Author: Rhina Portillo

Blog: Q&A with Teresa Bryce Bazemore of FHLBank San Francisco

Blog: Q&A with Meghan C. Bartholomew of Radian

Blog: Celebrating Hispanic Heritage Month – Q&A with Marisa Calderon, National Community Reinvestment Coalition

As we celebrate Hispanic Heritage Month, USMI reached out to prominent leaders in the housing finance and mortgage industries to discuss their work and perspectives on the goal of increasing Hispanic homeownership in America. In a recent blog post, USMI highlighted how the Hispanic population growth is positively impacting the homeownership market in the U.S., as the Urban Institute projects that from 2020 to 2040, most net new homeowners will be Hispanics – estimating that of the 6.9 million new homeowner households, 70 percent will be Hispanic. Further, despite having been acutely impacted by the COVID-19 pandemic, Hispanic Americans are the only demographic group to have increased their homeownership rate for six consecutive years (including 2020) according to a report by the National Association of Hispanic Real Estate Professionals (NAHREP).

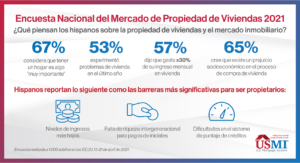

These figures speak to the importance of this demographic group to our nation and the impact they will have on mortgage markets and the face of homeownership over the next several decades. This presents an opportunity for policymakers to focus on challenges minorities face when it comes to homeownership, which USMI was also able to identify in its 2021 National Homeownership Market Survey, which polled 1,000 adults in the U.S., including an oversample of Hispanic respondents. Among the obstacles Hispanics face, 66 percent indicated that the lack of affordable homes is the biggest housing-related issue. Additionally, 20 percent said that one of the biggest challenges they face when buying a home is the inability to afford a 20 percent down payment, as monthly housing costs consume a large amount of Hispanics’ income. Lastly, 65 percent of Hispanics suggested they perceive socioeconomic bias in the homebuying process, with the survey finding that lower levels of income, lack of intergenerational wealth for down payments, and difficulties in the credit scoring system are the most significant barriers for increasing minority homeownership in the U.S.

For nearly 65 years, the private mortgage insurance (MI) industry has enabled more than 35 million low- to moderate-income borrowers attain affordable and sustainable homeownership in the conventional market. In the past year alone, nearly 60 percent of borrowers who purchased their home using private MI were first-time homebuyers, and more than 40 percent had incomes of $75,000 or less. It is a goal of the MI industry to work with policymakers to increase minority lending within the conventional mortgage market, and Hispanic Heritage Month is a perfect time to advance this conversation.

Marisa Calderon, Executive Director of National Community Reinvestment Coalition’s (NCRC) Community Development Fund and a housing and financial services industry veteran, recently shared with USMI her thoughts on these issues and others, relating to the mortgage finance sector in 2021 and beyond

(1) How does Hispanic Heritage Month intersect with homeownership?

This month is about recognizing and celebrating the Hispanic community’s contributions to U.S. culture and society – and that certainly includes this population’s undeniable economic impact. Latinos have been the primary driver of homeownership growth in our nation for the past decade and will continue to be for the foreseeable future. Looking ahead to 2040, Latinos will account for 70 percent of U.S. homeownership growth. If we as a country, can be attentive to the barriers that exist for Latinos to achieve these projected growth numbers, it enables a positive impact on building intergenerational wealth transfer for Hispanic families, and is helpful from an overall perspective for the U.S. economy.

(2) In USMI’s recent 2021 National Homeownership Market Survey, nearly 7 out of 10 Hispanic respondents considered owning a home as “very important,” as it provides stability and safety. However, survey data show most Hispanics have difficulties understanding the down payment requirements and more than half see the mortgage system in need of reform. What are the top two or three housing finance priorities that lawmakers and the Biden Administration should focus on to help Hispanics achieve affordable and sustainable homeownership?

