educational topics to our lender customers, and part of our success has been quickly shifting and refreshing what we offer to address an evolving set of customer needs. Since the data increasingly shows mortgage consumers are young and diverse, the mortgage industry needs to catch up to the new marketplace, especially in gaining skills and seeking guidance in media and training resources to reach the growing market of new homebuyers. Collaborating with industry partners such as NAMMBA enables us to move the conversation forward.

It is also important that companies take steps to make sure their workforces reflect the diversity in the population of homebuyers. When making one of the biggest financial decisions of their lives, consumers may feel more comfortable working with people who look like them and have a similar culture and background.

Still, the real estate finance industry has made great strides to promote diversity, equity and inclusion (DEI). At National MI, DEI is one of our core values and has always been a part of our company culture. Our efforts to further diversity, equity and inclusion guide us both internally and externally as we work to partner with diverse customers, clients and vendors by providing innovative products and value-driven services.

Brad M. Shuster’s Biography

Brad M. Shuster has served as Executive Chairman of the Board of NMI Holdings, Inc. since January 2019. He founded National MI in 2012 and served as Chairman and Chief Executive Officer of the company from 2012 to 2018.

Prior to founding National MI, Mr. Shuster was a senior executive with The PMI Group, Inc., where he served as President of International and Strategic Investments and Chief Executive Officer of PMI Capital Corporation. Before joining PMI in 1995, he was a partner at Deloitte LLP, where he served as partner-in-charge of Deloitte’s Northern California Insurance and Mortgage Banking practices.

Mr. Shuster holds a B.S. from The University of California, Berkeley and an MBA from The University of California, Los Angeles. He has received both CPA and CFA certifications.

Statement: Nomination of Sandra Thompson as FHFA Director

WASHINGTON — Lindsey Johnson, President of the U.S. Mortgage Insurers (USMI), today issued the following statement on President Biden’s intent to nominate Sandra Thompson for Federal Housing Finance Agency (FHFA) Director:

“USMI and our member companies welcome President Biden’s nomination of Sandra Thompson to serve as the next Director of FHFA. Thompson brings decades of experience in financial regulation, risk management, and consumer protection, all of which will help ensure the safety and soundness of the GSEs, Fannie Mae and Freddie Mac, and the Federal Home Loan Banks and will help instill strength into the housing finance system.

“Since being named Acting Director of FHFA in June, Thompson has quickly demonstrated her commitment to promoting an equitable and robust conventional mortgage market that balances access to affordable and sustainable mortgage credit. Private mortgage insurers share Thompson’s objectives to achieve sustainability and affordability for borrowers, as well as enhance equitable access to all those who are mortgage ready. Once confirmed by the Senate, the MI industry looks forward to continuing to work with Thompson in her new capacity to advance these goals.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Newsletter: December 2021

With the recent passage of the bipartisan infrastructure bill, Congress has moved onto the Build Back Better Act, which includes approximately $170 billion in funding for housing initiatives. On December 1, a bill was introduced in the House to make permanent and expand eligibility for the federal tax deduction of mortgage insurance (MI) premiums. USMI recently submitted two comment letters to the Federal Housing Finance Agency (FHFA) on its proposed “Amendments to the Enterprise Regulatory Capital Framework Rule,” and its “Enterprise Equitable Housing Finance Plans.” Finally, USMI published a new blog examining the costs that are often additional and unanticipated by prospective homeowners. We delve into these developments and more below.

Build Back Better Act

The Middle Class Mortgage Insurance Premium Act of 2021

USMI Submits Comment Letter on FHFA’s Proposed Amendments to the Enterprise Regulatory Capital Framework

USMI Submits Comment Letter on FHFA’s Enterprise Equitable Housing Request for Input

New Blog: Hidden Costs Harmful to Homeownership

What We’re Reading

Nominations We’re Watching

ICYMI: USMI Member Spotlight – Essent

Build Back Better Act. The House passed the $1.75 trillion Build Back Better (BBB) Act on November 19, sending the social spending bill to the Senate. The legislation allocates about $170 billion to provisions for affordable housing. According to the Biden administration, this would be the largest investment in affordable housing in history and it will mean the construction or preservation of more than 1 million affordable homes. BBB, in its current form, would provide funding for numerous homeownership initiatives, including: $10 billion for first-generation first-time homebuyer down payment assistance (DPA) based on House Financial Services Committee Chairwoman Maxine Waters’ (D-CA) “Downpayment Toward Equity Act”; $10 billion for the U.S. Department of Housing and Urban Development’s (HUD) HOME Investment Partnerships Program to fund building, buying, and/or rehabilitating affordable housing for rent or homeownership; $5 billion for wealth-building loans (20-year subsidized mortgages) for first-generation first-time homebuyers based on Sen. Mark Warner’s (D-VA) “Low-Income First-Time Homebuyers Act” (LIFT Act); $1.75 billion for a new “Unlocking Possibilities” zoning and land use reform program; $800 million for fair housing activities; and $100 million for a pilot program at HUD to expand small-dollar mortgage options for homebuyers purchasing homes at $100,000 or less.

The Middle Class Mortgage Insurance Premium Act of 2021. On December 1, Reps. Ron Kind (D-WI) and Vern Buchanan (R-FL) introduced legislation that would make permanent and expand eligibility for the deduction of MI premiums from federal income taxes. USMI released a statement writing that the legislation “is smart public policy that benefits potentially millions of existing homeowners…Since 2007, the ability to deduct the cost of MI premiums has helped to put extra dollars back into the hands of millions of families each year and we strongly support legislation to make the tax deduction permanent.” MI deductibility has enjoyed broad bipartisan support, dating back to when the bill was originally introduced in 2005, and continues to have broad housing industry support, including from the Mortgage Bankers Association, National Association of Home Builders, National Association of REALTORS®, and National Housing Conference. National Mortgage News, DS News, Financial Regulation News and InsuranceNewsNet.com published articles on the proposed legislation that quote the bill’s sponsors and USMI.

