Category: Blog

Blog: Q&A with Marcia Davies of the Mortgage Bankers Association

Blog: Q&A with Faith Schwartz of Housing Finance Strategies

Blog: Q&A with Paula C. Maggio of MGIC

Blog: Q&A with Debra Still of Pulte Financial Services

Blog: Q&A with Teresa Bryce Bazemore of FHLBank San Francisco

Blog: Q&A with Meghan C. Bartholomew of Radian

Blog: Where Housing Legislation Stands in an Election Year

By Brendan Kihn, Senior Government Relations Director of USMI

As the country kicks off primary elections in the mere matter of weeks, policymakers and advocacy groups are already sizing up what can and cannot be accomplished before voters go to the polls on November 8 for the 2022 midterm election. Just over a year ago, the Democrats gained control of the White House, Senate, and House of Representatives – their first trifecta since January 2011 – and Democrats were hopeful that the party could advance a long list of policy priorities related to taxation, healthcare, and housing investments. Following the enactment of the American Rescue Plan Act, which included $10 billion in homeowners assistance and $22 billion in emergency rental assistance, and the Infrastructure Investment and Jobs Act (the “Bipartisan Infrastructure Deal”), Democrats turned their attention to the Build Back Better Act (BBB), which includes more than $150 billion in housing investments.

Status Update on the “Build Back Better” Agenda

Policymakers are acutely aware of the affordability challenges facing homebuyers and there is especially bipartisan support for increasing housing supply. BBB, both the specific bill and the Biden Administration’s general policy theme, represents a broad collection of policy objectives and programs which includes initiatives to promote access to homeownership, fair housing, and affordable rental opportunities. BBB’s historic investment in housing includes:

- $65 billion to preserve and rebuild public housing

- $26 billion to create and preserve affordable and accessible housing

- $24 billion for new Housing Choice Vouchers to support families struggling to afford their rent

- $10 billion in down payment assistance for first-time, first-generation homebuyers

- $500 million for a wealth-building home loan program

- $250 million increase in allocation to Federal Home Loan Bank Affordable Housing Programs (AHP)

- $100 million to increase access to small-dollar mortgages

The U.S. House of Representatives passed BBB on November 19 with a 220-113 vote only for the bill to hit a major roadblock in the Senate exactly one month later. On December 19, Sen. Joe Manchin (D-WV) announced that “[d]espite my best efforts, I cannot explain the sweeping Build Back Better Act in West Virginia and I cannot vote to move forward on this mammoth piece of legislation.” The Democrats’ razor thin majority in the Senate (50 plus Vice President Harris) creates a tenuous “working majority,” whereby a single defection or absence can make or break a piece legislation. In this case, it is crystal clear that BBB as passed by the House is dead.

2022 began with a certain degree of legislative soul searching among Democrats to strategize avenues to pass elements of BBB that can either: (1) garner bipartisan support and pass via regular order with a 60-vote threshold in the Senate; or (2) enjoy support from the entire Democratic caucus for passage via reconciliation. Democrats will face internal and external pressure to pass something in an effort to show voters that they can govern and deliver for the American people who handed them the levers of power in the 2020 election. Housing advocates remain adamant that housing investments should be included in any legislative packages that seek to advance the Biden Administration’s BBB agenda. And, while critics are concerned that BBB will “dramatically reshape our society,” there is an equally strong sentiment among others that such a “reshape” is exactly what is necessary to invest in the American people and expand economic opportunities, including access to affordable homeownership.

Expanding Access to Mortgage Finance

USMI, as articled in its “2022 Policy Priorities for Access, Affordability & Sustainability in the U.S. Housing Finance System,” has consistently supported legislative and regulatory reforms to remove barriers to homeownership and promote an equitable and sustainable housing finance system. As policymakers seek to advance equity in the housing finance system and address significant affordability issues, they must thread the needle of expanding access to homeownership without further driving up housing costs in a very tight market. The country is experiencing an alarming shortage of homes, most notably in the “starter home” segment of the market, with only 1.8 months of supply for existing homes at the end of 2021, according to the National Association of Home Builders (NAHB). This has been one of the primary drivers of strong home price appreciation which came in at 17.5 percent for 2021, according to the Federal Housing Finance Agency’s (FHFA) House Price Index (HPI). While home price appreciation is a boon for existing homeowners who rapidly build up equity that can be tapped for other financial goals, increasing house prices represent a real hurdle for families looking to attain homeownership.