Because of the relative youth of the population, many Hispanics are first-time home buyers and are aging into their prime-homebuying years. In general, most first-time homebuyers do not fully understand whether and how much they need for a down payment; this is no different for Hispanics.

The difference is that many Hispanic households have less wealth and personal assets than their non-Hispanic White counterparts. This means they do not always have 3 or 5 percent saved for a down payment.

With that in mind, as part of the infrastructure package, lawmakers could focus on prioritizing down payment support for first-time buyers, low- to moderate-income individuals, Latinos, and other underserved communities that lack personal wealth and assets.

The second priority should be access to credit. Reevaluating how the industry looks at credit-scoring and evaluating risk for prospective homebuyers could be helpful in increasing access to homeownership, and more fairly and accurately assessing a borrower’s ability-to-repay. The mechanisms and approach used today are based on the behaviors and credit patterns of a mostly White population of borrowers from decades ago – which is very different from how today’s diverse consumers earn their income, understand, and use credit. For example, as drivers of U.S. small business growth, Hispanics are more likely to have non-W2 income as a significant or sole source of household income. They also are more likely to live in a multi-generational household where the income of other individuals contributes to household expense obligations. Factors like these, mean evaluating ability-to-repay must evolve beyond the fixed and firm nuclear family borrower that is a W2 wage earner. The method of earning income and household composition is different, not necessarily riskier.

That said, the most urgent issue to address is the critical lack of housing inventory across the country. If there are no homes to purchase, the potential to increase homeownership is invariably stymied. The Administration and lawmakers should make addressing the inventory crisis a priority and the need for affordable single-family inventory as part of its infrastructure approach. I stress this in particular because often times, a conversation about affordable housing is synonymous with affordable rentals alone. The reality is, it needs to be a yes/and approach to affordable rental and affordable single-family homes for owner occupancy, especially since homeownership is the primary way families build wealth in the U.S.

(3) As the Hispanic population in the U.S. is growing fast and it is projected to be the primary driver of net new homeowners for the next two decades, what actions or policies can promote greater racial homeownership equity in the next 5 to 10 years?

The home appraisal process is a good place to start in addressing systemic issues that contribute to building home equity for underserved communities. The disparity in increasing home values and the resulting lower home equity in historic communities of color is well documented. Addressing issues of conscious and unconscious bias in the appraisal process, as well as systemic issues that preclude a greater diversity of qualified appraisers from joining the profession, is one of the most direct actions that can be taken to address the evaluation of home value that ultimately results in equity or lack thereof.

Immigration reform is another important, often overlooked, policy area that has a direct impact on homeownership attainment. While there is nothing that precludes foreign born individuals from owning property in the United States, obtaining a mortgage as a foreign-born householder is another matter altogether. Few lenders make Individual Tax Identification Number (ITIN) loans part of their suite of products, and those that do, set terms and down payment requirements for borrowers that are frequently less favorable than those in the conventional market or Finance Housing Administration (FHA) financing, despite ITIN loans performing as well or better than traditional financing vehicles. With over 11 million undocumented individuals in the country, most of whom have resided in the U.S. for well over a decade, immigration reform with a pathway to citizenship would open traditional mortgage lending as an option to millions of potential new homeowners. Lack of status is not just a barrier to homeownership for undocumented individuals, it is an impediment to wealth building and economic mobility for millions who pay taxes, contribute to the economy, and have called the U.S. home for most of their lives.

Marisa Calderon’s Biography

Marisa Calderon is the executive director of the National Community Reinvestment Coalition’s (NCRC) Community Development Fund and a housing and financial services industry veteran.

Calderon has been ranked on the Swanepoel Power 200 as one of the most powerful leaders in the residential real estate industry and named one of HousingWire’s 2018 Women of Influence for her work in increasing real estate and mortgage professionals’ understanding and appreciation of the Hispanic home-buying market. Frequently sought out as an expert, Calderon has been interviewed by numerous publications and media outlets including NPR’s Marketplace and regularly speaks at events such as those for Mortgage Bankers Association (MBA), Consumer Federation of America (CFA), the Federal Deposit Insurance Corporation (FDIC), and the National Fair Housing Alliance (NFHA).

