USMI President Lindsey Johnson appeared on the Practical Wealth Show podcast with Curtis May and discussed how private mortgage insurance helps home-ready buyers get in their home sooner.

Listen here.

Author: dcadmin

Press Release: Comment Letter to CFPB For Proposed Rule on the General Qualified Mortgage Definition

WASHINGTON — U.S. Mortgage Insurers (USMI), the association representing the nation’s leading private mortgage insurance (MI) companies, submitted its comment letter to the Consumer Financial Protection Bureau (CFPB or Bureau) for its proposed rule on the General Qualified Mortgage (QM) Definition under the Truth in Lending Act (Regulation Z).

“While the CFPB is undertaking a thoughtful process to update the General QM definition, USMI urges the Bureau to strike a proper balance between prudent and transparent underwriting standards, and access to affordable and sustainable mortgage finance credit for home-ready borrowers,” said Lindsey Johnson, President of USMI. “Changes to the QM definition will broadly inform standards and practices across the mortgage market, but the currently proposed rule could limit access to the conventional market for the very borrowers that have traditionally been underserved.”

To ensure the QM definition does not inadvertently limit access to credit for home-ready borrowers, and particularly minority borrowers, USMI recommends that the QM Safe Harbor should be set at 200 basis points (bps) above the Average Prime Offer Rate (APOR). USMI states that this modification to the proposed rule would create a level playing field for the QM standard across the conventional and government mortgage markets, adding that historical delinquency data demonstrates that conventional mortgages with rate spreads between 150 bps and 200 bps are prudently underwritten and sustainable loans that have performed well.

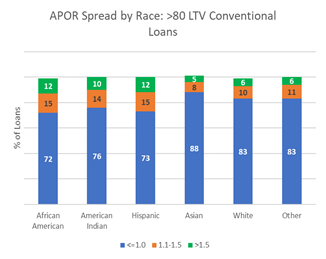

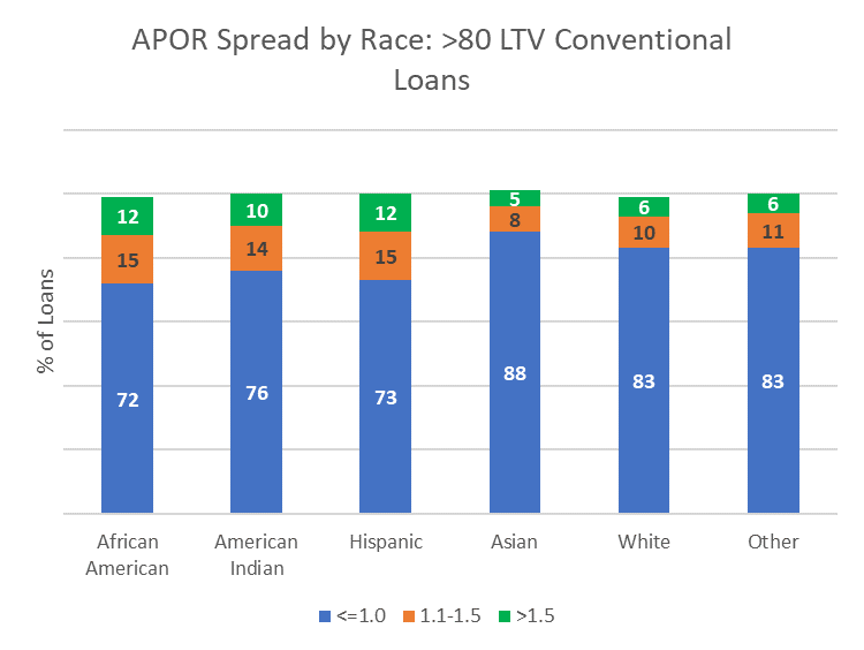

USMI highlights that “[a]ccording to 2019 Home Mortgage Disclosure Act (HMDA) data for conventional low down payment purchase mortgages (>80 percent loan-to-value ratio), Black and Hispanic borrowers were twice as likely as White borrowers to have mortgages with annual percentage rates in excess of the APOR plus 150 bps Safe Harbor spread. Under the proposed rule, many of the borrowers who are above the 150 bps threshold will be left only with the option of a Federal Housing Administration (FHA) loan, which means they have significantly fewer competitive choices in terms of product offerings and loans.”

Further, USMI agrees with the Bureau’s assessment that a hard 43 percent debt-to-income (DTI) ratio cap would be the most harmful option for the General QM definition because it would severely limit access to credit in the conventional market. Consistent with its September 2019 comment letter in response to the CFPB’s Advance Notice of Proposed Rule (ANPR) on the QM Definition, USMI continues to believe that the best approach to a General QM definition would be a standard that includes a higher DTI threshold with specified compensating factors.

In its comments, USMI advises the CFPB to preserve robust and measurable underwriting standards and practices as part of the requirements for “consider and verify” that have been proven to balance access to credit and prudent mortgage underwriting standards. With the elimination of reliance on a DTI cap and the introduction of a “consider and verify” standard for mortgage underwriting, it is critical that the CFPB identify specific requirements or best practices to be used by lenders to qualify for the compliance safe harbor.

Other recommendations to the CFPB include: working closely with federal regulators to implement a transparent and coordinated housing policy that promotes access to credit and prudent mortgage underwriting and creates a level playing field; and reconsidering its approach to adjustable-rate mortgages (ARMs) by amending the NPR to exclude 5-year ARM products from the proposed treatment of short-reset ARMs, as data demonstrates that ≥5-year ARM performance is in line with, or better than, >20-year fixed rate mortgages.

Finally, USMI urges the CFPB to provide sufficient time for a smooth transition from the temporary QM category (known as the government sponsored enterprises or “GSE Patch”) to the new General QM definition. This is particularly important given the extensive and undetermined scope of COVID-19 as the financial services industry appropriately focuses resources on responding to the economic and health fallout from the pandemic.

USMI writes, “[d]epending on the complexity of the finalized revisions to the General QM definition, the significance of the penalties for a violation of the [ability to repay]/QM Rule, and the large number of mortgage industry participants that will need to update their operations and systems, USMI recommends that the Bureau set the sunset date for the GSE Patch to be at least six months after the effective date of the general QM definition final rule. This would allow lenders to use either the GSE Patch or the new General QM definition during the mortgage underwriting process.”

USMI’s full comments on the CFPB’s proposed General QM Definition can be found here; its comment letter to the Bureau on the GSE patch extension can be found here; the 2019 comment letter to the CFPB’s Advance NPR can be found here; and its blog on why the Safe Harbor threshold should be increased can be found here.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org

Letter: Comments on General QM Definition

The Honorable Kathleen Kraninger

Director

Consumer Financial Protection Bureau

1700 G Street NW

Washington, DC 20052

Re: Qualified Mortgage Definition under the Truth in Lending Act (Regulation Z): General QM Loan Definition, Docket No. CFPB 2020-0020

Dear Director Kraninger:

U.S. Mortgage Insurers (USMI)1 represents America’s leading providers of private mortgage insurance (MI). Our members are dedicated to a strong housing finance system backed by private capital that enables access to prudent and sustainable mortgage finance for borrowers, while also protecting Fannie Mae and Freddie Mac (the GSEs) and the American taxpayer from mortgage credit-related losses. The MI industry has more than six decades of expertise in underwriting and actively managing mortgage credit risk. Our member companies are uniquely qualified to provide insights on federal policies concerning underwriting standards for the conventional mortgage market, especially given our experience balancing prudent underwriting with access to affordable credit.

USMI appreciates the opportunity to comment on the Consumer Financial Protection Bureau’s (Bureau) NNotice of Proposed Rulemaking (NPR)2 regarding changes to the General Qualified Mortgage (QM) definition. Done right, a revised General QM definition will promote prudent underwriting that enables home-ready borrowers to receive fairly priced and affordable conventional mortgages. USMI and other housing finance stakeholders recognize that changes to the General QM definition will broadly inform underwriting standards and practices across the mortgage market. As discussed below, we are concerned that, as contemplated, the proposed rule could limit access to the conventional market for the very borrowers that have traditionally been underserved.

In our comments below, USMI will discuss the following observations and recommendations:

- The Safe Harbor should be set at 200 basis points (bps) above the Average Prime Offer Rate (APOR) to ensure that the General QM definition does not inadvertently limit access to credit for home-ready borrowers, and particularly minority borrowers.

- As part of the requirements for “consider and verify,” the Bureau’s final rule should preserve robust and measurable underwriting standards and practices that have been proven to balance access to credit and prudent mortgage underwriting standards.

- It is critical that the Bureau work closely with federal regulators to implement a transparent and coordinated housing policy that promotes access to credit, prudent mortgage underwriting, and creates a level playing field.

- The Bureau should reconsider its approach to adjustable-rate mortgages (ARMs) and amend the NPR to exclude five-year ARM products from the proposed treatment of short-reset ARMs.