Survey and reports, including USMI’s 2021 National Homeownership Market Survey, routinely identify saving for a down payment as one of the primary challenges that families face when it comes to purchasing. Recent year’s home price appreciation demonstrates the critical need to ensure continued robust access to low down payment mortgages, where borrowers can put as little as 3 percent down with private mortgage insurance (MI) and 3.5 percent down with government-backed insurance. However, for those who are unable to cobble together the funds for a 3 or 3.5 percent down payment, non-profit organizations and governmental entities throughout the country operate thousands of down payment assistance (DPA) programs designed to help these homebuyers. Policymakers have honed in on DPA as a tool to expand homeownership and legislative proposals, most notably House Finance Services Committee (HFSC) Chairwoman Waters’ (D-CA) Downpayment Toward Equity Act (H.R. 4495 / S. 2920). These proposals understand the need to focus these programs to those who need assistance most, targeting first-time, first-generation homebuyers. BBB included $10 billion for such a program and housing advocates had called for that number to be increased to $100 billion. In the wake of BBB stalling in the Senate, policymakers in the House are exploring upcoming legislative vehicles to appropriate funds for targeted DPA.

Housing Tax Provisions

Mortgage Insurance Premium Tax Deduction

At the end of 2021, various temporary tax provisions commonly referred to as “tax extenders” expired, including the deduction for MI premiums. Borrowers who are unable to put down 20 percent for their homes typically finance the purchase transaction with loans that have either private MI of government-backed MI through the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA), or U.S. Department of Agriculture (USDA), and these premiums have been tax deductible for many homeowners since 2007. This deduction has been extremely beneficial for first-time, younger, and minority homebuyers who often rely on low down payment mortgages to purchase homes due to limited access to funds or intergenerational wealth for large down payments.

In December 2021, Reps. Ron Kind (D-WI) and Vern Buchanan (R-FL) introduced H.R. 6109 and earlier this month Sens. Maggie Hassan (D-NH) and Roy Blunt (R-MO) introduced S. 3590 to permanently extend the tax deduction for MI premiums and expand taxpayer eligibility by increasing the income threshold. This bipartisan, bicameral legislation would ensure that millions of homeowners continue to benefit from this tax deduction, which in 2019 amounted to an average deduction of more than $2,000.

State and Local Tax Deduction

One housing-related tax provision that has been extremely important to senators from high-cost states (which often happen to be Democratic states) is addressing the $10,000 limit on state and local tax (SALT) deductions through tax year 2025 imposed by the Tax Cuts and Jobs Act of 2017. In fact, changes to the SALT deduction are so high on the priority list for some members of Congress that they have declared “No SALT, no deal” with regard to supporting a BBB-like package. The House-passed version of BBB raised the SALT deduction cap from $10,000 to $80,000 for tax years 2021 through 2030 but, due to no chance of passage in the Senate, the cap remains unchanged. Outside of the BBB legislative process, lawmakers on both sides of the aisle have introduced standalone bills to address, in various manners, the current SALT cap, including:

- SALT Deductibility Act (R. 613 / S. 85) – repeals the temporary cap for tax years 2021 through 2025.

- SALT Fairness Act (R. 202) – repeals the temporary cap for tax years 2021 through 2025.

- SALT Deduction Fairness Act (804) – increases the cap to $20,000 for joint filers for tax years 2021 through 2025.

- SALT Fairness for Working Families Act (R. 2439) – increases the cap to $15,000 for individual filers and $30,000 for joint filers for tax years 2021 through 2025.

As Democrats look for legislative vehicles to address SALT, including upcoming spending bills and smaller packages that advance targeted portions of BBB, there is a growing sense that modifications should be tailored to help middle class Americans and not amount to a giveaway to millionaires and billionaires.

******

The pressure is on for Democrats to deliver on the Build Back Better agenda that was a pillar of the 2020 Biden campaign. One month in Washington, DC is a long time and eight months can seem like an eternity, but all eyes will be on the White House and congressional Democrats’ internal negotiations to determine what housing policies, if anything, can be passed before voters head to the polls in November.

Member Spotlight: Q&A with Brad Shuster of National MI

USMI’s member spotlight series focuses on how the private mortgage insurance (MI) industry works to address several critical issues within the housing finance system, including expanding access to affordable mortgage credit for first-time and minority homebuyers, protecting taxpayers from mortgage credit risk, and recommendations on ways to reform and enhance the housing finance system to put it on a more sustainable path for the long-term.

This month we chat with Brad M. Shuster, National MI’s Founder, Executive Chairman of NMI Holdings, Inc., and Immediate Past Chairman of USMI’s Board. Founded in 2012, National MI was built to serve borrowers, mortgage lenders, and the housing industry by helping more families achieve affordable and sustainable homeownership. The company continues to implement innovative risk management strategies to ensure lenders’ confidence and help borrowers qualify for low down payment mortgages. National MI consistently demonstrates a track record of strong performance and growth while delivering innovative mortgage solutions.

Below, Mr. Shuster discusses National MI’s views on what the housing finance industry should focus on to ensure access for first-time homebuyers as home prices continue to rise and demand remains robust. He also talks about the findings of the 2021 NextGen Homebuyer Report and how demographic changes are shaping the mortgage industry.