She previously served on the advisory board for the Banc of California and the Fannie Mae Affordable Housing Advisory Council, and previously authored the State of Hispanic Homeownership Report.

She currently serves as board secretary for the Hispanic Wealth Project, which has a stated goal of tripling the median household wealth of Hispanics by 2024. She earned her bachelor’s degree from the University of California at Berkeley and is in the process of completing her MBA.

Blog: Viviendas para los hispanos: Cómo el crecimiento de la población hispana ayuda a impulsar el mercado de la propiedad

El número de hogares hispanos ha crecido por seis años consecutivos, incluso durante la pandemia del COVID-19. Aumentar de manera sostenible el acceso a la propiedad de vivienda a través de políticas como los préstamos para un pago inicial bajo, puede ayudar a cerrar la brecha de la propiedad de vivienda.

El 15 de septiembre marca el inicio del Mes de la Herencia Hispana y es una oportunidad para reconocer las significativas contribuciones y la influencia de los hispanos-americanos a la historia, cultura y logros de los Estados Unidos. También es un momento para reflexionar acerca del mercado de propiedades de viviendas para los hispanos en América. En particular, durante los últimos años, la población hispana ha sido un componente clave para el crecimiento de la propiedad de vivienda en los EE.UU., y se proyecta a ser el grupo demográfico que liderará este segmento de la industria por las siguientes cuatro décadas.

De acuerdo con el reporte de 2020 de la Oficina de Censo de EE.UU., durante los siguientes 40 años los hispanos serán los principales contribuidores al crecimiento de la población estadounidense, representando un 68 por ciento hasta el 2060. El Urban Institute también proyecta que de 2020 a 2040, la mayoría de los nuevos propietarios de viviendas netos serán hispanos, estimando que, de 6,9 millones de nuevos hogares, 70 por ciento serán hispanos. Estas cifras hablan de la importancia de este grupo demográfico a nuestra nación y el impacto que tendrán en el mercado de hipotecas y de propiedades de viviendas durante las siguientes décadas.

El crecimiento de la población hispana también es una razón importante para concentrarse en las barreras que existen para que grupos minoritarios puedan acceder a las viviendas. Retos como barreras económicas y la oferta de viviendas asequibles mantienen el acceso a la propiedad fuera del alcance de muchos de estos potenciales propietarios. La brecha de ingresos entre hispanos y blancos no-hispanos sigue siendo pronunciada, con hogares blancos no-hispanos recibiendo un ingreso medio de hasta 26 por ciento por encima de los hogares hispanos. En 2019, el ingreso medio de un hogar hispano fue de $56.113 (Oficina de Censo de EE.UU.). Además, de acuerdo con el reporte “El Estado de la Propiedad de Viviendas para Hispanos 2020”, de la Asociación Nacional de Profesionales Hispanos de Bienes Raíces (NAHREP por sus siglas en inglés), los hispanos tienden a tener una relación de deuda-ingresos (DTI por sus siglas en inglés) más altos y puntajes de crédito más bajos, y dada la juventud de la comunidad hispana, compradores primerizos impulsan las ganancias en la propiedad de viviendas de hispanos. En 2019, el 56 por ciento de propietarios hispanos indicaron que estaban viviendo en el primer hogar que habían tenido, según reportó la encuesta de “Viviendas Americanas de 2019” de la Oficina de Censo de EE.UU. Por lo tanto, los compradores hispanos son un grupo demográfico importante, quienes son atendidos por productos hipotecarios de pago inicial bajo, los cuales benefician a compradores primerizos y de ingresos moderados, principalmente ayudando a cerrar la brecha del pago inicial.