USMI Submits Comment Letter for FHFA’s Proposed Amendments to the Enterprise Regulatory Capital Framework. On November 23, USMI submitted a comment letter on FHFA’s Notice of Proposed Rulemaking (NPR) on “Amendments to the Enterprise Regulatory Capital Framework (ERCF) Rule – Prescribed Leverage Buffer Amount and Credit Risk Transfer.” In its letter, USMI recommends that FHFA adjust the credit risk transfer (CRT) minimum risk weight floor to lower than 5 percent, consider alternative methods to determine the Prescribed Leverage Buffer Amount (PLBA), reduce the single-family risk weight floor to 10 percent or less, and make changes to the Countercyclical Adjustment. These recommendations are outlined further in USMI’s executive summary to the comment letter.

Most comments to the NPR support the proposed changes by FHFA to CRT and the PLBA. On the PLBA, many respondents note that the proposed changes would make the framework more risk-based and prevent the PLBA from being the typical binding requirement. On the proposed changes to reduce the minimum risk weight floor for CRT from 10 to 5 percent, most commenters generally supported the reduction and some suggested it be reduced or refined further. Most commenters also supported the removal of the overall effectiveness adjustment for CRT. In addition, many responses – including from insurance agency Guy Carpenter, Freddie Mac, and the Housing Policy Council – support reducing the single-family risk weight floor below the current 20 percent in the final rule. Further, several other organizations – including Urban Institute, Center for Responsible Lending, National Community Stabilization Trust, National Housing Conference, Consumer Federation of America, Leadership Conference and the National Association of REALTORS® – express concerns with the current Countercyclical Adjustment and recommend FHFA revisit this element within the final rule to ensure it will not have unintended consequences.

In a press release, USM President Lindsey Johnson is quoted saying, “We appreciate the work FHFA has undertaken to date to provide for minimum capital requirements for the Enterprises, including the December 2020 final rule to establish a post-conservatorship capital framework. While a robust framework is necessary to ensure the stability of the housing finance system, overly stringent requirements or ones that inaccurately reflect the risks of the assets held by the Enterprises can be disruptive. It is critical FHFA creates a capital framework that strikes an appropriate balance between maintaining borrowers’ access to affordable mortgage credit and ensuring the Enterprises and taxpayers are protected from risk.”

USMI Submits Comment Letter on FHFA’s Enterprise Equitable Housing Request for Input (RFI). On October 25, USMI submitted a comment letter to FHFA’s RFI on “Enterprise Equitable Housing Finance Plans” (the Plans), which articulates a framework by which the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, will be required to prepare and implement three-year plans to advance equity in housing finance. USMI writes in its letter that it “commends the FHFA for soliciting feedback on the Plans to identify the barriers to sustainable housing opportunities, set goals to address those barriers, and implement policies to address them. The private MI industry welcomes the opportunity to work with FHFA, the GSEs, and other housing finance stakeholders to support the Biden Administration’s goal of a comprehensive approach to advancing equity for all.” In its comment letter, USMI specifically recommends that FHFA review and reform loan-level price adjustments (LLPAs); review and revise the ERCF; modify the Preferred Stock Purchase Agreements (PSPAs); finalize the new products and activities rule; and provide greater data and transparency to address longstanding inequities in the housing finance system.

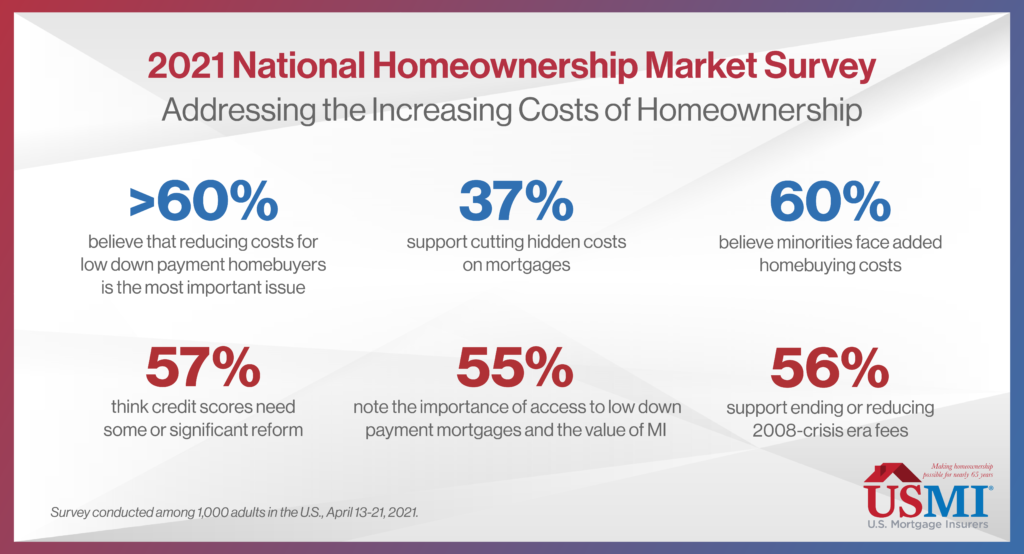

New Blog: Hidden Costs Harmful to Homeownership. In USMI’s latest blog on its 2021 National Homeownership Market Survey, we examined the way hidden or unanticipated costs impact homeownership. Home prices are increasing at historic levels and consumers expect both home prices and mortgage interest rates to increase over the next year. Sixty percent of respondents to the survey believe minorities face added homebuying costs because they tend to have lower credit and higher debt according to the survey. The survey also found that 60 percent of respondents believe reducing costs for low down payment homebuyers is the most important item for the homebuying process and 37 percent support cutting hidden costs on mortgages.

