Since Fannie Mae and Freddie Mac (the “GSEs”) entered conservatorship in 2008, federal policymakers and industry professionals have debated their future role in the housing finance system, as well as what reforms are appropriate and necessary to put the GSEs on stable footing for the long term.

Twelve years later, the Federal Housing Finance Agency (FHFA) is taking steps to release the GSEs from conservatorship. To that end, FHFA has proposed an Enterprise Regulatory Capital Framework (ERCF) intended to prevent future failures by requiring the GSEs to hold much more capital. In fact, the re-proposed ERCF would require the GSEs to hold about 10 times their current capital levels ($243 billion versus $28 billion, respectively, as of Q2 2020) and roughly five times their projected losses under the most severe economic downturn.

Importantly, the proposed framework supposes that the GSEs will return to their pre-conservatorship status in the housing finance system—quasi-government companies—with congressional charters, missions, and mandates, yet private companies with profit objectives. FHFA’s re-proposed capital framework is intended to help the GSEs avoid taxpayer bailouts by building and maintaining large enough capital reserves to withstand future downturns.

USMI agrees that a robust and appropriately tailored capital standard for the GSEs is necessary and should strike the right balance to ensure consumers maintain access to affordable mortgage credit while also protecting taxpayers. The best way to achieve these objectives is to have a standard that reflects the business models of the GSEs, whose primary business is a guaranty business, and that is akin to an insurance framework. Further, the capital framework should be objectively risk-based, and the quantity and quality of capital requirements should be completely transparent and analytically justified.

In its comment letter to FHFA on its 2020 proposed rule, USMI identified key issues with the re-proposed ERCF and provided recommendations for ensuring greater balance between the two aforementioned objectives. (An executive summary of USMI’s observations and recommendations is available here). While actions taken during conservatorship have strengthened the GSEs, it is clear that additional reforms are necessary to improve the GSEs’ operations in advance of their exit from conservatorship. USMI strongly urges FHFA to turn its attention to critical reforms that incentivize the prudent management of mortgage credit risk and ensure access to affordable and sustainable mortgages for home-ready consumers.

INCREASE, NOT DECREASE THE USE OF PRIVATE CAPITAL

Proposed Capital Rule Disincentivizes Critical Loss Protection and Beneficial Risk Transfer