La encuesta del “Mercado de Propiedad de Viviendas Nacional 2021” de USMI, la cual encuestó a 1.000 adultos en los EE.UU., incluyendo una muestra de hispanos, encontró que el 67 por ciento de hispanos considera que ser propietario de un hogar es algo “muy importante”. Además, la encuesta arrojó que 53 por ciento de hispanos reportó haber experimentado problemas de vivienda durante la pandemia del COVID-19, siendo las principales preocupaciones: desalojos y retrasos en el pago de rentas o hipotecas.

Entre los obstáculos que los hispanos enfrentan, 66 por ciento indicó que la escasez de hogares asequibles es el principal problema relacionado a la vivienda. Adicionalmente, el 20 por ciento señaló que uno de los mayores problemas al comprar una casa es la imposibilidad de costear un pago inicial del 20 por ciento, dado que costos mensuales de vivienda consumen una gran parte de los ingresos hispanos; cerca del 60 por ciento indicó que gastan más del 30 por ciento de sus ingresos en vivienda. Finalmente, 65 por ciento de hispanos sugirió que existe un prejuicio socioeconómico en el proceso de compra de viviendas, con la encuesta señalando que niveles bajos de ingreso, falta de riqueza intergeneracional para pagos de iniciales y dificultades en el sistema de puntaje de créditos, están entre las barreras más significativas para incrementar los niveles de propiedad de vivienda entre grupos minoritarios en los EE.UU.

Sin embargo, aunque estas barreras fueron mencionadas, el 90 por ciento de los hispanos también señaló que se sintieron tratados de manera justa durante el proceso de hipoteca. No obstante, mitos y desinformación persisten alrededor de este grupo demográfico. Por una relación de casi 3 a 1 comparado con los encuestados blancos, los hispanos creen que el proceso de aprobación de hipotecas no es asequible e indicaron que no comprenden a plenitud los requisitos para el pago de iniciales. De hecho, el 45 por ciento cree erróneamente que se requiere un pago inicial de 20 por ciento o más cuando en realidad los seguros de hipotecas privados (PMI por sus siglas en inglés) permiten a los compradores adquirir viviendas con pagos de iniciales tan bajos como el 3 por ciento.

Estas cifras y proyecciones dejan claro que, a medida que la población hispana crece rápidamente y tiene un impacto importante sobre el mercado inmobiliario, los responsables de la formulación de políticas no deben perder de vista tanto retos del mercado a corto plazo, como la escasez significativa de viviendas asequibles para compra o renta, como también problemas sistémicos de largo plazo que incrementan innecesariamente los costos o crean barreras para minorías y compradores de menor ingreso. Aun así, a pesar de haber sido particularmente impactados por la pandemia del COVID-19, hispanos-americanos son el único grupo demográfico que ha incrementado su tasa de propiedad de vivienda por seis años consecutivos (incluyendo el 2020) de acuerdo con NAHREP. Retirar las barreras que enfrentan las minorías para acceder a viviendas permitirá que incluso más hogares hispanos gocen de los beneficios de ser propietarios durante las siguientes décadas.

Los seguros de hipotecas privados (PMI) aumentan las posibilidades de compra de viviendas para minorías y hogares de bajos ingresos, al permitirles obtener préstamos de manera asequible y sostenible, ayudándoles así a alcanzar una estabilidad inmobiliaria y generar riqueza, logrando el Sueño Americano. En 2020, casi el 60 por ciento de los prestatarios atendidos por seguros de hipotecas privados eran compradores primerizos y más del 40 por ciento eran prestatarios con ingresos por debajo de los $75.000 anuales. De hecho, la encuesta de USMI encontró que los consumidores ven a este sector privado como una pieza importante dentro del rompecabezas del mercado de propiedad de viviendas, nivelando el campo de juego al ayudar a compradores de bajos y moderados ingresos y primerizos a acceder la financiación de viviendas.