What We’re Reading. On December 2, Fannie Mae released a report titled, “Barriers to Entry: Closing Costs for First-Time and Low-Income Homebuyers,” which analyzed the costs associated with closing a mortgage loan and presented potential solutions to reduce certain closing costs for specific borrowers, where these additional costs may act as a barrier to homeownership. Based on a sample of 1.1 million conventional purchase mortgages acquired in 2020, Fannie Mae found that “median closing costs as a percent of home purchase price were 13 percent higher for low-income first-time homebuyers than for all homebuyers, and 19 percent higher than for non-low-income repeat homebuyers.”

Nominations We’re Watching. Julia Gordon, the nominee to lead the Federal Housing Administration, is still waiting on a full Senate vote. Meanwhile, the Senate Committee on Banking, Housing, and Urban Affairs on December 2 favorably reported via voice vote the nomination of Alanna McCargo to serve as the president of Ginnie Mae.

ICYMI: USMI Member Spotlight – Essent. In case you missed it, Essent Chairman and CEO Mark Casale was featured on our member spotlight. Casale shared his thoughts on Essent’s views on the housing market as we come out of the COVID-19 pandemic, the continued evolution of the private MI industry and the role of innovation, and how this evolution will better serve borrowers and the housing finance system. Read the full Q&A here.

Blog: Addressing the Increasing Costs of Homeownership

Buying a home is the largest single investment most Americans will make, but during the last few years, that dream has become increasingly unreachable for a significant portion of the population as the housing market experiences strong home price appreciation (HPA) and historically low levels of supply. A recent Wall Street Journal article reported on this rising home price trend, outlining how mortgage payments can become unaffordable as a result. According to the Federal Reserve Bank of Atlanta, the median American household would need 32.1 percent of its income to cover mortgage payments on a median-priced home – the most since November 2008, when the same outlays would require 34.2 percent of income. Moreover, the Federal Housing Finance Agency’s (FHFA) 2021 Q3 House Price Index (HPI®) report indicates that house prices were up 4.2 percent compared to the second quarter of 2021, but the real surprise comes when you look over the one year period during which home prices climbed 18.5 percent.

With this in mind, it is no surprise that an increasing number of consumers (64 percent) believe it is a bad time for buying a home, according to Fannie Mae’s latest Home Purchase Sentiment Index (HPSI®). This is a dramatic change from a year ago when that rate stood at only 35 percent, a change driven by consumers’ sentiments that home prices (plurality at 45 percent) and mortgage rates (majority at 58 percent) will increase over the next 12 months.

This entire situation only serves to push the goal of owning a home further out of reach for many prospective first-time, minority, and low- to moderate-income (LMI) homebuyers. In addition, there are other fees and charges that potential homebuyers could incur, increasing the cost of homeownership for creditworthy borrowers throughout the country. In fact, USMI’s 2021 National Homeownership Market Survey, which polled 1,000 adults in the U.S., found that 60 percent of respondents believe minorities face added homebuying costs because they tend to have lower credit and higher debt.

Moreover, when asked about the priorities and reforms the housing finance industry should focus on, over 60 percent of respondents believe that reducing costs for low down payment homebuyers is the most important item for the home buying process, and 37 percent support cutting hidden costs on mortgages. Other issues respondents conveyed include:

- Nearly 70 percent of respondents ranked the lack of affordable housing as the number one housing challenge and almost 60 percent stated that low housing supply is another top issue.

- 61 percent of respondents want to eliminate added costs for low down payment homebuyers and 56 percent of respondents specifically support ending Loan-Level Price Adjustments (LLPAs), 2008-crisis era fees that disproportionately affect minority and first-time homebuyers.

- 55 percent of respondents noted the importance of access to low down payment mortgages and the value of mortgage insurance (MI) to help borrowers qualify for mortgage financing.

- 57 percent think credit scores need some or significant reform, driven by respondents’ view that credit score is the underwriting element that most impacts mortgage costs.

Many of the “hidden costs” that borrowers reference when purchasing a mortgage are not really “hidden,” but instead are costs that they may not have anticipated incurring as part of closing the loan. Last week, Fannie Mae released a report titled, “Barriers to Entry: Closing Costs for First-Time and Low-Income Homebuyers,” which finds “[i]n a sample of approximately 1.1 million conventional home purchase loans acquired by Fannie Mae in 2020, median closing costs as a percent of home purchase price were 13 [percent] higher for low-income first-time homebuyers than for all homebuyers, and 19 [percent] higher than for non-low-income repeat homebuyers.” The report also finds that “Black and white Hispanic low-income first-time homebuyers on average paid higher closing costs relative to purchase price than their white non-Hispanic or Asian counterparts […] For some low-income first-time homebuyers, closing costs can be particularly onerous.” Fannie Mae found that some of these “homebuyers had closing costs equal to or exceeding their down payment.”

The FHFA released an Equitable Housing Finance Plans Request for Input (RFI) in September 2021, and the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, are required to submit Equitable Housing Finance Plans to FHFA by December 31, 2021. The plans will be in effect on January 1, 2022. USMI submitted its comment to the RFI in October. Given the private MI industry is one of the only forms of private capital available through market cycles and whose core business is focused on helping people without large down payments achieve affordable and sustainable homeownership, private MIs share the FHFA and GSEs’ view that the two pillars of good mortgage lending are sustainability and affordability. The goal should be a strong housing finance system that ensures equitable access to all mortgage-ready borrowers. USMI strongly supports efforts to remove barriers to homeownership and increase access and affordability, including for historically underserved households, while instilling sustainability for these same borrowers. The MI industry welcomes the opportunity to work with the FHFA, the GSEs, and other housing finance stakeholders to advance these goals.