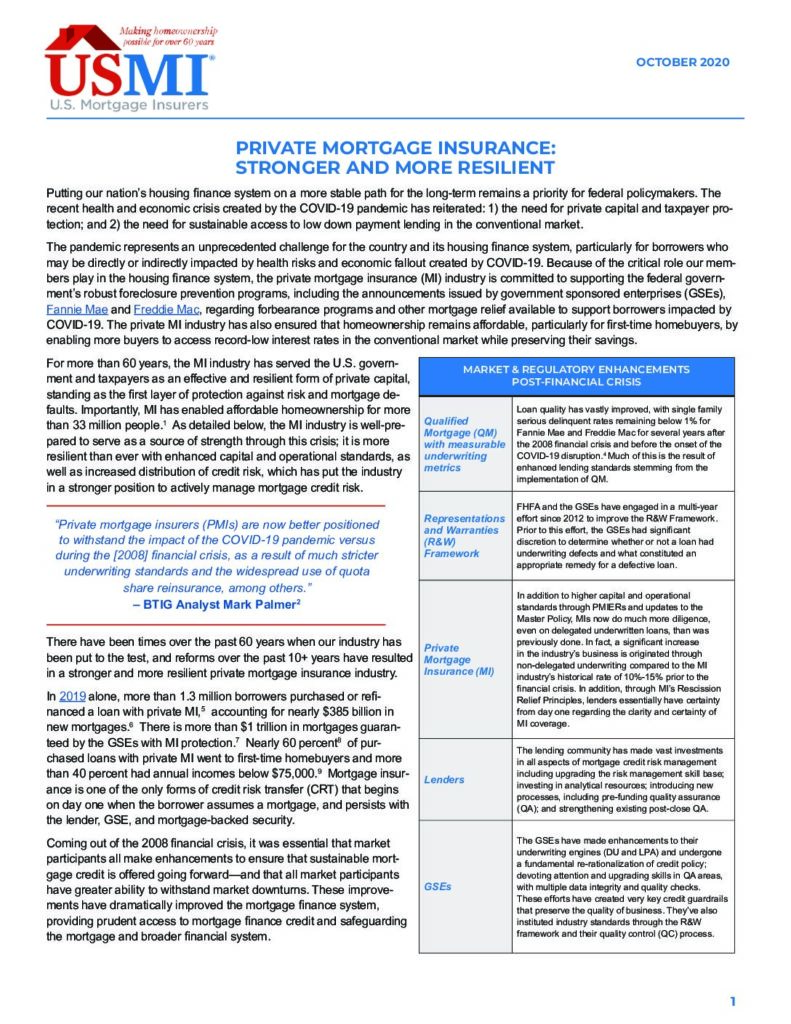

While we support strong GSE balance sheets to best serve borrowers and protect taxpayers from mortgage credit risk, certain elements of the re-proposed rule would promote risk consolidation at the GSEs and disincentivize the distribution of risk. The ERCF should incentivize the increased transfer of mortgage credit risk to private capital where possible. Unfortunately, as many stated in their comment letters to the proposed ERCF, the reduced capital benefit for private mortgage insurance (MI), punitive treatment of credit risk transfers (CRT), and proposed floors on mortgage exposures would likely reduce the GSEs’ ability or willingness to transfer risk to other sources of private capital.

Until Congress enacts comprehensive housing finance reform and/or gives FHFA the authority to charter additional GSEs, it is imperative that the concentration of mortgage credit risk at Fannie Mae and Freddie Mac be transferred to highly regulated counterparties to appropriately underwrite, actively manage and hold capital against. One way FHFA can accomplish this objective is to provide the appropriate capital benefit to the GSEs for transferring risk—based on an historical analysis of the capital credit that should be given to any such counterparty or risk transfer. To ensure that credit risk is transferred to strong counterparties, FHFA—rather than the GSEs—should establish and update robust operational and capital requirements for GSE counterparties, as necessary. Transparent and objective standards will promote a level playing field and ensure that private market participants can perform an important role in de-risking the GSEs. Private MI and the GSEs’ CRT programs are important tools to bring private capital into the housing finance system and any final rule on GSE capital requirements should recognize their risk-reducing benefits.

However, it seems that in addressing some of the structural weaknesses of CRT, the proverbial “baby was thrown out with the bathwater” by the current proposed rule. Instead, to fully assess the weaknesses and determine the appropriate capital relief that the GSEs should receive for different forms of CRT, FHFA should publish a transparent model that capital markets executions and reinsurance transactions can be modeled against. This will ensure that weaknesses are properly addressed but will also maintain integrity and increase transparency and consistency in FHFA and the private market’s assessment of and capital benefit for CRT and will better ensure a viable CRT market going forward.

Balance Capital Requirements with Access to Sustainable Mortgage Finance Credit

Importantly, the re-proposed rule, if implemented in its current form, could push homeownership out of reach for many Americans –particularly minority and first-time homebuyers –or it could leave many borrowers with the lone option of obtaining a mortgage backed by the Federal Housing Administration (FHA). According to the Urban Institute[1] and the GSEs themselves,[2] the capital proposal would result in higher costs for borrowers and less mortgage credit availability, as higher capital requirements would necessitate higher profits to support the capital. For the GSEs, this will mean higher Guarantee Fees (G-Fees), raising the cost of homeownership for millions, with a disproportionate negative impact on lower wealth and traditionally underserved borrowers. In light of these increased costs, many of these borrowers, would migrate to the FHA market.

The proposed ERCF has a number of overly conservative elements, as well as numerous examples of non-risk aspects. Instead, FHFA should reduce or eliminate non-risk based elements and establish the capital rule around an insurance framework, given the GSEs’ core guaranty business is to ensure the adequate capital for the risks taken by the GSEs, but not an arbitrarily high level of capital that puts homeownership out of reach for many American families.