En la medida que celebramos el Mes de la Herencia Hispana, manifestamos nuestro compromiso con el apoyo de políticas sólidas y prudentes que ayuden a expandir la propiedad de viviendas.

Blog: Hispanic Homeownership: How Hispanic Population Growth Helps Drive the Homeownership Market

Hispanic homeownership has grown for six consecutive years, even during the COVID-19 pandemic. Sustainably increasing homeownership access through policy tools such as low down payment lending can help bridge the homeownership gap

September 15 marks the beginning of Hispanic Heritage Month, and it is an opportunity to recognize the significant contributions and influence of Hispanic Americans to the history, culture, and achievements of the United States. It is also a moment to reflect on Hispanic homeownership in America. In particular, over the last few years, the Hispanic population has been a key component of the growth in homeownership in the U.S., and it is projected to be the demographic group leading this segment of the industry for the next four decades.

According to the 2020 U.S. Census Bureau report, over the next 40 years Hispanics will be the primary contributors to the U.S. population growth, accounting for 68 percent between now and 2060. The Urban Institute also projects that from 2020 to 2040, most net new homeowners will be Hispanics – estimating that of the 6.9 million new homeowner households, 70 percent will be Hispanic. These figures speak to the importance of this demographic group to our nation and the impact they will have on mortgage markets and the face of homeownership over the next few decades.

Hispanic population growth is also a significant reason to be focused on the barriers to homeownership for all minorities. Economic barriers and housing supply challenges for this population continue to keep homeownership out of reach for many of these potential homeowners. The income gap between Hispanics and non-Hispanic Whites remains steep, with non-Hispanic White households having a median income 26 percent higher than that of Hispanic households. In 2019, the median Hispanic household income was $56,113 (U.S. Census Bureau). Additionally, according to the National Association of Hispanic Real Estate Professional’s (NAHREP) 2020 State of Hispanic Homeownership Report, Hispanics also tend to have higher debt-to-income (DTI) ratios and lower credit scores, and given the youth in the Hispanic community, first-time homebuyers drive Hispanic homeownership gains. In 2019, 56 percent of Hispanic homeowners indicated that they were living in the first home they had ever owned, as reported by the U.S. Census Bureau’s 2019 American Housing Survey. Therefore, Hispanic homebuyers are an important demographic served by low down payment mortgage products, which benefit first-time and low- to moderate-income homebuyers primarily by bridging the down payment gap.

USMI’s 2021 National Homeownership Market Survey, which polled 1,000 adults in the U.S., including an oversample of Hispanics, found that 67 percent of Hispanics consider owning a home as “very important.” Further, the survey found that 53 percent of Hispanic respondents reported having experienced housing problems during the COVID-19 pandemic, with the primary cited concerns including evictions and falling behind rent or mortgage payments.

Among the obstacles Hispanics face, 66 percent indicated that the lack of affordable homes is the biggest housing-related issue. Additionally, 20 percent said that one of the biggest challenges they face when buying a home is the inability to afford a 20 percent down payment, as monthly housing costs consume a large amount of Hispanics’ income – nearly 60 percent said they spend 30+ percent of their monthly household income on housing. Lastly, 65 percent of Hispanics suggested there is socioeconomic bias in the homebuying process, with the survey finding that lower levels of income, lack of intergenerational wealth for down payments, and difficulties in the credit scoring system are the most significant barriers for increasing minority homeownership in the U.S.

However, while these barriers were cited, 90 percent of Hispanics also conveyed that they felt treated fairly during the mortgage process. Nonetheless, myths and misinformation persist around this demographic. By a nearly 3 to 1 ratio compared to White respondents, Hispanics believe the mortgage approval process is not affordable, and stated that they do not fully understand down payment requirements. In fact, 45 percent mistakenly believe a 20+ percent down payment is required, and another 21 percent report they do not know what amount of a down payment is required. In reality, private mortgage insurance (MI) enables homebuyers to purchase homes with down payments as low as 3 percent.

