Blog: Black History Month – Working to Promote More Affordable and Sustainable Homeownership

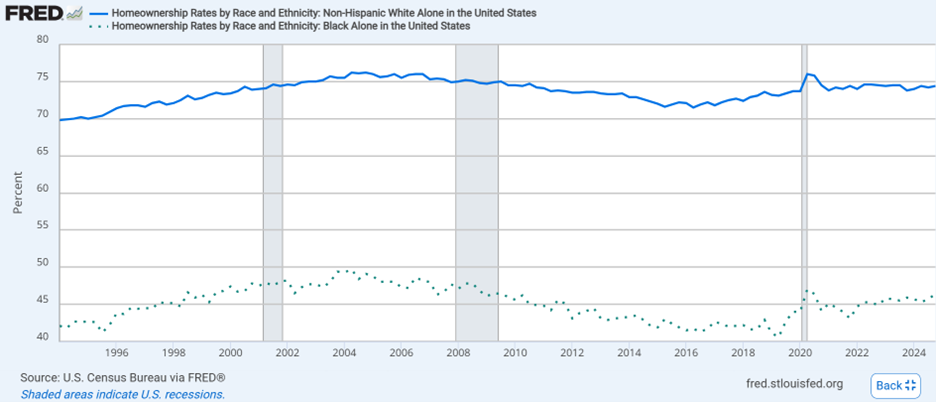

As Black History Month comes to a close, U.S. Mortgage Insurers (USMI) recognizes the importance of homeownership and highlights key insights from our recent National Homeownership Market Survey about data and trends influencing Black homeownership in America today, as well as ways the industry and policymakers can work to make affordable and sustainable homeownership a reality for more Black Americans. While homeownership has been the traditional path for many families to enter the middle class and build wealth, the Black homeownership rate has continued to lag nearly 30 percentage points behind the non-Hispanic White homeownership rate – 45.7% compared to 74.2% – according to the U.S. Census Bureau. The Black homeownership rate has not recovered from the Great Financial Crisis and the gulf between the White and Black homeownership rates is wider than it was when housing discrimination was legal. As the National Association of Real Estate Brokers noted in its “2024 State of Housing in Black America” report, “despite a gradual increase in the number of Black homeowners since the 1968 Fair Housing Act was implemented, the gap in homeownership rates between Black and White families is wider now than it was over fifty years ago.”

The survey found that homeownership remains a key part of the American Dream for Black Americans. The most important reasons to own a home, according to Black survey respondents, include that it is a good investment (37% selected this reason as a top choice making it the top ranked reason), that it provides safety (31%) and that it provides stability (30%). Similar to other respondent groups, a plurality of Black Americans believe it has gotten harder to purchase a home in the last few years, citing factors such as higher home prices and interest rates.

Survey results suggest that being unable to afford a down payment is the leading challenge for potential Black homebuyers. Given this, access to low down payment mortgage financing through private mortgage insurance (MI) has become increasingly important for Black families to attain homeownership. MI can help eliminate barriers to homeownership by allowing borrowers to qualify for a mortgage with as little as three percent down.

In good news when it comes to closing the knowledge gap, Black Americans are aware that it is possible to qualify for financing with a low down payment. In 2024, 38% of Black survey respondents correctly recognized that the minimum down payment required to qualify for a home mortgage was 5% or lower, an increase of 23% from 2021. Black Americans also largely report familiarity with options such as down payment assistance programs (64%), homebuyer counseling or education (50%) and mortgage insurance (47%).

In 2023 alone, private MI helped nearly 800,000 people become homeowners, including more than 70,000 Black households. Nearly 35% of private MI borrowers had annual incomes below $75,000, and 64% of purchase loans with private MI went to first-time homebuyers – a percentage that continues to increase. Rather than wait many years to save for a 20% down payment plus closing costs, MI can help American families access homeownership sooner so they can begin creating equity and wealth.

USMI actively works to support policies that responsibly and sustainably expand access to affordable mortgage credit for borrowers without large cash down payments, helping them build financial equity and intergenerational wealth. We are committed to working alongside policymakers, industry stakeholders and consumer advocates to help make homeownership a reality for more hardworking American families. This includes advocating for the return of the MI tax deduction, which was claimed by 44.5 million low- and moderate-income homeowners between 2007 and 2021, with an average annual MI deduction amount of $1,454. USMI, along with a broad coalition of housing, civil rights, and consumer advocate organizations, strongly supports bicameral, bicameral legislation – the Middle Class Mortgage Insurance Premium Act – to provide targeted tax relief to working families. Nearly 65% of Black homebuyers in 2024 that used conventional mortgages with private MI could have been eligible for the deduction under the proposed legislation.

USMI is dedicated to a housing finance system backed by private capital that enables access to mortgage credit for borrowers while protecting taxpayers from credit risk.