THE NEXT STEPS FOR STRENGTHENING THE HOUSING FINANCE SYSTEM

FHFA’s work on a post-conservatorship capital framework is a welcome development. However, it is important to recognize that capital alone is not comprehensive GSE reform

In order to put the housing finance system on a more sustainable path and to best serve consumers and taxpayers, it is imperative that FHFA implement reforms beyond increasing capital before the GSEs exit conservatorship. In September, FHFA released its “Strategic Plan: Fiscal Years 2021-2024,”outlining goals to fulfill its statutory duties as both regulator and conservator of the GSEs. While a primary goal of the plan is to take actions to support the GSEs’ recapitalization and exit from conservatorship, FHFA invited comments on the “mile markers,” or additional reforms or thresholds to be met by the GSEs and/or FHFA prior to the GSEs’ exit from conservatorship.

It is imperative that FHFA take steps to further reduce the GSEs’ risk exposure, level the playing field, and increase transparency around the GSEs’ pricing and business operations. As recommended in USMI’s comment letter on the Strategic Plan to FHFA, the agency should take the following actions to strengthen the housing finance system prior to the GSEs’ release from conservatorship:

- Limit the GSEs’ activities to those necessary to fulfill their intended role of facilitating a liquid secondary market for mortgages, preserving the “bright line” separation between the primary and secondary mortgage markets. Pursuant to their unique congressional charters, the GSEs are required to restrict their activities to secondary market functions. FHFA should implement regulatory guardrails to ensure that the GSEs do not encroach on primary market activities and do not disintermediate private market participants.

- Increase transparency around the GSEs’ operations, credit decisioning, technologies, and role in the housing finance system. Absent proper guardrails and transparency for market participants, the GSEs’ innovation can further hardwire their technologies and systems into the housing finance system. Though technology can lead to positive transformation, often these technologies make critical underwriting or credit decisioning less opaque and more centralized in the GSEs. Further, this additional entrenchment complicates the prospects and logistics of enacting permanent structural reforms.

- Require a “notice and comment period” process and prior approval for new products and activities at the GSEs. While in conservatorship, the GSEs have rolled out, with little to no transparency, pilots and programs which have often represented expansions into activities long considered to be functions of the primary mortgage market. Recently, FHFA proposed a new rule that would establish a more transparent and objective process for the development and approval of new GSE products and activities. USMI welcomes these efforts and urges FHFA to implement an approval process that facilitates robust feedback from interested stakeholders and ensures that any new products and activities support the GSEs’ explicit public policy objectives, support and do not compete with other market participants on an unlevel playing field, and comply with their charters. While USMI looks forward to reviewing and commenting on all aspects of the proposed rule, it is a much-needed step in the right direction as it relates FHFA’s oversight of the GSEs.

- Require that counterparty standards be set by or in coordination with FHFA, and not just the GSEs. FHFA should promulgate strong risk-based capital and operational standards for GSE counterparties, similar to what was established through the development of the Private Mortgage Insurers Eligibility Requirements (PMIERs). Greater transparency and oversight of the GSEs and their counterparties should be conducted in a manner to increase transparency, reduce conflicts of interest, and to ensure the GSEs cannot arbitrarily pick winners and losers or promote opportunities to arbitrage the rules.

- Promote a clear, consistent, and coordinated housing finance system. It is paramount for FHFA to work with other federal regulators, including the U.S. Department of Housing and Urban Development (HUD) and Consumer Financial Protection Bureau (CFPB), to reduce—not merely shift—credit risk in the housing finance system. A coordinated and clearly articulated federal housing policy will ensure that American consumers are best served by housing market participants and that the federal government is adequately protected from mortgage credit risk related losses.

[1] The Urban Institute estimates that mortgage rates would increase 15-20 bps while in conservatorship and 30-35 bps if they are released. J. Parrott, B. Ryan, and M. Zandi, “FHFA’s Capital Rule Is A Step Backward” (July 2020). Available at https://www.urban.org/sites/default/files/publication/102595/fhfa-capital-rule-is-a-step-backward_0.pdf.

[2] Fannie Mae and Freddie Mac’s comments to the FHFA on the proposed Enterprise Regulatory Capital Framework noted that the capital requirements could increase guarantee fees by 20 bps and 15-35 bps, respectively. Available at https://www.fhfa.gov//SupervisionRegulation/Rules/Pages/Comment-Detail.aspx?CommentId=15605 and https://www.fhfa.gov//SupervisionRegulation/Rules/Pages/Comment-Detail.aspx?CommentId=15606.