- USMI agrees with the Bureau’s assessment that a hard 43% debt-to-income (DTI) ratio cap would be the most harmful option for the General QM definition because it would severely limit access to credit in the conventional market. Consistent with our comment letter dated September 16, 2019 in response to the Bureau’s Advance Notice of Proposed Rulemaking on the QM Definition, we continue to believe that the best approach to a General QM definition would be a standard that includes a higher DTI threshold with specified compensating factors. Please see Appendix A for additional information about a General QM definition that retains a DTI limit.

Overview of QM Definition or the Conventional Market

2013 ATR/QM Rule

Street Reform and Consumer Protection Act (Dodd-Frank)4 that created specific mortgage product restrictions and required the Bureau to promulgate the Ability-to-Repay/Qualified Mortgage Rule (ATR/QM Rule). The Bureau’s final ATR/QM Rule – issued in June 2013 and made effective on January 10, 2014 – created a General QM category with a 43% DTI limit and requirements concerning product features and points and fees, as well as a temporary QM category for mortgages that met statutory limitations on product features and points and fees and are eligible for purchase by Fannie Mae or Freddie Mac. This temporary QM category has become known as the “GSE Patch,” and the 2013 final rule stipulated that the GSE Patch would sunset the earlier of: (1) the GSEs exiting conservatorship; or (2) January 10, 2021. The GSE Patch has served its intended purpose of maintaining credit availability in the conventional mortgage market and CoreLogic estimates that approximately 16% of 2018 mortgage originations ($260 billion) were made as QM loans by virtue of the GSE Patch. We note that, under the Patch, QM loans have included mortgages with DTI ratios up to 50% with compensating factors.

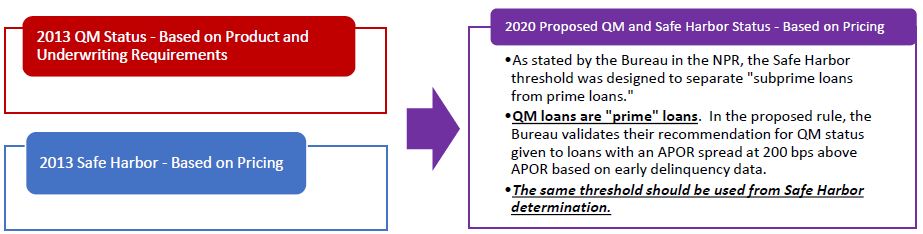

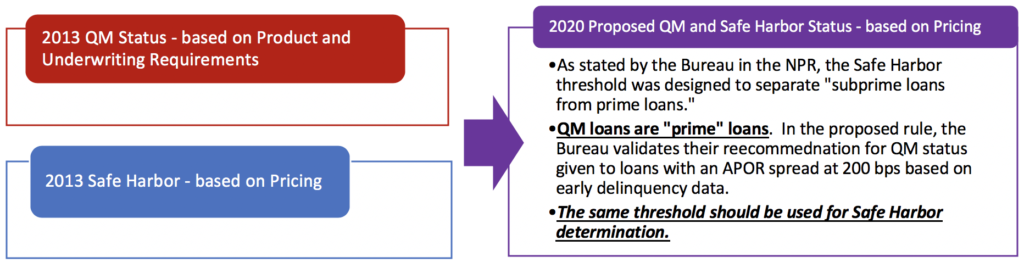

The Dodd-Frank Act went beyond previous federal consumer protection laws that were largely intended to root out predatory, subprime mortgage products, including the Home Ownership and Equity Protection Act (HOEPA) that defined a class of “higher priced mortgage loans” (HPMLs). HOEPA was later expanded in 2001 and 2008 to provide for a presumed violation of the law when a lender engaged in a pattern of originating higher-priced mortgages without verifying and documenting the borrower’s ATR. Dodd-Frank went beyond HPMLs to address concerns about mortgage underwriting practices by creating specific mortgage product restrictions and requiring the CFPB to promulgate a rule defining “Qualified Mortgage” based on specific underwriting criteria. As promulgated in the 2013 final rule, QM and Safe Harbor were determined by two separate measures: QM status was based on product and underwriting requirements; and Safe Harbor was based on loan pricing. Given that distinction, the different standards made a certain amount of sense. Under the 2020 proposed rule, however, QM status and Safe Harbor are measured using the same metric – price – so there is no longer any reason to set those standards at different spread amounts. As further discussed below, and as the Bureau validates based on early delinquency data, this spread threshold should be set at 200 bps above APOR.

2020 NPR

The NPR would remove the 43% DTI limit and instead grant QM status to a mortgage “only if the annual percentage rate (APR) exceeds [the] APOR for a comparable transaction by less than two percentage points as of the date the interest rate is set.” Although the NPR recommends establishing the pricing threshold for defining QM loans at an APR spread of 200 bps over APOR, it also preserves the APR spread over APOR of 150 bps to distinguish between Safe Harbor and Rebuttable Presumption QM loans.

QM Safe Harbor Threshold Should be Increased to APOR Plus 200 bps

Safe Harbor Threshold Will Determine the Conventional Mortgage Market

If the final General QM rule maintains a pricing-based QM, the Bureau should increase the spread that is used to delineate Safe Harbor loans and Rebuttable Presumption loans from 150 bps to 200 bps over APOR. This would not only align the delineation with the APOR threshold that the Bureau recommends using to determine QM status, but would also broaden access to the conventional QM market for more home-ready borrowers and create a more level and coordinated housing finance system across the government and conventional mortgage markets.

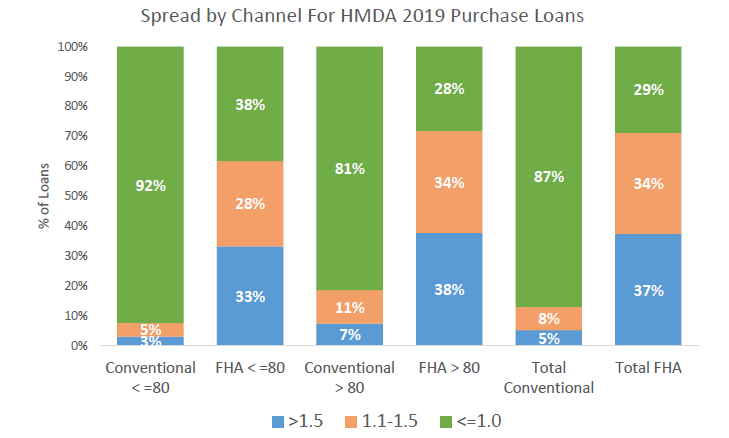

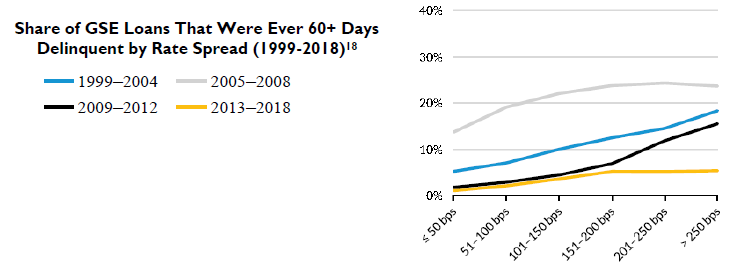

Determining the Safe Harbor threshold impacts the makeup for the conventional market and who it will be able to serve under a new General QM definition because so few Rebuttable Presumption mortgages have been originated in the conventional market since the final QM rule was implemented in 2014. This is because mortgage lenders have sought to minimize their legal risk by almost exclusively originating QM Safe Harbor loans, thus effectively making the Safe Harbor threshold the standard for QM loans. Home Mortgage Disclosure Act (HMDA) data shows that only 4.6% of purchase QM conventional mortgages and 2.5% of refinance QM conventional mortgages from 2019 were above the APOR plus 150 bps Safe Harbor threshold. However, this data should not be mistakenly interpreted as an indication that there is not a market interest in safely lending above this threshold. In fact, lenders are willing to make loans with pricing above 150 bps when those loans have Safe Harbor status, as evidenced by the fact that loans insured by the Federal Housing Administration (FHA) are five times more likely to be originated with spreads above 150 bps than conventional market loans because the FHA Safe Harbor delineation is set at close to 200 bps. It is also important to look at the performance of loans with higher spreads. Historical GSE 60 plus days delinquency data underscores that loans with spreads up to 200 bps above APOR have performed well, are sustainable mortgages that have been made to creditworthy borrowers, and should qualify for QM Safe Harbor treatment.