(1) Home-price growth reached a record high in the third quarter of 2021, and demand from homebuyers remains robust despite rapidly increasing home prices. What do you think the housing finance industry should do or focus on to improve first-time homebuyers’ access to the housing market?

We are seeing more and more first-time homebuyers enter the housing market. Housing continues to remain strong and as a result, we are seeing an imbalance of supply and demand in the market, creating entry barriers to prospective homebuyers.

While strong House Price Appreciation (HPA) is great for current homeowners, it creates a moving target for those looking to transition from renting to owning. We see historically low supply, especially in the starter home segment of the market. According to the National Association of Home Builders (NAHB) there was only 2.1 months of supply for existing homes as of November 2021. And a recent National Association of REALTORS® (NAR) report said that housing affordability will be an increasingly important consideration for buyers, but with rents rising by 18.5 percent, buying may be the relatively more affordable housing option for some.

Now more than ever, there is a societal need to help qualified borrowers use private mortgage insurance to achieve the dream of homeownership affordably, responsibly and sustainably, and we take that role very seriously.

The housing finance industry should focus on educating homebuyers about all of the options available for mortgage financing. It is critical that younger, first-time and minority homebuyers – who often lack the resources or intergenerational wealth to afford a 20 percent down payment – are aware of the availability of lower down payment mortgages made possible by the support of private MI.

The industry also needs to educate potential homebuyers on the significant benefits of purchasing a home sooner with a low-down payment, rather than waiting many years to save up for a bigger down payment. Buying a home earlier means that the homeowner can begin to build equity and long-term wealth rather than waiting to enter the market.

The increase to the government-sponsored enterprises (GSEs) conforming loan limits for 2022 recently announced by the Federal Housing Finance Agency (FHFA) will also help open up the market, particularly in high-cost areas.

The private MI industry is well-positioned to help meet the needs of consumers and to drive responsible growth in the mortgage market by facilitating access to sustainable low down payment loans for millions of mortgage-ready borrowers. As part of that effort, our industry is working to raise consumers’ awareness of all mortgage financing options available.

(2) In October 2021, National MI collaborated with Cultural Outreach and the Mortgage Bankers Association (MBA) to study NextGen (ages 22-37) homebuying and economic trends. The 2021 NextGen Homebuyer Report found that this generation exhibits different spending patterns and has a lack of understanding about the homebuying process, especially around down payment and income requirements. Could you tell us more about these trends? What patterns are this generation following when it comes to buying a home? Why do you think that is the case?

National MI is committed to expanding homeownership to all segments of the market, and our work with Cultural Outreach and the MBA on the NextGen Homebuyer Report is an important step in that direction. The NextGen population is significant: it accounts for one out of every three home purchases. The report uncovers the challenges and concerns this group of consumers has about entering the housing market.

The 2021 survey revealed that many NextGen future buyers are unsure whether purchasing a home is a good investment. NextGen buyers also indicate that COVID-19 has had a significant impact on their plans to purchase a house. They perceive a lack of information on personal finance and mortgage loans, so they increasingly are performing their own research, turning to their personal networks as one source.

That provides further evidence that the mortgage finance industry needs to do more to educate the NextGen segment of potential homebuyers on what it takes to be “mortgage-ready” and about their different low down payment options. In particular, we need to dispel the myth that to purchase a home, you must have a 20 percent down payment. In fact, the report indicates that more than half of the survey respondents mistakenly believe that they need to save 20 percent for a down payment. By raising awareness of mortgage financing options available with private MI, many NextGen consumers could come to realize that that homeownership may be closer than they think.

USMI’s most recent “MI In Your State Report” provides an analysis of how long it could take for a borrower to save 20 percent compared to a 5 percent down payment. The report found that saving for a 20 percent down payment could take potential homebuyers 21 years — three times the length of time it could take to save for a 5 percent down payment with private MI. For example, for a household earning the 2019 national median income of $68,703, it would take 21 years to save 20 percent, plus closing costs, for a single-family home. That number increases to 26 years for a Hispanic household and to 32 years for a Black household. Private MI can help reduce that timeframe to seven years. That is quite a difference.

(3) National MI hosted two webinars (here and here) on what diversity means in the mortgage industry, which you presented in collaboration with Tony Thompson from the National Association of Minority Mortgage Bankers of America (NAMMBA). Can you share insights into where our industry is today and how it can leverage diversity as a competitive marketplace advantage?

The newest generation of homebuyers is more diverse than previous generations in terms of race, gender, and socioeconomic status. National MI’s training platform offers relevant educational topics to our lender customers, and part of our success has been quickly shifting and refreshing what we offer to address an evolving set of customer needs. Since the data increasingly shows mortgage consumers are young and diverse, the mortgage industry needs to catch up to the new marketplace, especially in gaining skills and seeking guidance in media and training resources to reach the growing market of new homebuyers. Collaborating with industry partners such as NAMMBA enables us to move the conversation forward.