Statement: Introduction of The Middle Class Mortgage Insurance Premium Act of 2021

WASHINGTON — Lindsey Johnson, President of U.S. Mortgage Insurers (USMI), released the following statement on the introduction of The Middle Class Mortgage Insurance Premium Act of 2021 sponsored by Reps. Ron Kind (D-WI) and Vern Buchanan (R-FL):

“Making permanent the ability of homeowners to deduct mortgage insurance (MI) premiums from federal income taxes and doing so in a way that makes this important tax deduction available to more hard-working middle class families, is smart public policy that benefits potentially millions of existing homeowners. Affordability remains a persistent barrier to homeownership across the country, particularly for first-time homebuyers. MI helps to sustainably bridge the down payment gap by helping families secure financing when they are unable to put 20 percent down. Low down payment mortgages, including conventional loans with private MI, have proven critical for millions of low- and moderate-income, first-time, and minority borrowers to buy a home sooner, secure financial stability, and build intergenerational wealth.

“Since 2007, the ability to deduct the cost of MI premiums has helped to put extra dollars back into the hands of millions of families each year and we strongly support legislation to make the tax deduction permanent. We are grateful to Congressmen Kind and Buchanan for their leadership on this critical legislation, and we encourage swift passage by both congressional chambers.”

In April 2021, USMI sent a letter to the Joint Committee on Taxation outlining how two key aspects of the current deduction diminish its effectiveness: (1) its temporary nature; and (2) its relatively low adjusted gross income (AGI) phase out. Congress first enacted legislation allowing the MI premiums tax deduction in 2006 and limited it to those making less than $100,000. In June, USMI then joined other housing industry groups, including the Mortgage Bankers Association, National Association of Home Builders, National Association of REALTORS®, and National Housing Conference, in sending a letter to the House Ways and Means Committee and Senate Finance Committee urging congressional tax writers to make this important deduction permanent.

The tax provision on MI premiums has always been temporary, with extensions made every couple of years. Nearly 2.3 million Americans claimed the deduction in 2017 (the latest data available) with almost 60 percent of those taxpayers having less than $75,000 AGI and 90 percent with less than $100,000. In 2020, approximately 4.8 million families obtained mortgages with some form of MI, including conventional loans with private MI (over 2 million) and loans guaranteed though the Federal Housing Administration (nearly 1.4 million) and U.S. Department of Veteran Affairs (nearly 1.4 million).

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Press Release: Comment Letter on FHFA’s NPR on “Amendments to the Enterprise Regulatory Capital Framework Rule”

WASHINGTON — U.S. Mortgage Insurers (USMI), the association representing the nation’s leading private mortgage insurance (MI) companies, today submitted a comment letter to the Federal Housing Finance Agency (FHFA) on its Notice of Proposed Rulemaking (NPR) on “Amendments to the Enterprise Regulatory Capital Framework (ERCF) Rule – Prescribed Leverage Buffer Amount and Credit Risk Transfer.” In its letter, USMI emphasizes the importance of setting appropriate, balanced, and analytically justified requirements for the government-sponsored enterprises (Enterprises), Fannie Mae and Freddie Mac, to simultaneously ensure their financial strength and borrowers’ continued access to affordable mortgage finance credit in the conventional market.

“We appreciate the work FHFA has undertaken to date to provide for minimum capital requirements for the Enterprises, including the December 2020 final rule to establish a post-conservatorship capital framework,” said Lindsey Johnson, President of USMI. “While a robust framework is necessary to ensure the stability of the housing finance system, overly stringent requirements or ones that inaccurately reflect the risks of the assets held by the Enterprises can be disruptive. It is critical FHFA creates a capital framework that strikes an appropriate balance between maintaining borrowers’ access to affordable mortgage credit and ensuring the Enterprises and taxpayers are protected from risk.”

In its comments, USMI writes the final rule ensures the Enterprises have sufficient levels of capital to withstand a steep economic downturn but recommends the following to FHFA:

- Adjust credit risk transfer (CRT) minimum risk weight floor to lower than 5 percent. USMI writes that any CRT floor should be designed to consider whether it will have the unintended consequences of discouraging the use of CRT or motivate CRT structures in which the Enterprises retain credit risk simply to justify the arbitrary capital floor. It urges FHFA to consider adjusting the CRT minimum risk weight floor lower than its proposed 5 percent change to a level closer to the statistically determined risk in a retained position to better align the CRT decisioning with the underlying economics and risks posed by the transaction. USMI also recommends FHFA establish and make public the model used to assess the CRT capital benefit, the statistical basis for any floor, and an analysis of the CRT capital treatment impact on the statutory goals of the Enterprises.

- Consider alternative methods to determine the Prescribed Leverage Buffer Amount (PLBA). USMI agrees that the PLBA needs to be adjusted, and that 1.5 percent is excessive, but it recommends FHFA consider alternative methods of determining the amount of the PLBA that more closely relate to risk than the Stability Capital Buffer. USMI writes that it emphatically agrees that the PLBA should not be the usual binding constraint on the Enterprises. However, the NPR does not explain why 50 percent of the Stability Capital Buffer is the appropriate standard. The Stability Capital Buffer itself is a subjectively determined capital requirement and no rationale has been provided for why 5 basis points times market share over 5 percent is chosen, how it is related to the risk, or why the threat to the national housing finance system is not adequately dealt with through the other elements of the ERCF.