Minority Borrowers are Denied Greater Choice and Access to Credit as a Result of a Safe Harbor Threshold at 150 bps Above APOR

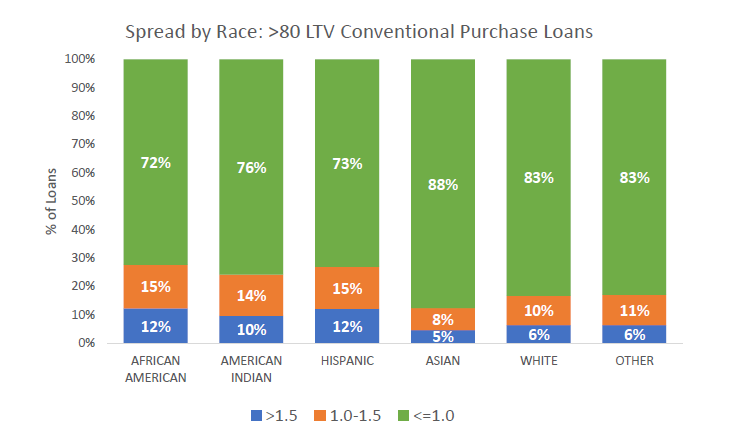

Failure to increase the QM Safe Harbor threshold to 200 bps above APOR misaligns the Safe Harbor definition across the government and conventional mortgage markets and results in the same mortgage being a QM Safe Harbor in one channel, but merely a Rebuttable Presumption QM in another, effectively denying that borrower true choice in lenders and mortgage products. This impact is particularly acute for minority borrowers who overwhelmingly rely on low down payment mortgages to purchase their homes. According to 2019 HMDA data for conventional low down payment purchase mortgages (>80% loan-to-value or LTV), Black and Hispanic borrowers were twice as likely as White borrowers to have mortgages with APRs in excess of the APOR plus 150 bps Safe Harbor spread.

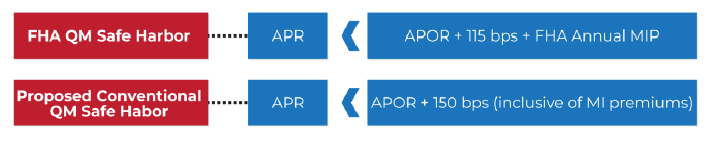

Market Impact from the Calculations for the APOR Spread

As discussed below, the different method for calculating the APOR spread for FHA loans results in loans qualifying for FHA QM Safe Harbor status that would merely qualify for Rebuttable Presumption status in the conventional market. As seen in the chart below, FHA loans are six times more likely to have pricing spreads greater than 150 bps above APOR than conventional loans. In 2019, only 7% of high LTV conventional purchase mortgages were above the APOR plus 150 bps Safe Harbor threshold (representing approximately 82,000 borrowers and $23 billion in origination volume) while 38% of FHA’s high LTV purchase mortgages were above the threshold (representing approximately 252,000 borrowers and $63 billion in origination volume).

The de minimis amount of QM Rebuttable Presumption lending in the conventional market strongly suggests that borrowers – most of whom are minorities – with loan spreads above the proposed APOR plus 150 bps threshold would likely have no real choice other than loans insured by the FHA, because their lenders will only want to originate Safe Harbor loans. To underscore this significant reduction in competition, consider that for 2019 there were nearly three times the number of HMDA reporting

lenders for conventional purchase loans than FHA purchase loans (approximately 3,200 versus 1,200).

Safe Harbor at APOR Plus 200 bps Results in Safe, Sustainable Mortgages

The NPR proposes a pricing threshold to determine whether a loan is a QM and sets the threshold at an APR of up to 200 bps above APOR. The Bureau justifies this threshold using early delinquency data as an indicator of determining consumers’ ATR. The NPR specifically states that “…the Bureau tentatively concludes that this threshold would strike an appropriate balance between ensuring that loans receiving QM status may be presumed to comply with the ATR provisions and ensuring that access to responsible, affordable mortgage credit remains available to consumers” (emphasis added). The proposed QM threshold is predicated on the Bureau’s analysis of early delinquency levels and historical GSE data on 60 plus days delinquent rates demonstrates that increasing the QM Safe Harbor threshold from 150 bps to 200 bps above APOR does not result in a significant deterioration in loan performance that would warrant a different and highly impactful legal characterization. While delinquency is correlated with rate spread, the graph below shows a minimal increase in delinquency rates, especially for the 2013-2018 vintages, which reflect post-crisis enhanced underwriting standards as a result of Dodd-Frank, subsequent rulemakings, and improved lender practices and technologies. This cohort of originations is most indicative of future loan quality and proves that setting the QM Safe Harbor at 200 bps above APOR does not materially increase risk in the system but does indeed expand access to conventional mortgage credit.

Safe Harbor at APOR Plus 150 bps Creates an Unlevel Playing Field Where Lending is Dictated by Regulatory Standards rather than Borrower Credit Profile

Dodd-Frank required the Bureau, U.S. Department of Housing and Urban Developments, U.S. Department of Veterans Affairs, and the Rural Housing Service to create their own QM definitions, including delineating between Safe Harbor and Rebuttable Presumption. The result is a patchwork of standards based on which entity purchases, insures, or guarantees a mortgage loan. In the case of loans insured by the FHA, the delineation between Safe Harbor and Rebuttable Presumption is calculated differently than for conventional loans. This difference has resulted in lenders being much more willing to originate FHA-insured loans with spreads above APOR plus 150 bps because FHA uses a “floating standard” to calculate Safe Harbor that is not impacted by the amount of FHA premium charged. Based on the current FHA Annual Mortgage Insurance Premium (MIP), the FHA QM Safe Harbor is effectively APOR plus 200 bps. As a result, USMI’s recommendation would effectively create a level playing field between FHA and conventional standards for Safe Harbor QMs.

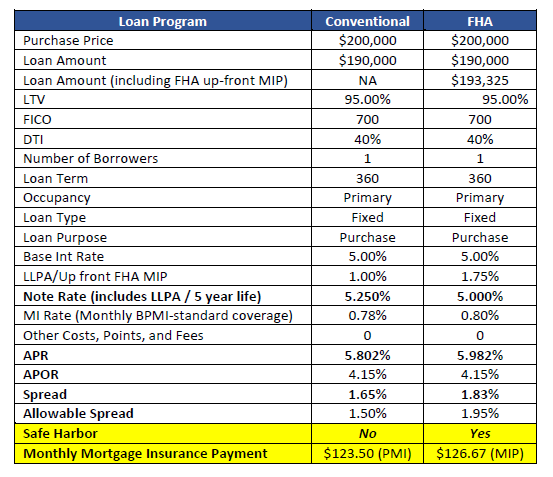

The table below demonstrates how, under the NPR, two loans with identical loan terms and credit characteristics would both be considered QM under the conventional and FHA standards. However, the FHA-insured mortgage would have Safe Harbor status, while the conventional mortgage would merely receive Rebuttable Presumption status. This highlights the current regulatory imbalance that results in many borrowers effectively having no choice on mortgage products because of lenders’ unwillingness to originate Rebuttable Presumption loans.

Another critical difference between the FHA and conventional market calculations is how fees charged by the GSEs and the Government National Mortgage Association (Ginnie Mae) for guaranteeing mortgages affect a loan’s pricing. Unlike the GSEs, Ginnie Mae does not charge risk-based loan-level price adjustments (LLPAs) that factor into a loan’s APR. While the GSEs’ guarantee fees (G-Fees) are in some part based on the attributes of a specific borrower and property, G-Fees and LLPAs also can be –and are – used by the GSEs, Federal Housing Finance Agency (FHFA), and other federal policymakers to accomplish specific public policy or credit risk management goals that can be wholly separate from the credit risk associated with a particular mortgage loan. Further, pricing changes, such as the impact of a finalized rule on GSE capital requirements, adverse market fees based on market developments, or the implementation of new accounting standards have the potential to create temporary credit contractions due to the lag in APOR factoring in new GSE fees and a period of time where APOR is not truly reflective of the mortgage market.

The impact of LLPAs and G-Fees on a conventional loan’s APR could be further magnified by the GSE capital rule that the FHFA recently re-proposed. USMI urges the Bureau and FHFA to study the intersection of these two rulemakings before finalizing either. To the extent that the final capital rule would result in higher G-Fees and/or LLPAs to meet market expectations for a reasonable return on equity (ROE), given the materially higher capital called for under the re-proposed rule, those fees would result in higher APRs and spreads over APOR that could deny a loan Safe Harbor status. USMI urges the Bureau to work with FHFA to ensure clarity and transparency with regard to how the proposed capital requirements could impact the QM Safe Harbor determination.