These figures and projections make very clear that as the Hispanic population rapidly grows and has a significant impact on the housing market, policymakers must not lose sight of addressing both near term market challenges, such as the significant lack of affordable homes for purchase or rent, as well as longer-term systemic issues that unnecessarily increase costs or create barriers for minority and lower income homebuyers. Notably, despite having been acutely impacted by the COVID-19 pandemic, Hispanic Americans are the only demographic group to have increased their homeownership rate for six consecutive years (including 2020) according to NAHREP. Removing barriers to minority homeownership will enable even more Hispanic households to benefit from sustainable homeownership in the decades to come.

Private MI enhances the ability of minority and lower income homebuyers to borrow in an affordable and sustainable way, enabling them to achieve housing stability and build wealth—and realize the American Dream. In 2020, nearly 60 percent of borrowers served by private MI were first-time homebuyers and more than 40 percent were borrowers with incomes below $75,000. In fact, USMI’s national survey found that consumers view MI as an important piece of the homeownership puzzle, leveling the playing field by helping low- to moderate-income and first-time homebuyers access home financing.

As we celebrate Hispanic Heritage Month, we are committed to supporting sound and prudent policies that help expand homeownership.

See here for a Spanish version of this blog post.

Blog: 5 Questions to Ask When Shopping for a Mortgage

Buying a home is a major financial commitment. It’s exciting, but can also be confusing and overwhelming. Choosing the best mortgage that fits your needs is an important first step and first-time homebuyers in particular should research the many options and know the right questions to ask. Here are some questions to ask a lender that will help you make an informed mortgage decision:

* How much can I afford? A home affordability calculator can help you get an idea of what you may be able to afford and keep your monthly payments within your budget. In addition to recurring expenses like car payments, student loans, credit cards and disposable income, be sure to consider other monthly expenses related to the new home, like association fees, homeowners’ insurance, utilities and property taxes. Further, some types of mortgages have firm eligibility cutoffs related to the ratio between a buyer’s total debt amounts and their monthly income.

* How much do I need for a down payment? It’s a common misconception that a 20 percent down payment is required to buy a home. Let’s face it, a 20 percent down payment is a lot of money, and often the largest obstacle for homeownership, especially for first-time buyers. You can qualify for a conventional mortgage with as little as 3 percent down. Conventional mortgages originated with a low down payment, which is defined as less than 20 percent, require private mortgage insurance (MI) until approximately 20 percent equity is established through either monthly payments or home price appreciation. When mortgage insurance cancels, your monthly mortgage bill is reduced. It is important to know that not all forms of MI are created equal — private mortgage insurance is temporary and cancelable but the overwhelming majority of mortgages backed by the government’s Federal Housing Administration (FHA) contain insurance that cannot be canceled.

* What is the interest rate and is it fixed? Most first-time homebuyers go with a 30-year fixed-rate mortgage, which locks you into an interest rate with steady, predictable payments. Different lenders may offer different rates, so make sure to contact several lenders to ensure you’re getting the best option available in the market. A rate lock protects you from rising interest rates while the loan is being processed and lasts for a specific amount of time. In addition, make sure you know whether the rate is fixed or “adjustable.” Adjustable rate mortgages, commonly referred to as “ARMs,” result in periodic adjustments in the interest rate based on the lender’s cost of credit, and can be detrimental to homeowners in rising interest rate environments. Finally, ask if you are paying for “points” to reduce the interest rate. It’s an added upfront cost paid at closing, but it results in a lower rate for the life of the loan.

* Does my credit score matter? Yes, generally stronger credit scores (FICO 720 and above) come with better interest rates, but fortunately there are mortgage options for those with imperfect credit scores too. When you apply for a mortgage, your credit record is used to help determine your approval and mortgage terms, but it is not the only thing lenders consider. A lender will also look at your debt-to-income (DTI) ratio, cash reserves and other factors to help gauge your overall creditworthiness.