- Reduce the single-family risk weight floor to 10 percent or less. USMI recommends the minimum 20 percent risk weight floor for single-family mortgages be reduced to 10 percent or less to more accurately account for the improvements in mortgage lending since the 2008 financial crisis, and to reflect and allow for credit enhancement, while also still requiring the Enterprises to hold an amount of capital against remote credit risk exposure more accurately. Reducing the single-family risk weight floor to 10 percent or less better achieves this outcome.

- Make changes to the Countercyclical Adjustment. While FHFA does not discuss in the NPR, USMI does comment on the Countercyclical Adjustment impact within the 2020 ERCF final rule. Significant home price appreciation (HPA), such as what occurred over the last two years, under the Countercyclical Adjustment, will require the Enterprises to hold more capital against higher mark-to-market loan-to-value (MTMLTV) loans, likely resulting in increased pricing of these loans. Specifically, USMI urges FHFA to:

- Reconsider and recalibrate the Countercyclical Adjustment. USMI recommends this to ensure the outcome of this adjustment meet FHFA’s policy objectives and considers real-world scenarios where there is significant home price appreciation above or below an inflation adjusted long-term trend.

- Report on whether significant HPA is based on market fundamentals or something else. While FHFA notes in the final rule it does not have discretion around the Countercyclical Adjustment, this should be re-evaluated. Based on market data, including FHFA’s own Housing Price Index, the agency should determine and report on why home prices are escalating. It may be appropriate for FHFA to have discretion to cap capital increases to up to 20 percent when HPA exceeds a certain threshold, rather than allowing for a 40-50 percent increase as would be applicable in today’s market with today’s market HPA.

- Consider recalibrating the Countercyclical Adjustment based on the reassessment. To address the significant impact that the current approach can have on the required capital, and thus the pricing of certain loans, FHFA should consider the different recommendations made in the 2020 NPR responses, including using asymmetric MTMLTV collars, and/or allowing for wider collars (perhaps 7.5 or 10 percent) during increased HPA versus when home prices are declining, or capping the capital increases to up to 20 percent when HPA exceeds a certain threshold.

- Simplify the language and formula for the Countercyclical Adjustment. The Countercyclical Adjustment element of the ERCF is extremely complex and difficult to analyze. It would benefit all stakeholders if FHFA took a more direct and simpler to read and analyze approach to this section.

An executive summary of USMI’s comments can be found here. USMI’s 2020 full comments can be found here and an executive summary can be found here. USMI’s comments on the FHFA’s 2018 proposed Enterprise capital framework can be found here.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Letter: Comments to FHFA on Amendments to the Enterprise Regulatory Capital Framework Rule

In November 2021, USMI submitted a comment letter to the Federal Housing Finance Agency (FHFA) on its Notice of Proposed Rulemaking (NPR) on “Amendments to the Enterprise Regulatory Capital Framework (ERCF) Rule – Prescribed Leverage Buffer Amount and Credit Risk Transfer.” In its comments, USMI writes the final rule ensures the Enterprises have sufficient levels of capital to withstand a steep economic downturn but recommends the following to FHFA:

- Adjust credit risk transfer (CRT) minimum risk weight floor to lower than 5 percent. USMI writes that any CRT floor should be designed to consider whether it will have the unintended consequences of discouraging the use of CRT or motivate CRT structures in which the Enterprises retain credit risk simply to justify the arbitrary capital floor. It urges FHFA to consider adjusting the CRT minimum risk weight floor lower than its proposed 5 percent change to a level closer to the statistically determined risk in a retained position to better align the CRT decisioning with the underlying economics and risks posed by the transaction. USMI also recommends FHFA establish and make public the model used to assess the CRT capital benefit, the statistical basis for any floor, and an analysis of the CRT capital treatment impact on the statutory goals of the Enterprises.

- Consider alternative methods to determine the Prescribed Leverage Buffer Amount (PLBA). USMI agrees that the PLBA needs to be adjusted, and that 1.5 percent is excessive, but it recommends FHFA consider alternative methods of determining the amount of the PLBA that more closely relate to risk than the Stability Capital Buffer. USMI writes that it emphatically agrees that the PLBA should not be the usual binding constraint on the Enterprises. However, the NPR does not explain why 50 percent of the Stability Capital Buffer is the appropriate standard. The Stability Capital Buffer itself is a subjectively determined capital requirement and no rationale has been provided for why 5 basis points times market share over 5 percent is chosen, how it is related to the risk, or why the threat to the national housing finance system is not adequately dealt with through the other elements of the ERCF.

- Reduce the single-family risk weight floor to 10 percent or less. USMI recommends the minimum 20 percent risk weight floor for single-family mortgages be reduced to 10 percent or less to more accurately account for the improvements in mortgage lending since the 2008 financial crisis, and to reflect and allow for credit enhancement, while also still requiring the Enterprises to hold an amount of capital against remote credit risk exposure more accurately. Reducing the single-family risk weight floor to 10 percent or less better achieves this outcome.

- Make changes to the Countercyclical Adjustment. While FHFA does not discuss in the NPR, USMI does comment on the Countercyclical Adjustment impact within the 2020 ERCF final rule. Significant home price appreciation (HPA), such as what occurred over the last two years, under the Countercyclical Adjustment, will require the Enterprises to hold more capital against higher mark-to-market loan-to-value (MTMLTV) loans, likely resulting in increased pricing of these loans. Specifically, USMI urges FHFA to:

- Reconsider and recalibrate the Countercyclical Adjustment. USMI recommends this to ensure the outcome of this adjustment meet FHFA’s policy objectives and considers real-world scenarios where there is significant home price appreciation above or below an inflation adjusted long-term trend.