Implementation of a “Consider and Verify” Standard and Elimination of Appendix Q

With the removal of the 43% DTI limit and Appendix Q from the General QM loan definition, an important element of the NPR is the requirement that a lender “consider and verify” a borrower’s income, assets and debt obligations, as well as provides a compliance safe harbor for the use of Bureau approved external standards. USMI continues to have concerns with a QM standard that relies only on the limited Dodd-Frank product restrictions without any other standards or bright line thresholds that would ensure a borrower has a true ATR. The proposed “consider” requirement is especially subjective and the NPR does not currently include specific standards that a lender must meet in order to satisfy this element of the QM definition. In order to provide clarity to market participants, the final rule should identify specific requirements or best practices to be used by lenders to qualify for the “consider and verify” compliance safe harbor. While under the proposed approach in the NPR a specific DTI threshold would be removed from the General QM definition, we think that a properly crafted standard for “consider and verify” could function to encourage the kind of robust underwriting that is needed to assess a borrower’s ATR. For example, one way in which a creditor might document how it “considered” a loan with an elevated DTI would be to use a specific set of underwriting criteria, including compensating factors for consumers with elevated DTIs as recommended in USMI’s 2019 comment letter. Such an approach would be more consistent with the intent of a General QM definition that includes underwriting guardrails and would better ensure creditors appropriately consider critical elements in assessing and ensuring a borrower’s ATR. Further, a set of transparent compensating factors would provide for great consistency across government and conventional mortgage markets and would be more meaningful for considering and determining a borrower’s ATR.

Also related to the “consider and verify” standard, USMI supports the NPR’s proposal to eliminate the requirement that mortgage lenders use Appendix Q to calculate a borrower’s income and debt obligations and to allow other forms of documenting and verifying income, assets, and debt. Widely understood, accessible, and trusted standards for determining income and debt are critical for consistent and prudent mortgage underwriting. However, the static nature of Appendix Q has proven problematic, especially as financial technology (fintech) and workforce trends continue to evolve. By eliminating Appendix Q, the Bureau opens the door to the use of more flexible and dynamic standards and processes for calculating income and debt, which is especially important for creditworthy borrowers with non-traditional forms of income who would be disadvantaged should lenders be required to use Appendix Q.

The NPR notes that lenders would have the flexibility to develop their own income and debt verification standards or could rely on “verification standards the Bureau specifies,” which potentially includes the following: Fannie Mae’s Single Family Selling Guide; Freddie Mac’s Single-Family Seller/Servicer Guide; FHA’s Single Family Housing Policy Handbook; the VA’s Lenders Handbook; and the Field Office Handbook for the Direct Single Family Housing Program, and the Handbook for the Single Family Guaranteed Loan Program of the U.S. Department of Agriculture (USDA).23 These guides and the standards contained within are widely understood by mortgage market participants and, unlike federal regulations, can be, and are, easily revised to account for housing market or broader economic developments or fintech innovation. In the final rule, the Bureau should detail a transparent process by which it will evaluate, approve, and supervise verification standards developed by individual market participants or through a collaborative entity, such as an industry self-regulatory organization.

Notwithstanding the elimination of underwriting thresholds in the General QM definition, in the low down payment segment of the conventional market, MI companies will continue to apply and rely on their underwriting guidelines to assess individual borrowers for purposes of determining ATR and overall creditworthiness. The MI industry’s underwriting guidelines and role as “second pairs of eyes” have proven beneficial with identifying credit risk trends, most notably risk layering and ensuring prudent conventional mortgages.

Regulatory Alignment

Realizing this rulemaking’s impact on the size of the conventional market and its underwriting guardrails, it is critical to highlight the historical link between the QM definition and the Credit Risk Retention Rule, which includes an exemption from the five percent retention requirement for assetbacked securities collateralized exclusively by mortgages that are deemed “qualified residential mortgages” (QRMs). Due to the two standards being linked by statute and the requirement that QRM be “no broader than” the definition for QM, the promulgating agencies established a QRM framework that fully aligns with QM. The housing finance system has functioned well under this alignment which has enhanced financial stability, protected investors, promoted compliance, and preserved consumers’ access to affordable credit. The promulgating agencies announced that they would postpone consideration of changes to the QRM standard until June 2021 to factor in any changes to the QM definition. USMI urges housing and financial regulators to preserve the full alignment between the QM and QRM standards in order to preserve current housing market functions and processes.

It is critical that housing finance regulators, including the Bureau, FHFA, and FHA, have a transparent and coordinated approach to the federal government’s housing policy. In addition to preserving the alignment between the QM and QRM standards, USMI urges the Bureau to work closely with the FHFA on the implications for QM due to its proposed GSE capital rule, and with the FHA to align QM standards. Robust coordination will ensure that borrowers are best served by housing market participants and that the federal government, and therefore taxpayers, are adequately protected from losses related to mortgage credit risk.

Treatment of Adjustable-Rate Mortgages

The NPR would modify the assessment of ARMs for purposes of determining QM status, such that lenders “must treat the maximum interest rate that could apply at any time during [the] five-year period [after the date on which the first regular periodic payment will be due] as the interest rate for the full term of the loan to determine the annual percentage rate.” This provision would likely reduce the availability of three- and five-year ARM products in the conventional mortgage market. USMI believes that this element of the NPR should be reconsidered and amended to exclude five-year ARM products from the proposed treatment of short-reset ARMs. Based on internal analysis of the performance for five-year ARM products, USMI member company data demonstrates that ≥5-year ARM performance is in line with, or better than, >20-year fixed-rate mortgages. Further, private MIs’ guidelines treat five year ARMs as a “fixed-rate mortgage” based on historical performance.

Implementation of the New General QM Definition

The NPR indicates that a new General QM definition will likely not take effect before April 1, 2021, based on the Bureau’s determination that “a six-month period between Federal Register publication of a final rule and the final rule’s effective date would give creditors enough time to bring their systems into compliance with the revised regulations.” The Bureau has also proposed that the GSE Patch expire no earlier than: (1) the GSEs exiting conservatorship; or (2) the effective date of the General QM final rule.

As explained in our comment letter on the Bureau’s proposed rule regarding the sunset of the GSE Patch, it is critical that the Bureau provide for a smooth transition from the GSE Patch to the new General QM definition.

Depending on the complexity of the finalized revisions to the General QM definition, the significance of the penalties for a violation of the ATR/QM Rule, and the large number of mortgage industry participants (lenders, brokers, MIs, warehouse lenders, etc.) that will need to update their operations and systems, USMI recommends that the Bureau set the sunset date for the GSE Patch to be at least six months after the effective date of the General QM definition final rule. During this six-month period, lenders should be permitted to use either the GSE Patch or the new General QM definition during the

mortgage underwriting process, such that a loan meeting either standard would qualify as a QM. This would afford industry participants an appropriate amount of time to develop, test, and implement new models and business operations in order to smoothly transition to the new General QM framework. More specifically, the six-month overlap period would fix the regulatory gap caused by using the mortgage consummation date for the GSE Patch and the loan application date for the proposed General QM definition.

Further, mortgage market participants, consumers, and the economy as a whole are grappling with an unprecedented level of uncertainty due to the COVID-19 pandemic. The mortgage industry is working diligently to support homeowners directly and indirectly affected by COVID-19, especially through the implementation of broad nationwide mortgage relief for homeowners following the enactment of the “Coronavirus Aid, Relief, and Economic Security Act” (CARES Act). Given the extensive scope of the

pandemic and the financial services industry’s appropriate focus on responding to the economic and health fallout from COVID-19, USMI believes that a six-month overlap period would promote an orderly implementation timeframe for the new General QM framework while continuing to assist homeowners

throughout the country.

**************************

Thank you again for the opportunity to comment on the proposed General QM definition and your consideration of our recommendations to best balance prudent mortgage underwriting and credit risk management with borrower access to mortgage finance credit. USMI and our member companies appreciate the Bureau’s thorough review of this very important issue and we look forward to continued dialogue as the Bureau proceeds with finalizing and implementing a new General QM definition.

Sincerely,

Lindsey D. Johnson

President

U.S. Mortgage Insurers

View the letter as a PDF.

Press Release: USMI Submits Comments to FHFA on its Re-Proposed Enterprise Regulatory Capital Framework

WASHINGTON — U.S. Mortgage Insurers (USMI), the association representing the nation’s leading private mortgage insurance (MI) companies, submitted its comment letter to the Federal Housing Finance Agency (FHFA) for its re-proposed Enterprise Regulatory Capital Framework (ERCF). In its letter, USMI emphasizes the importance of constructing a balanced, transparent, and analytically justified post-conservatorship capital framework for the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac.

“USMI supports FHFA’s efforts on this important rulemaking. While sufficient levels of capital are important to the sustainable operation of Fannie Mae and Freddie Mac, excessive capital requirements could have a detrimental effect on mortgage availability and costs for consumers, and can inadvertently push mortgage lending outside of the conventional mortgage market,” said Lindsey Johnson, President of USMI. “As FHFA advances this rulemaking, a balance must be struck between prudently managing the GSEs’ risk and protecting taxpayers, while also ensuring that affordable low down payment mortgages remain available for borrowers.”

In its comments, USMI notes the important issues and specific components of the proposed rule that require further attention, as they could potentially create unintended negative consequences. USMI urges the adoption of a final regulation that appropriately balances taxpayer protection and support for the housing markets, consistent with the GSEs’ charters and unique role in the mortgage finance system. Continued access to sustainable, affordable conventional mortgages is particularly important for minorities, lower income individuals, and first-time homebuyers.