* Should I get pre-approved for a mortgage? Yes. Pre-approval means you receive a conditional commitment from a lender up to a specific loan amount. In a seller’s market with tight housing supply, being pre-approved demonstrates that you are a serious buyer with access to mortgage financing. To become pre-approved, you’ll provide your lender with information on your income, assets, debts and credit history to analyze your financial profile and determine your creditworthiness and amount you can borrow to purchase a home.

Make sure to know your options and choose the one that works for you. Check out lowdownpaymentfacts.org to learn more.

Statement: Great News For Homebuyers: U.S. Congress Extends Mortgage Insurance Tax Deduction

WASHINGTON — U.S. Mortgage Insurers (USMI) President and Executive Director Lindsey Johnson issued the following statement on the federal budget deal passed by Congress and signed into law by President Trump today, which includes an extension of the tax deduction for mortgage insurance (MI) premiums.

“Mortgage insurance has helped millions of middle income Americans become homeowners and for nearly ten years, the tax deductibility of MI premiums has helped to reduce the cost of homeownership. In a bipartisan manner, our elected lawmakers in Congress demonstrated today their commitment toward helping low down payment first time homebuyers by keeping mortgage insurance tax deductible. This is important, because while many on Capitol Hill appreciate how MI protects the government and taxpayers from credit risk in the housing system, MI also directly benefits everyday workers.”

First available to taxpayers in 2007 and extended multiple times since then on a bipartisan basis, this tax deduction has been a successful tool in ensuring low- and moderate-income homebuyers have access to prudent and affordable low down payment mortgage finance. In 2015 alone, 4.1 million families benefitted from the MI premium tax deduction, for an average deduction of $1,528. The deduction is available to homeowners with MI who have an adjusted gross income under $100,000 and phases-out for adjusted gross incomes up to $110,000. USMI data show that more than half of purchase loans with private MI go to first-time homebuyers and more than 40 percent of borrowers with private MI have incomes below $75,000. The deduction expired at the end of 2016.

Over the past 60 years, private MI has helped more than 25 million families qualify for home financing by bridging the gap between a 20 percent down payment and perfect credit. In the past year alone, MI helped more than 850,000 families purchase or refinance homes.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: FHA’s Annual Report to Congress

Report Shows Agency’s Financial Reserves Weakening

WASHINGTON — Today, the Federal Housing Administration (FHA) released its “Annual Report to Congress Regarding the Financial Status of the Mutual Mortgage Insurance Fund (MMIF) Fiscal Year 2017.” The following statement can be attributed to Lindsey Johnson, USMI President and Executive Director:

“The Federal Housing Administration today released its 2017 annual report to Congress on the financial status of its MMIF. According to the report, the MMIF stands at 2.09 percent, down from 2.35 percent last year and now just slightly above the statutory requirement of 2 percent. The FHA has taken important steps in recent years to improve its financial stability after requiring a $1.7 billion government bailout in 2013 when the agency did not have the necessary capital to cover losses, though more needs to be done. With more than $1.2 trillion in mortgage credit risk, the FHA must enhance its financial strength to continue to serve the borrowers who need it the most.

“The FHA is a critical part of the housing finance system. While there have been calls to reduce FHA insurance premiums, today’s report makes clear that had this happened, the fund would be at 1.76 percent and undercapitalized. The FHA should resist calls for significant policy changes, such as reducing the cost of its insurance or cancelling the collection of insurance premiums while the FHA insurance protection remains in-force on a mortgage. This will help the agency rebuild its financial strength.