- Report on whether significant HPA is based on market fundamentals or something else. While FHFA notes in the final rule it does not have discretion around the Countercyclical Adjustment, this should be re-evaluated. Based on market data, including FHFA’s own Housing Price Index, the agency should determine and report on why home prices are escalating. It may be appropriate for FHFA to have discretion to cap capital increases to up to 20 percent when HPA exceeds a certain threshold, rather than allowing for a 40-50 percent increase as would be applicable in today’s market with today’s market HPA.

- Consider recalibrating the Countercyclical Adjustment based on the reassessment. To address the significant impact that the current approach can have on the required capital, and thus the pricing of certain loans, FHFA should consider the different recommendations made in the 2020 NPR responses, including using asymmetric MTMLTV collars, and/or allowing for wider collars (perhaps 7.5 or 10 percent) during increased HPA versus when home prices are declining, or capping the capital increases to up to 20 percent when HPA exceeds a certain threshold.

- Simplify the language and formula for the Countercyclical Adjustment. The Countercyclical Adjustment element of the ERCF is extremely complex and difficult to analyze. It would benefit all stakeholders if FHFA took a more direct and simpler to read and analyze approach to this section.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: FHA’s 2021 Annual Financial Report to Congress

WASHINGTON— Lindsey Johnson, President of the U.S. Mortgage Insurers (USMI), released the following statement on the Federal Housing Administration’s (FHA) release of its Fiscal Year 2021 Annual Report to Congress on the Financial Status of the Mutual Mortgage Insurance Fund [hud.gov] (MMIF). This year’s report shows that the MMIF’s combined capital ratio stands at 8.03 percent, up from 6.10 percent for Fiscal Year 2020, an increase of 1.93 percent. The single-family forward mortgage portfolio capital ratio stood at 7.99 percent and the reverse mortgage program stood at 6.08 percent:

“We applaud the FHA’s continued efforts and commitment to sustain the fiscal health of the MMIF. The FHA is a vital part of the housing finance system and a critical resource for borrowers who may not have access to homeownership through the conventional market. We appreciate the FHA’s continued focus on assisting borrowers who were impacted by the COVID-19 pandemic. While the seriously delinquent rate remains high at 8.81 percent, it continues to improve from a high of 11.9 percent in November 2020. The mortgage market welcomes this improvement and USMI encourages the FHA to remain focused on assisting these borrowers. USMI urges the FHA to maintain its current disciplined approach to policies and pricing to ensure that the long-term financial health of the MMIF best serves future homebuyers and is prepared for an increase in potential foreclosures as the COVID-19 forbearance period ends.

“USMI and our member companies look forward to continuing to work with the FHA, the Administration, and Congress to promote a coordinated and consistent housing market to meet the needs of low-down payment borrowers while protecting taxpayers.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Press Release: USMI Submits Comment Letter on FHFA’s Request for Input on Enterprise Equitable Housing Finance Plans

WASHINGTON — U.S. Mortgage Insurers (USMI), the association representing the nation’s leading private mortgage insurance (MI) companies, submitted a comment letter to the Federal Housing Finance Agency (FHFA) on its Request for Input (RFI) on “Enterprise Equitable Housing Finance Plans” (the Plans), which articulates a framework by which the government-sponsored enterprises (GSEs or Enterprises), Fannie Mae and Freddie Mac, will be required to prepare and implement three-year plans to advance equity in housing finance.

“USMI commends the FHFA for soliciting feedback on the Plans to identify the barriers to sustainable housing opportunities, set goals to address those barriers, and implement policies to address them. The private MI industry welcomes the opportunity to work with FHFA, the GSEs, and other housing finance stakeholders to support the Biden Administration’s goal of a comprehensive approach to advancing equity for all,” said Lindsey Johnson, President of USMI. “As an industry that is dedicated to the U.S. housing finance system and exclusively serves homebuyers with limited access to funds for large down payments, USMI and its member companies are keenly interested in advancing policies that promote access to the conventional mortgage market and support sustainable homeownership.”

In order to address longstanding inequities in the housing finance system, USMI encourages the GSEs to explore and implement geography- (including historically redlines areas, areas of concentrated poverty, and rural areas) and income-based initiatives to expand minority homebuying opportunities in the conventional mortgage market.

On behalf of the private mortgage industry, USMI routinely engages with policymakers to sustainably expand access to homeownership and address barriers that disproportionately impact minority homebuyers. USMI believes that the following actions represent viable policies to promote sustainable homeownership and level the playing field for minority homebuyers:

- Review and Reform Loan-Level Price Adjustments (LLPAs): As 2008-era LLPA fees remain in place and continue to be disproportionately paid in the form of higher interest rates by low- and moderate-income (LMI) and minority borrowers, USMI urges the FHFA to review and reform LLPAs. Changes in the LLPA framework should account for the numerous improvements in the housing finance system since LLPAs were introduced in 2008, promote access to affordable conventional mortgages, and appropriately balance the credit risk being assumed by the GSEs. Given all of the significant improvements in mortgage lending and risk management, USMI supports a holistic review of GSE pricing, including LLPAs, and the current level of cross-subsidization to support LMI homebuyers.

- Review and Revise the Enterprise Regulatory Capital Framework (ERCF): As stated in USMI’s August 31, 2020 comment letter, USMI supports FHFA’s efforts to establish capital standards for the GSEs that appropriately reflect their activities and risk exposures to ensure that capital requirements do not arbitrarily price prospective homebuyers out of the conventional mortgage market. As entities with congressionally-mandated public missions, the GSEs’ capital requirements should promote an appropriate level of cross-subsidization and support LMI borrowers. USMI welcomed FHFA’s September 15 release of a notice of proposed rulemaking (NPR) to amend the ERCF to address two critical elements: (1) the prescribed leverage buffer amount (PLBA); and (2) the treatment of credit risk transfer (CRT) transactions. Ultimately, USMI believes that the proposed changes, coupled with the additional recommendations made by USMI, will more appropriately balance prudent risk management and the level of capital for the GSEs, and their statutory missions.