Further, USMI advocates for a rule that gives interested parties the opportunity to fully understand the basis for the elements of the proposal and submit beneficial comments to FHFA. USMI, along with other industry participants, continue to be concerned that subjective determinations have the potential to cause great harm to the housing market and are inappropriate if the GSEs are released from conservatorship. Moreover, the current proposed rule would require capital levels that are significantly higher than is necessary for the GSEs’ post 2008 financial crisis and does not reflect the improved loan underwriting required by the GSEs and the Dodd-Frank Act.

USMI’s comments also caution FHFA to avoid adopting a bank capital model given the insurance nature of the GSEs’ business, suggesting they should be subject to an insurance capital framework and that, if necessary, adjustments can be made to account for systemic risk. Additionally, USMI recommends that the risk-adjusted capital rule should be based on credit risk and be as risk-sensitive as possible, having non-credit risk concerns addressed through separate regulatory requirements.

USMI also advocates for more transparent and objective treatment of the GSEs’ counterparties, especially private mortgage insurers that meet a set of rigorous capital and operational requirements known as the Private Mortgage Insurer Eligibility Requirements (PMIERs). USMI adds that private mortgage insurers should not be subject to additional measures of creditworthiness given they already comply with, and exceed, PMIERs. Further, USMI suggests that the proposed rule should promote private capital through the use of both loan level credit enhancement, such as private MI, and through responsible credit risk transfer (CRT). For CRT, the proposed rule should be adjusted to reflect the risk-reduction benefit that is attained by properly priced CRT, and eliminate non-credit risk related buffers that overly penalize CRT to a point that will disincentivize the GSEs’ from de-risking.

Finally, USMI underscores that a revised capital standard is only one element of GSE reform, writing: “The FHFA should use its considerable authority, both as the regulator and conservator, to take steps to ensure that the GSEs are appropriately regulated and do not cross the bright line between primary and secondary mortgage markets. Specifically, we believe that the GSEs should be subject to utility-like regulation, with capped rates of return, restricted to explicitly authorized secondary market activities, and with open and transparent underwriting engines and systems, and publicly disclosed pricing. Doing so would maintain the GSEs as market makers, provide stability through different market cycles, protect taxpayers, and ensure accessibility to sustainable and affordable mortgage finance credit.”

USMI’s full comments on the 2020 NPR can be found here and an executive summary can be found here. Its comments on the 2018 NPR can be found here.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Letter: Comments on FHFA’s Proposed Rule on the Enterprise Regulatory Capital Framework

On June 30, 2020, the Federal Housing Finance Agency (FHFA) published a Notice of Proposed Rulemaking (NPR) on the Enterprise Regulatory Capital Framework (ERCF). On August 31, USMI submitted comments to the NPR, emphasizing the importance of constructing a balanced, transparent, and analytically justified framework. USMI’s full comments can be found here and an executive summary can be found here. In 2018, FHFA issued a prior proposal for changing the risk-based capital framework for the GSEs. USMI also submitted a comment letter, which can be found here.

Blog: CFPB Should Increase Safe Harbor Threshold to Mitigate Borrower Impact

One of the main drivers of the 2008 financial crisis was lending to borrowers with inadequate ability to repay their mortgage loans. In response, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act, which created the Consumer Financial Protection Bureau (CFPB) and established an ability-to-repay/qualified mortgage (ATR/QM) standard. Dodd-Frank went beyond previous federal regulations and consumer protections, including the Home Ownership and Equity Protection Act (HOEPA) that had previously defined a class of higher priced mortgage loans (HPMLs).

Going beyond HPML to address some of the underwriting concerns in the marketplace, Dodd-Frank created specific mortgage product restrictions and required the CFPB to promulgate a rule defining Qualified Mortgage based on specific underwriting criteria. As promulgated in the 2013 final rule, QM and safe harbor were measuring two separate things so different standards made a certain amount of sense. The QM standard was based on product and underwriting requirements, while safe harbor was based on loan pricing specifically assessing whether the loan was a HPML.

The CFPB is now seeking to update the regulation. In late June, the Bureau issued Notices of Proposed Rulemaking (NPRM) on the general QM definition under the Truth in Lending Act (Regulation Z) and the GSE Patch. The CFPB proposes to change the current QM standard in favor of a pricing threshold based on the difference between the loan’s annual percentage rate (APR) and the average prime offer rate (APOR) for a comparable transaction. The proposed rule would define a QM as a mortgage loan which is priced not more than 200 basis points (bps) above the APOR.

Unlike the 2013 final rule, the QM standard and safe harbor are measured using the same price metric under the new proposed rule. Having two different pricing thresholds to determine QM and safe harbor loan status creates an unlevel playing field that will arbitrarily shift borrowers to mortgages backed by the Federal Housing Administration (FHA) and leave consumers with less access to mortgage finance credit—all based on an arbitrary line.[1]

While USMI will comment on other aspects of the proposed rule, we think that one of the most significant issues within the proposal is the safe harbor pricing threshold. Based on our analysis of mortgage originations, loan performance, market dynamics, and the need to ensure consumer access to affordable mortgage finance, we recommend that this threshold should be pegged to the same threshold as the QM status, which the NPR suggests should be 200 bps. USMI made this recommendation to the CFPB in a September 2019 comment letter in response the CFPB’s Advance NPRM.

In the 2020 proposed rule, the Bureau justifies recommending QM status be based on a pricing threshold to 200 bps using early delinquency data as an indicator of determining a borrower’s ATR, stating in the NPRM:

“…the Bureau tentatively concludes that this threshold would strike an appropriate balance between ensuring that loans receiving QM status may be presumed to comply with the ATR provisions and ensuring that access to responsible, affordable mortgage credit remains available to consumers.”[2]

Should the CFPB move forward to replace the current QM definition with one based on a pricing threshold, then the Bureau can and should increase the spread that is used to delineate safe harbor loans from 150 to 200 bps over APOR to be consistent with the threshold that the Bureau recommends for QM status in its NPRM.

Why moving the safe harbor threshold to 200 bps matters:

- Lenders don’t lend above the safe harbor line in the conventional market.The distinction between safe harbor and rebuttable presumption matters. Market data makes it clear that many lenders avoid making rebuttable presumption QM loans to avoid any risk of legal liability. This is evidenced by the fact that less than five percent of all the conventional market financing in 2019 was done above the safe harbor line. For all intents and purposes, the safe harbor line effectively defines the conventional market and changes to how the Bureau defines QM safe harbor will impact who the conventional market will serve going forward.

- Current recommended threshold disproportionately impacts Black and Latinx borrowers who are twice as likely as White borrowers to have conventional low down payment purchase loans outside a safe harbor of 150 bps. Under the proposed rule, many of the borrowers who are above the 150 bps threshold will be left only with the option of a FHA loan, which means they have vastly different competitive choices in terms of product offerings and loan terms—as demonstrated by the fact that there were approximately 3,200 HMDA reporting lenders for conventional purchase loans versus only about 1,200 for FHA purchase loans. This arbitrary line affects these borrowers’ credit options and leaves them with significantly fewer competitive options in the marketplace.[3]

- Creates an unlevel playing field. While the percentage of the conventional market above 150 bps is small on a percentage basis, this is not to suggest that there are not good quality loans above this threshold being done. FHA is five times more likely to have loans above the 150 bps simply because FHA calculates the APOR cap and APR calculation differently. HUD defines safe harbor as 115 bps plus the mortgage insurance premium, which is closer to FHA having a safe harbor threshold of approximately 200 bps, or even higher. Due to the discrepancies for how this threshold is calculated between the conventional and FHA markets, leaving the safe harbor threshold for conventional loans at 150 bps will arbitrarily distort the market and shift borrowers to FHA. This will give these borrowers fewer choices and shift borrowers from a market backed by private capital to the 100 percent taxpayer-backed market.

The Solution:

The solution is to increase the safe harbor pricing threshold to 200 bps to be consistent with the proposed QM pricing threshold. This will result not only in a more level playing field, but most importantly, by changing the threshold, the impact to borrowers can be mitigated. The volume of loans that would otherwise be left out of the conventional safe harbor market is reduced by almost 60 percent for the high-LTV market and reduced by over 50 percent for the entire conventional market.[4]

Increasing the safe harbor threshold to 200 bps above APOR will best ensure that we strike an appropriate balance between prudent underwriting, credit risk management, and consumers’ access to sustainable and affordable mortgage credit.

[1] 85 Fed. Reg. 41716 (July 10, 2020).

[2] 85 Fed. Reg. 41735 (July 10, 2020). Underlying and emphasis added.

[3] 2019 HMDA Data.

[4] 2019 HMDA Data.