“Now is the time for the FHA to refocus on its core mission, scaling back from the oversized role it played during the recession so that it can return to serving low-to-moderate income individuals who need the FHA’s 100-percent government backed loans the most. Today borrowers have low down payment options through the conventional market backed by private mortgage insurance. Private mortgage insurers put their own capital at risk, paying more than $50 billion in claims since the financial crisis, and have all implemented new higher robust capital standards. USMI looks forward to working with Congress and the Administration to establish a coordinated and consistent housing policy so that private capital can shoulder more of the credit risk in the housing markets, while FHA and the private sector act in the marketplace together to ensure borrowers have access to safe, sustainable and affordable mortgage options. Private MI has served as a reliable and affordable credit enhancement tool for more than 25 million American families for 60 years.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: Nomination Hearing of Brian Montgomery for FHA Commissioner

WASHINGTON — Lindsey Johnson, President and Executive Director of the U.S. Mortgage Insurers (USMI), today issued the following statement on the U.S. Senate Committee on Banking, Housing, & Urban Affairs’ hearing on the nomination of Brian Montgomery for Federal Housing Administration (FHA) Commissioner:

“Brian Montgomery is a respected expert and seasoned mortgage finance professional who our industry supports to serve once again as FHA Commissioner. While serving in the President George W. Bush administration, Mr. Montgomery led the FHA when the agency expanded as part of its countercyclical role during the financial crisis – a time of unprecedented market stress. As such, Brian Montgomery has the historic experience and expertise to oversee and manage the FHA’s return to its smaller, appropriate, and intended role in the market focusing on those borrowers who need the FHA’s 100% taxpayer-backed loans the most. The conventional mortgage market today is healthy and continues to prudently serve creditworthy homebuyers, including those with low down payments.

“The FHA serves an incredibly important role for many low-to-moderate income borrowers. We are confident that as FHA Commissioner, Brian Montgomery will continue to be a champion for a robust housing finance system that strikes the appropriate balance between the conventional market backed by private capital and government-backed FHA loans. We agree with Mr. Montgomery’s previously expressed views that private capital should play a leading role in guaranteeing low down payment mortgage credit risk to protect U.S. taxpayers and the federal government, and it is encouraging to know that he believes the FHA ‘should never take the place of the private sector first-loss solution provided by private mortgage insurers.’

“While the FHA serves a very important function in the housing finance system, its footprint has expanded dramatically since the financial crisis. Now is the time to focus on ensuring that the FHA is not overexposing taxpayers to undue risk and refocus the agency on its core mission of serving borrowers who need 100% government-backed home loans. We look forward to working closely with Brian Montgomery in seeking ways to establish a more collaborative, coordinated, and consistent housing policy and to help expand private capital’s role in shouldering more risk in front of taxpayers in the housing market. For 60 years private mortgage insurance has played a leading role in promoting affordable and sustainable homeownership and we look forward to building upon our success in the future.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: Confirmation of Deputy HUD Secretary Pam Patenaude

WASHINGTON — Lindsey Johnson, President and Executive Director of the U.S. Mortgage Insurers (USMI), today issued the following statement on the confirmation of Pam Patenaude to be Deputy Secretary of the Department of Housing and Urban Development (HUD):

“USMI applauds the Senate for its confirmation of Pam Patenaude to be Deputy Secretary of HUD. As a longtime public servant and expert in the housing finance system, Deputy Secretary Patenaude fully understands the need for a coordinated, consistent, and transparent approach to federal housing policy across government channels.

“Deputy Secretary Patenaude’s extensive background in housing finance will allow her to immediately begin work on the most important issues facing the housing finance system. Importantly, Deputy Secretary Patenaude’s leadership in these efforts will ensure that Americans have greater access to mortgage finance credit, promote a greater role for increased private capital in mortgage finance, and reduce taxpayer risk exposure. USMI and the private mortgage insurance industry look forward to working with Deputy Secretary Patenaude going forward to establish a more equitable and robust housing finance system.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Letter: USMI Joins Coalition in Support of Full Senate Vote on Pam Patenaude

USMI joined nearly 60 other organizations in supporting a full Senate vote on the nomination of Pam Patenaude as HUD Deputy Secretary. Click below to read the full coalition letter. Click here to download the letter as a PDF.