- Modify the Preferred Stock Purchase Agreements (PSPAs): USMI welcomed FHFA’s September 14 announcement on the suspension of portions of the January 2021 PSPA amendments, most notably the caps on the acquisition of “high-risk” loans. USMI encourages the agency to remove, and not merely suspend, the provisions concerning the so-called “high-risk” loan acquisition caps that disproportionately impact minority access to conventional mortgages.

- Finalize the New Products and Activities Rule: While innovation can be beneficial for expanding homeownership opportunities, USMI highlights the need for a transparent and thorough regulatory mechanism to assess new GSE activities and products to ensure they do not disintermediate other market participants. USMI is encouraged by FHFA’s ongoing review of the GSEs’ pilots, activities, and products to ensure they align with the Enterprises’ explicit public policy objectives in compliance with their charters. USMI believes that new products, activities, and pilots should only be allowed when there is clear and compelling evidence that the GSEs are needed to fill a market void that the private market cannot meet.

- Greater Data and Transparency: To address longstanding inequities in the housing finance system, USMI strongly believes that consistent transparency should be hard-wired into the GSEs’ credit policies and that data around the Enterprises’ performance in key areas, most notably access to credit for minority households, should be publicly available. As noted in USMI’s comment letter, the association firmly believes that additional transparency and data sharing initiatives will enable market participants to enhance access, affordability, and sustainability in the mortgage markets.

“USMI fully supports increased public-private collaboration along with advancing a coordinated housing policy that ensures all borrowers have access to mortgage products in both the conventional and government-backed markets while maintaining safe and sound operations at the GSEs. Policymakers and stakeholders should work together to implement policies that promote access to sustainable housing finance credit to ensure the ability of consumers to purchase and stay in their homes.”

USMI’s full comments on the FHFA’s RFI on the Plans can be found here.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Letter: Comments on CFPB’s Advance Notice of Proposed Rulemaking on the Qualified Mortgage Definition

WASHINGTON — Lindsey Johnson, President of U.S. Mortgage Insurers (USMI), today released the following statement on the organization’s comment letter submitted in response to the Consumer Financial Protection Bureau’s (“the Bureau”) Advance Notice of Proposed Rulemaking on the “Qualified Mortgage (QM) Definition under the Truth in Lending Act (Regulation Z).”

“As takers of first-loss mortgage credit risk with more than six decades of expertise and experience underwriting and actively managing that risk, USMI members understand the need to balance prudent underwriting with a clear and transparent standard that maintains access to affordable and sustainable mortgage finance credit for home-ready borrowers. The upcoming expiration of the temporary QM category, often referred to as the “GSE Patch,” provides an important opportunity for the Bureau to assess what has developed within the marketplace since the enactment of the QM Rule. Notably, mortgage lending has been done with far greater diligence by market participants to ensure consumers have a reasonable ability-to-repay (ATR) and has resulted in a much stronger housing finance system. Further, the GSE Patch has played a critical role in maintaining credit availability. In our comments to the Bureau, we offer specific recommendations for replacing the current GSE Patch to establish a single transparent and consistent QM definition in a way to balance access to mortgage finance credit and proper underwriting guardrails to ensure consumers’ ATR. USMI’s recommendations include:

- Maintaining the ATR and product restrictions as part of any updates to the QM definition to ensure discipline in the lending community and to protect consumers;

- Retaining specific underwriting guardrails such as the current debt-to-income (DTI) component of the QM definition, but modifying the specific threshold to better serve consumers; and

- Developing a single set of transparent compensating factors for loans with DTIs above 45 and up to 50 percent for defining QM across all markets, similar to how the GSEs, FHA, and VA use compensating factors in their respective markets today.

“Retaining specific thresholds in measuring a consumer’s income, assets, and financial obligations better serves consumers and ensures that the statutory and regulatory intent of measuring a consumer’s ATR is met. Further, adjusting the current DTI limit from 43% to 45% for all loans, and up to 50% for loans with accompanying compensating factors creates a more transparent and level playing field that provides greater certainty for borrowers and lenders and reduces the impact of the expiration of the GSE Patch. USMI believes that the development of a single transparent industry standard will facilitate greater consistency across all lending channels and ensure there is not market arbitrage to achieve QM status.

“USMI applauds the Bureau for undertaking the necessary process for updating this critical rule that is aimed at enhancing lending standards and consumer protection. We look forward to working with the Bureau as it seeks to implement any changes to this important rule.”

Following the release of the Bureau’s ANPR in July, USMI published a blog with observations and recommendations for replacing the GSE Patch.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Member Spotlight: Q&A with Mark Casale of Essent

USMI’s member spotlight series focuses on how the private mortgage insurance (MI) industry works to address several critical issues within the housing finance system, including expanding access to affordable mortgage credit for first-time and minority homebuyers, protecting taxpayers from mortgage credit risk, and recommendations on ways to reform and enhance the housing finance system to put it on a more sustainable path for the long-term.

This month we chat with Mark A. Casale, Chairman, President and CEO at Essent Guaranty, and Vice Chairman of USMI’s board. Essent, founded in 2008, offers private MI for single-family mortgage loans in the United States, providing private capital to mitigate mortgage credit risk for lenders and investors, allowing lenders to make additional mortgage financing available to prospective homeowners. To better execute Essent’s core purpose to ensure borrowers have access to sustainable mortgage credit, Essent remains focused on managing mortgage credit risk, enhancing the business model of the private MI industry, and strengthening private MIs as counterparties to the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, lenders, and other stakeholders.