Newsletter: August 2020

While this summer has posed new and unexpected challenges, policymakers and U.S. Mortgage Insurers (USMI) and our members continue to work hard to make sure the U.S. housing system remains strong as we face unprecedented economic and health challenges resulting from COVID-19. Below are topics we have been following:

USMI Member Company COVID-19 Response

CFPB Kraninger’s Semi-Annual Hearings

USMI Submits Comment Letter to CFPB on GSE Patch Extension

SCOTUS to Hear Arguments on FHFA’s structure

Dana Wade Confirmed as FHA Commissioner

USMI President in Mortgage Professional America

- USMI Member Company COVID-19 Response. USMI updated its COVID-19 resource webpage with its members’ response fact sheet, highlighting many of the important actions that USMI members have taken to support homeowners, servicers, and lenders across the country during the pandemic. Because of the critical role USMI members play in the housing finance system, the mortgage insurance (MI) industry is committed to supporting the federal government’s robust mortgage relief initiatives, including the nationwide forbearance programs implemented by Fannie Mae and Freddie Mac (GSEs). The fact sheet outlines areas of common ground between USMI members and how they have focused their efforts on helping borrowers remain in their homes by supporting their lender customers during these challenging times.

- CFPB Kraninger’s Semi-Annual Hearings. On July 29 and 30, Consumer Financial Protection Bureau (CFPB) Director Kathleen Kraninger testified before the Senate Banking Committee and House Financial Services Committee, respectively. Both hearings focused on the Bureau’s response to the COVID-19 pandemic and on its ongoing rulemakings and supervision activities. In her written testimony submitted to the Senate Banking Committee, Director Kraninger provided an update on the CFPB’s proposed changes to the GSE provision (GSE Patch) of the Bureau’s Ability-to-Repay (ATR)/Qualified Mortgage (QM) Rule, which is set to expire in January 2021. The CFPB is still considering removing the QM loan definition’s 43 percent debt-to-income (DTI) ratio and replacing it with a pricing threshold.

During the Senate Banking hearing, Senator Tim Scott (R-SC) asked Director Kraninger why the QM standard and safe harbor thresholds would be different and stated, “I think we should do all that we can for credit worthy borrowers to become homeowners when it makes sense. By harmonizing the QM and the safe harbor, it might make it easier for financial institutions to not go to the default position of the safe harbor that’s 50 (basis) points lower.” In addition, during the House Financial Services Committee hearing, members from both parties expressed interest in the CFPB’s rulemaking on the General QM definition and its effect on prudent underwriting and consumers’ access to credit. Representatives Bill Foster (D-IL) and French Hill (R-AR) emphasized that any new QM standard should retain robust underwriting standards to ensure ATR and promote sustainable homeownership. Further, Representatives Hill and Steve Stivers (R-OH) noted that there should be a single pricing standard for QM and Safe Harbor since, unlike the 2013 ATR/QM Rule, pricing would be used to measure both under the proposed rule.

- USMI Submits Comment Letter to CFPB on GSE Patch Extension. On August 10, USMI submitted a comment letter to the CFPB in response to the Notice of Proposed Rulemaking (NPR) regarding the extension of the sunset date for the Temporary GSE QM definition, or the “GSE Patch,” under the Qualified Mortgage Definition under the Truth in Lending Act (Regulation Z), which is currently set to expire on January 10, 2021. USMI recommended to Director Kraninger that the CFPB should “set the sunset date for the GSE Patch to be at least six months after the effective date of the finalized General QM definition rule.” Doing so would allow all industry stakeholders sufficient time to fully understand and implement the new rule and afford industry participants an appropriate amount of time to develop, test, and implement new models to facilitate a smooth transition to the new general QM framework. Moreover, as the financial services industry grapples with implications of COVID-19 and works to support market participants, consumers, and the economy, USMI believes a six-month overlap period would promote an orderly implementation of the new General QM definition while offering continued assistance to homeowners across the county.

In June 2020, the CFPB issued a NPR on the General QM definition under the Truth in Lending Act (Regulation Z) and the GSE Patch. The Bureau’s NPR proposes to change the current QM standard in favor of a pricing threshold; specifically, the difference between the loan’s Annual Percentage Rate (APR) and the Average Prime Offer Rate (APOR) for a comparable transaction at 200 basis points (bps) above APOR. The Bureau justifies this threshold using early delinquency data as an indicator of determining consumers’ ATR.

In a September 2019 comment letter to the CFPB, USMI emphasized that, should the Bureau move forward to replace the QM definition with one based on a pricing threshold, it can and should increase the spread that is used to delineate Safe Harbor loans. The previous 2013 ATR/QM Rule created two legal presumptions for QM loans: “Safe Harbor” and “Rebuttal Presumption.” These presumptions have, in turn, created a norm by which lenders will not typically lend above the Safe Harbor line and avoid making Rebuttable Presumption loans as to avoid risk to legal responsibility. This standard has disproportionality impacted Black and Hispanic homebuyers, who were twice as likely as White borrowers to have low down payment conventional purchase loans outside of the Safe Harbor. Under the proposed rule, many of the borrowers who are above the 150 bps threshold will be left only with the option of a Federal Housing Administration (FHA) loan, which means they have vastly different competitive choices in terms of product offerings and loan terms. Further, due to the discrepancies for how this threshold is calculated between the conventional and FHA markets, leaving the Safe Harbor threshold at 150 bps will arbitrarily distort the market and shift borrowers to FHA.

Based on this, USMI and other industry members recommend that the Bureau increase the Safe Harbor threshold to 200 bps above APOR to be consistent with the proposed QM APOR threshold that the Bureau recommended in its June 2020 NPR.

- SCOTUS to Hear Arguments on FHFA’s structure. On July 9, the Supreme Court announced that it would hear Collins v. Mnuchin upon its return in October. The suit questions the constitutionality of the FHFA’s single-director structure. Currently, the FHFA director is appointed to serve a five-year term and can only be removed “for-cause;” he or she cannot be fired at-will by the president. This follows the Court striking down the CFPB’s single-director structure in a 5-4 ruling in Seila Law v. CFPB in June, declaring it unconstitutional and severable from the other provisions of the Dodd-Frank Act.

In a statement, the FHFA said it did not believe the Court’s ruling applied to the FHFA. “The Seila Law decision does not directly affect the constitutionality of FHFA, including the for-cause removal provision.” It continued, “FHFA looks forward to the U.S. Supreme Court taking up the Collins case and clarifying these important issues.”

- Dana Wade Confirmed as FHA Commissioner. On July 28, the Senate confirmed Dana Wade in a 57-40 bipartisan vote as commissioner of the FHA. USMI issued a statement praising Wade’s confirmation. USMI President Lindsey Johnson said, “Commissioner Wade has shown commitment to keeping FHA’s core mission of providing affordable housing opportunities to moderate and low-income households, who need the agency’s 100 percent taxpayer-backed loans the most. We are confident that Commissioner Wade will continue to carry out this mission as she understands the important role the agency plays in our housing financial system.” Mortgage Professional America included USMI’s statement in its coverage of Wade’s confirmation.

- USMI President in Mortgage Professional America. Mortgage Professional America published USMI President Lindsey Johnson’s op-ed titled, “Low Down Payments Backed by Mortgage Insurance More Important Than Ever.” Using data from USMI’s 2020 “MI in Your State” report, Johnson explains why low down payment lending will be even more critical for future homeowners as the country endures and recovers from the current COVID-19 pandemic. The report found that it could take the average American homebuyer over 20 years to save for a 20 percent down payment. With private MI, the wait time could drop to just 7 years with a 5 percent down payment. Low down payments with private MI enable more well-qualified borrowers to become homeowners while keeping more cash on hand, a critical aspect during these trying times. Private MI also assumes the first layer of protection against mortgage credit risk protecting the federal government, and thus, American taxpayers. She concludes stating, “right now, more than ever, we are even more aware of the benefits of owning a home—from building wealth to creating stability to the importance of having a safe place to call your own.”

Op-Ed: Low Down Payments Backed by Mortgage Insurance More Important Than Ever

By: Lindsey Johnson

Today, the place you call home matters more than ever. Unfortunately, many Americans continue to believe homeownership is out of reach because they think a 20 percent down payment is needed to qualify for a mortgage.

A recent report by the private mortgage insurance (MI) industry finds that it could take a family earning the national median income over 20 years to save for a 20 percent down payment. But the wait decreases by 67 percent when a five percent down payment is the goal. Fortunately, millions of homebuyers each year qualify for home financing with low down payments.

Given the current economic environment due to COVID-19 and the desire of many people to keep more cash on-hand, low down payment loans are more important than ever. Low down payment mortgages with private mortgage insurance have proven to be a time-tested means for Americans to access affordable homeownership sooner while still providing credit risk protection and stability to the U.S. housing system. It is no wonder why more than 33 million homeowners have used this type of home financing and why its use is on the rise.

The report finds that in 2019, the number of low down payment loans backed by private MI increased 22.9 percent. Over 1.3 million home loans were purchased or refinanced with private MI, up from just over 1 million in 2018. Nearly 60 percent of the borrowers of these loans were first-time homebuyers and 40 percent had annual incomes of less than $75,000.

Why have millions turned to this type home financing?

Let us first take a closer look at a borrower who earns the national median income of $63,179. To save 20 percent, plus closing costs, for a $274,600 home, the median sales price for a single-family home last year, they would need to bring more than $63,000 in cash to the table. It could take up to 21 years to save up this amount based on the national savings rate dedicated towards a mortgage. But if this borrower qualifies using private MI on a five percent down payment mortgage, their wait time drops to just seven years. This type of home financing offers Americans a chance to secure home financing much sooner than previously believed.

Why is 20% the “magic number”?

Data demonstrates that borrowers who make larger down payments are less likely to default on their mortgages than borrowers with lower down payments. Therefore, lenders traditionally require a 20 percent down payment to offer mortgage financing to a borrower. This is where mortgage insurance steps in, providing credit enhancement for the borrower with a lower down payment, and insuring the loan for the lender in the event the borrower stops making their payments. Once the borrower builds 20 percent equity in their mortgage, the insurance can be cancelled, thus lowering the monthly payment. Private MI also helps Americans buy a home without necessarily breaking the bank.

Private mortgage insurance is offered on so-called conventional loans that are backed by the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. When there is private MI on a loan, the risk protection provided to lenders for making a low down payment mortgage possible is extended to the GSEs too. In the event of a default, the private mortgage insurance stands to cover losses first, meaning private MI also protects taxpayers.

Supporting the American Dream

As the report demonstrates, private mortgage insurers’ role in the low down payment market significantly increased over the last five years. Between 2015 and 2019, private mortgage insurers’ market share in the low down payment lending sector increased from 34.8 percent of the insured market in 2015 to 44.7 percent in 2019, helping millions of Americans qualify for home financing.

Private MI offers a reliable path to the American dream of owning a home. Since 1957, private MI has helped more than 33 million Americans become homeowners while protecting taxpayers. And right now, more than ever, we are even more aware of the benefits of owning a home—from building wealth to creating stability to the importance of having a safe place to call your own.

Lindsey Johnson is the president of the U.S. Mortgage Insurers (USMI), the association representing the nation’s leading private mortgage insurance companies.

###

Mortgage Professional America originally published USMI President Lindsey Johnson’s opinion piece, “Low down payments backed by mortgage insurance more important than ever” on August 10, 2020.

Letter: GSE Patch Extension

The Honorable Kathleen Kraninger

Director

Consumer Financial Protection Bureau

1700 G Street NW

Washington, DC 20052

Re: Qualified Mortgage Definition Under the Truth in Lending Act (Regulation Z): Extension of Sunset Date, Docket No. CFPB-2020-0021

Dear Director Kraninger:

U.S. Mortgage Insurers (USMI) represents America’s leading providers of private mortgage insurance (MI). Our members are dedicated to a housing finance system backed by private capital that enables access to prudent and sustainable mortgage finance for borrowers while also protecting Fannie Mae and Freddie Mac (the GSEs) and the American taxpayer. The MI industry has more than six decades of expertise in underwriting and actively managing mortgage credit risk, and our member companies are uniquely qualified to provide insights on federal policies concerning underwriting standards for the conventional mortgage market, especially given our experience balancing prudent underwriting with access to affordable mortgage credit.

USMI appreciates the opportunity to comment on the Consumer Financial Protection Bureau’s (Bureau) Notice of Proposed Rulemaking (NPR) regarding the Extension of the Sunset Date for the Temporary GSE Qualified Mortgage (QM) definition. This is an important rulemaking that will work in tandem with the Bureau’s proposed rule to amend the General QM definition and USMI fully supports a smooth transition to a well-calibrated QM definition that promotes prudent underwriting and facilitates access to affordable conventional mortgages for creditworthy consumers. USMI and other housing finance stakeholders recognize that changes to the General QM definition will broadly inform underwriting standards and policies across the mortgage market and will have a significant impact on the number and profile of borrowers served by the conventional mortgage market.

Background

The Bureau’s 2013 Ability-to-Repay/Qualified Mortgage Rule (ATR/QM Rule) created a Temporary GSE QM category for mortgages that: (1) comply with statutory product restrictions, including a points and fees limit; and (2) and are eligible for purchase or guarantee by the GSEs. This QM category became known as the “GSE Patch” and was scheduled to expire the earlier of: (1) the GSEs exiting conservatorship; or (2) or January 10, 2021. The Bureau believed this sunset date would create “an adequate period for economic, market, and regulatory conditions to stabilize” and a “reasonable transition period to the General QM definition.”

For nearly seven years, the GSE Patch has served its intended purpose of maintaining credit availability in the conventional mortgage market. According to data from the Bureau and Federal Housing Finance Agency (FHFA), approximately 957,000 mortgages – or 16 percent of all closed-end first-lien residential mortgage originations – in 2018 fell outside the General QM loan definition but received QM status due to the GSE Patch. These borrowers only had access to financing in the conventional market due to the existence of the GSE Patch.

Expiration of the GSE Patch & Implementation of the New General QM Definition

The NPR would modify the sunset date for the GSE Patch such that its expiration would be the earlier of: (1) the GSEs exiting conservatorship; or (2) the effective date of the General QM final rule. The Bureau has indicated that it “does not intend to issue a final rule amending the General QM loan definition early enough for it to take effect before April 1, 2021” based on the proposed “six-month interval between Federal Register publication of a final rule and the rule’s effective date.”

Recommendation

Consistent with the fact that the GSE Patch was created as a temporary QM category, USMI has strongly supported moving to a QM definition that can be applied consistently throughout the mortgage market. The GSE Patch has played a critical role in maintaining access to mortgage credit and it is paramount that the Bureau provide a smooth transition from its expiration to the new General QM definition. USMI recommends that the Bureau set the sunset date for the GSE Patch to be at least six months after the effective date of the finalized General QM definition rule.

In order to maximize the balance between access to credit, consumer protections, and sustainable homeownership, it is critical that housing industry stakeholders have sufficient time to fully understand and implement a new General QM standard. Depending on the complexity of the finalized revisions to the General QM definition, the significance of the penalties for a violation of the amended ATR/QM Rule, and the large number of mortgage industry participants (lenders, brokers, MIs, warehouse lenders, etc.) that will need to update their operations and systems, USMI recommends a six-month overlap period to mitigate issues associated with implementing a new General QM standard. During the six-month period, mortgage lenders should be permitted to use either the GSE Patch or the new General QM definition, such that a loan meeting either standard would qualify as a QM. This would afford industry participants an appropriate amount of time to develop, test, and implement new models and business operations/processes and facilitate a smooth transition to the new General QM framework. Further, a six-month overlap period would reduce compliance issues that could arise with a singular date that ends the GSE Patch and makes the new General QM definition effective. Specifically, the overlap period would fix the regulatory gap caused by using the mortgage consummation date for the GSE Patch and the loan application date for the proposed General QM definition.

Further, due to the ongoing COVID-19 pandemic, mortgage market participants, consumers, and the economy as a whole are grappling with an unprecedent level of uncertainty. Following the enactment of the “Coronavirus Aid, Relief, and Economic Security Act” (CARES Act), industry is working hard to support homeowners directly and indirectly affected by COVID-19, especially through the implementation of broad nationwide mortgage relief for homeowners with mortgages backed by the GSEs. Due to the extensive scope of the pandemic and the financial services industry’s appropriate focus on responding to the economic and health fallout from COVID-19, USMI believes that a six-month overlap period would promote an orderly implementation period for the new General QM framework while continuing to assist homeowners throughout the country.

***********************

Thank you again for the opportunity to comment on the Extension of the Sunset Date for the GSE Patch and your consideration of our recommendation. USMI and our member companies appreciate the Bureau’s thorough review of this very important issue and we look forward to a continued dialogue as the Bureau proceeds with finalizing and transitioning to a new General QM definition.

Sincerely,

Lindsey D. Johnson

President

U.S. Mortgage Insurers

View the letter as a PDF here.

Statement: Bipartisan Senate Confirmation of Dana Wade as FHA Commissioner

WASHINGTON — Lindsey Johnson, President of the U.S. Mortgage Insurers (USMI), today issued the following statement on the U.S. Senate’s bipartisan confirmation of Dana Wade to serve as Federal Housing Administration (FHA) Commissioner:

“USMI applauds the Senate for its bipartisan vote to confirm Dana Wade to serve as FHA Commissioner. Commissioner Wade is a respected expert with broad experience in financial and housing policy issues, which provide her of the adequate tools to tackle the challenges facing the FHA and housing finance system going forward.