Below, Casale discusses Essent’s views on the housing market as we come out of the COVID-19 pandemic, the continued evolution of the private MI industry and the role of innovation, and how this evolution will better serve borrowers and the housing finance system.

(1) Given the importance of low-down payment financing in the housing finance system and considering the competitive real estate market, what steps do you think the industry should take in the next year or two to better serve first-time buyers?

The 2021 housing environment has been strong as low interest rates continue to boost refinance and purchase market activity. However, a meaningful lack of housing supply has impacted affordability.

Millennials ―around 80 million strong― continue to contribute to the favorable demand dynamics. Driven by significant life events such as marriage and children, an increasing number of millennials are forming households, and continuing to provide strength to first-time homebuyer demand.

Millennials, and especially Hispanics, which represent 20 percent of this important segment of our population, are projected to be the dominant population and primary drivers of new homeownership for years to come; and we can already see the significant impact they are having on the real estate market and demand for housing.

Given this context, as more millennial homebuyers enter the market, it will be critical for the industry to improve consumer access to affordable credit, especially to first-time, younger and minority homebuyers, who may not have the resources or intergenerational wealth to afford the standard 20 percent down. Private MI companies are an important supporter of affordable, low down payment mortgages, helping more homebuyers get into homes and on a path to building the long-term wealth associated with homeownership.

(2) Private MI has provided credit risk protection to lenders and the GSEs for nearly 65 years, but our industry has also evolved to become stronger and more resilient. How does Essent describe its approach to risk management and credit risk transfer (CRT)?

Risk management has always been a key tenet for mortgage insurers because of the nature of our business of taking first loss credit risk on high loan to value loans. Post the Great Financial Crisis, risk management continues to evolve through new data sources, enhanced analytic tools and techniques, as well as the importance of quality control of the loan manufacturing process.

The ability to transfer credit risk to third parties in CRT transactions is an integral component of risk management for MI companies. The industry traditionally relied on reinsurance transactions and has completed over 30 transactions reducing loss exposure and making more capital available to support additional lending. Innovative leadership by the GSEs and the Federal Housing Finance Agency (FHFA) in the CRT market helped create a broader credit risk transfer market for mortgage insurers through the advent of Insurance Linked Notes (ILN). The MIs began utilizing ILN transactions beginning in 2015 and ILNs have since become a programmatic execution for MIs as a risk management hedging tool and a reliable source of capital. The industry has completed over 43 ILN transactions to date. The MI industry has transferred over $50 billion of risk in force via CRT.

CRT has transformed Essent and our industry from an old business model of “Buy and Hold” risk to a new business model of “Buy, Manage and Distribute” risk. We have approximately 85 percent of our $200+ billion insurance portfolio hedged via CRT as of 2021Q2. This model will make Essent, and our industry, more resilient during times of crisis, enhancing our ability to insure loans during all cycles while serving as strong counterparties to our customers and the GSEs.

(3) How will MI need to innovate and evolve as an industry in order to ensure future generations have access to affordable housing?

A competitive mortgage insurance industry backed by private capital serves the housing finance system very well. Today, over $1.3 trillion of mortgages are financed by loans with private MI. However, mortgage insurers have and will continue to evolve, particularly as technology enables key connection points with loan origination systems and our lenders. In the past 2 years, more refined risk assessment and pricing of risk has been an important evolution in the MI space. Currently, over 95 percent of lenders now get MI quotes from a proprietary risk-based pricing engine vs a legacy rate card. Essent expects more granular risk assessment and pricing to continue to improve by prudently leveraging machine learning and artificial intelligence with existing and new sources of data. We believe these approaches enable us to more accurately assess the risk of the loan and make more affordable credit available to borrowers that traditional approaches might have turned away. Fannie Mae recently announced a change to include rental payment history in Desktop Underwriter, a great demonstration of how incremental data can assist in improving the overall risk assessment of a transaction.

We strongly believe that the inclusion of more data to evaluate loans will be a differentiator that expands access to credit for qualified borrowers and delivers the best MI price available to prospective homeowners. These types of innovations align with FHFA’s stated goals of improving access and affordability as well as reducing racial inequality in homeownership. The MI industry will continue to be a valuable business partner to lenders and the GSEs in improving access and maintaining responsible lending standards so that our housing finance system provides sustainable homeownership.

Mark A. Casale’s Biography

Mark A. Casale is the founder, Chief Executive Officer and Chairman of the Board of Directors of Essent Group Ltd. (NYSE: ESNT). Mr. Casale has more than 25 years of financial services experience, which includes senior roles in mortgage banking, mortgage insurance, bond insurance and capital markets.

Founded in 2008 by Mr. Casale with $500 million of equity funding, Essent Group Ltd. has grown to a market capitalization of approximately $5 billion and manages more than $200 billion of insurance in force. Under Mr. Casale’s leadership, Essent has become a leading mortgage insurer and reinsurer serving as a trusted and strong counterparty to lenders and GSEs and has enabled over two million borrowers to become homeowners. Mr. Casale continues to evolve the franchise using risk-based pricing and AI-driven analytics to support his core mission of prudently growing shareholder value and promoting affordable and sustainable homeownership.

Mr. Casale also champions Essent’s philanthropic mission, supporting local and national organizations centered around children, housing, health, and education. He currently serves as a member of the Board of Trustees for St. Joseph’s University, La Salle College High School, and the Academy of Notre Dame de Namur.

A native of the Philadelphia region, Mr. Casale holds a BS in accounting from St. Joseph’s University and an MBA in finance from New York University.