“Commissioner Wade has shown commitment to keeping FHA’s core mission of providing affordable housing opportunities to moderate and low-income households, who need the agency’s 100 percent taxpayer-backed loans the most. We are confident that Commissioner Wade will continue to carry out this mission as she understands the important role the agency plays in our housing financial system.

“The FHA has improved its financial health over the last few years, however it is important that policymakers keep their focus on ensuring that the FHA is not overexposing taxpayers to undue risk. The FHA-insured market and the conventional market should complement one another. For more than 60 years private mortgage insurance has played a leading role in promoting affordable and sustainable homeownership. We look forward to working closely with Commissioner Wade in seeking ways to establish a more complimentary, collaborative, and consistent housing policy that can expand private capital’s role in shouldering more risk in front of taxpayers in the housing market.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Podcast: President Lindsey Johnson on Millennial to Millionaire

USMI President Lindsey Johnson appeared on the Millennial to Millionaire podcast with Paris Grant and discussed how private mortgage insurance helps young people become homeowners sooner.

Newsletter: July 2020

We wish everyone a happy, healthy July 4th holiday and thank those who continue to serve the nation on the front lines of the COVID-19 health crisis. USMI and our members remain committed to supporting the U.S. housing finance system, ensuring homeowners continue to have access to prudent, affordable, low down payment mortgages to keep more cash on hand, especially during these critical and uncertain economic times. Additional information can be found on USMI’s COVID-19 Resource page. Below are updates related to COVID-19 as well as other recent significant policy and regulatory developments.

USMI Releases its Annual State-by-State Report

New Board Chairman at USMI

FHFA and the GSEs Provide Clarity on PMIERs Amid COVID-19

SCOTUS Rules on CFPB’s Single-Director Structure

CFPB Proposes Rules on QM Definition and Extension of the GSE Patch

FHFA Issues Re-Proposed Enterprise Capital Rule

ICYMI: New Video Explains How Private MI Work

- USMI Releases its Annual State-By-State Report. On June 22, USMI released its annual report on low down payment lending at the state level. The report highlights that the number of low down payment loans backed by private mortgage insurance (MI) increased 22.9 percent in 2019; meanwhile saving for a 20 percent down payment could take potential homebuyers 21 years to save — three times the length of time it could take to save a 5 percent down payment. USMI also found that the top five states for low down payment home financing with private MI were Texas, California, Florida, Illinois, and Ohio.

Upon release of the report, USMI President Lindsey Johnson noted that “Given the current economic environment and the desire of many people to keep more cash on-hand, low down payment loans are more important than ever. Loans backed by private MI are a great option as a time-tested means for accessing homeownership sooner while still providing credit risk protection and stability to the U.S. housing system.” See coverage of the report by National Mortgage News, Forbes, and Bankrate.

- New USMI Board Chairman. On July 1, USMI announced that Derek Brummer, President of Mortgage at Radian Group, will serve as the Chairman of USMI’s Board of Directors. Brummer, who was appointed Radian’s President of Mortgage in February, previously served as USMI’s Vice Chairman of the Board and brings extensive experience in housing finance. In the announcement, Brummer stated that he looks “forward to ensuring the industry remains well-positioned to serve as an important source of strength for the housing finance system during all market cycles, so consumers continue to have access to affordable, low down payment, conventional mortgages.”

- FHFA and the GSEs Provide Clarity on PMIERs Amid COVID-19. On June 26,the Federal Housing Finance Agency (FHFA) and the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, provided guidance on the Private Mortgage Insurer Eligibility Requirements (PMIERs), PMIERs 2020-01, effective June 30, 2020. PMIERs are a set of operational and risk-based capital requirements implemented in 2015 and updated in 2018 for private MI companies to be approved to insure loans acquired by Fannie Mae and Freddie Mac. Due to the unprecedented nature of the COVID-19 disaster, including its national scope and the ongoing duration of the health and economic effects, the PMIERs language needed additional clarity, which USMI is pleased FHFA, Fannie Mae and Freddie Mac understood and provided.

USMI President Lindsey Johnson said in a statement, “USMI supports the actions taken by federal policymakers, particularly the FHFA, to stabilize the economy and provide assistance to those who have been impacted by the COVID-19 pandemic. USMI’s member companies are well-positioned to support the FHFA and GSEs’ efforts to ensure that homeowners who have been affected by COVID-19 are able to stay in their homes and maintain a safe and secure environment for their families.”

- SCOTUS Rules on CFPB’s Single-Director Structure. On June 29, the Supreme Court ruled in a 5-4 decision in Seila Law v. CFPB that the single-director structure of the Consumer Financial Protection Bureau (CFPB), where the leadership by a single director that is removable only “for cause” (inefficiency, neglect, or malfeasance), violates the Constitution. However, the Court did not invalidate the agency in its entirety. The majority held that the removal protection of the CFPB Director is severable from the other provisions of the Dodd-Frank Act that created the CFPB and defined its authorities and responsibilities. The CFPB did not challenge the decision and the White House released a statement saying the Supreme Court’s “decision represents an important victory for the fundamental principle that government officials should be accountable to the American people.” Given the FHFA has a similar structure, it is likely the legal conclusion may be applied to the FHFA. The Court’s decision opens the door for any future new administration to usher in new leadership of these two independent agencies.

- CFPB Proposes Rules on QM Definition and Temporary Extension of the GSE Patch. With the temporary QM category, also known as the “GSE Patch,” set to expire on January 10, 2021, the CFPB released Notices of Proposed Rulemakings (NPRMs) on a new QM definition and to temporarily extend the GSE Patch on June 22, 2020. Comments for the general QM definition are due 60 days after the rule is published in the Federal Register. In a statement after the release of the NPRMs, USMI President Lindsey Johnson stated, “USMI members, as takers of first-loss mortgage credit, emphasized the need to balance prudent underwriting with a clear standard that maintains access to mortgage finance for home-ready borrowers.”

The CFPB previously released an Advanced NPRM on the QM definition over a year ago, after which USMI submitted a comment letter that among other things, recommended replacing the current GSE Patch by establishing a single transparent and consistent QM definition that balances access to mortgage finance credit and proper underwriting guardrails to ensure consumers’ ability to repay (ATR). USMI specifically recommended that the Bureau establish a list of transparent mitigating underwriting criteria (compensating factors) for loans with a debt-to-income ratios above 45 percent and up to 50 percent. USMI also recommended that, to provide a more level playing field between the Federal Housing Administration (FHA) and the conventional market, the QM Safe Harbor annual percentage rate (APR) cap of the Average Prime Offer Rate (APOR) + 150bps needs to be increased to not arbitrarily shift the market to FHA, or leave some home-ready borrowers without access to mortgage finance credit. Setting the cap at APOR + 200bps would limit this arbitrary shift in the market, preserve greater private capital participation in the pricing of risk, and promote better taxpayer protection.

The Bureau’s June 2020 NPRM on the QM definition largely proposes an approach that would rely on a pricing spread between APR and APOR to determine QM status. While it is notable that the Bureau retained a QM Safe Harbor and QM Rebuttable Presumption, it is critical that the Safe Harbor threshold be increased from 150bps to 200bps above APOR, as it has been demonstrated that few loans are done outside of Safe Harbor. As USMI commented in its 2019 comment letter, it is essential that the Safe Harbor threshold be moved from 150bps to 200bps to ensure that creditworthy borrowers are not arbitrarily left only with the option of an FHA mortgage or left out of the market entirely, and to promote greater private capital participation in the pricing of risk and better taxpayer protection.

- FHFA Issues Re-Proposed Rule on Enterprise Capital. Another very significant rule recently released is the re-proposed Enterprise Regulatory Capital Framework (ERCF), which was published in the Federal Register this week, starting the 60-day clock for comments to be submitted. FHFA noted that one of the key reasons for the re-proposed rule is that establishing robust capital standards is a key step in the process to end the GSEs conservatorships, which was “a departure from the expectations of interested parties at the time of the 2018 proposal.” FHFA also noted that the re-proposed rule increases the quantity and quality of the regulatory capital at the GSEs to ensure their safety and soundness—with the overall capital required under the 2020 proposal being roughly $240 billion in loss absorbing capital—nearly $100 billion more than the 2018 proposal. FHFA officials believe that the re-proposed rule puts the GSEs on track to begin raising capital as soon as next year.

USMI submitted a comment letter to the FHFA in 2018 when the ERCF was originally proposed. On May 21, USMI issued a statement in response to the re-proposed rule, sharing its support for “meaningful capital requirements” and recognizing the ERCF’s importance in determining the future role of the GSEs, how private capital, such as private MI, will be able to continue to support the conventional market to protect taxpayers, and importantly, determine consumers’ access to and cost of mortgage finance credit.

- ICYMI: New Video Explains How Private MI Works. As part of June’s National Homeownership month, USMI released a new video helping first-time homebuyers understand whether they are mortgage ready. The video explores low down payment financing options to future homeowners and explains the benefits of private mortgage insurance.