It is also important that companies take steps to make sure their workforces reflect the diversity in the population of homebuyers. When making one of the biggest financial decisions of their lives, consumers may feel more comfortable working with people who look like them and have a similar culture and background.

Still, the real estate finance industry has made great strides to promote diversity, equity and inclusion (DEI). At National MI, DEI is one of our core values and has always been a part of our company culture. Our efforts to further diversity, equity and inclusion guide us both internally and externally as we work to partner with diverse customers, clients and vendors by providing innovative products and value-driven services.

Brad M. Shuster’s Biography

Brad M. Shuster has served as Executive Chairman of the Board of NMI Holdings, Inc. since January 2019. He founded National MI in 2012 and served as Chairman and Chief Executive Officer of the company from 2012 to 2018.

Prior to founding National MI, Mr. Shuster was a senior executive with The PMI Group, Inc., where he served as President of International and Strategic Investments and Chief Executive Officer of PMI Capital Corporation. Before joining PMI in 1995, he was a partner at Deloitte LLP, where he served as partner-in-charge of Deloitte’s Northern California Insurance and Mortgage Banking practices.

Mr. Shuster holds a B.S. from The University of California, Berkeley and an MBA from The University of California, Los Angeles. He has received both CPA and CFA certifications.

Blog: Addressing the Increasing Costs of Homeownership

Buying a home is the largest single investment most Americans will make, but during the last few years, that dream has become increasingly unreachable for a significant portion of the population as the housing market experiences strong home price appreciation (HPA) and historically low levels of supply. A recent Wall Street Journal article reported on this rising home price trend, outlining how mortgage payments can become unaffordable as a result. According to the Federal Reserve Bank of Atlanta, the median American household would need 32.1 percent of its income to cover mortgage payments on a median-priced home – the most since November 2008, when the same outlays would require 34.2 percent of income. Moreover, the Federal Housing Finance Agency’s (FHFA) 2021 Q3 House Price Index (HPI®) report indicates that house prices were up 4.2 percent compared to the second quarter of 2021, but the real surprise comes when you look over the one year period during which home prices climbed 18.5 percent.

With this in mind, it is no surprise that an increasing number of consumers (64 percent) believe it is a bad time for buying a home, according to Fannie Mae’s latest Home Purchase Sentiment Index (HPSI®). This is a dramatic change from a year ago when that rate stood at only 35 percent, a change driven by consumers’ sentiments that home prices (plurality at 45 percent) and mortgage rates (majority at 58 percent) will increase over the next 12 months.

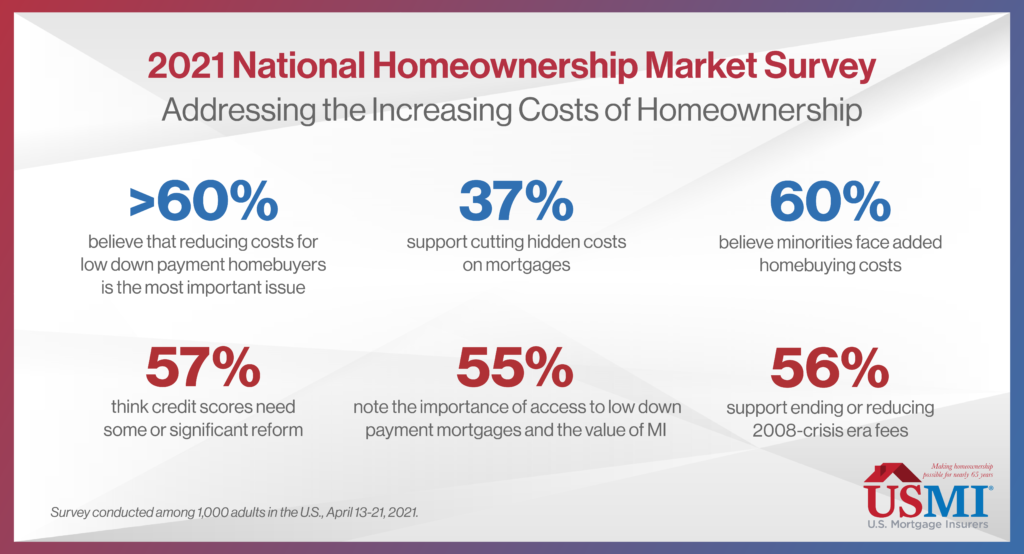

This entire situation only serves to push the goal of owning a home further out of reach for many prospective first-time, minority, and low- to moderate-income (LMI) homebuyers. In addition, there are other fees and charges that potential homebuyers could incur, increasing the cost of homeownership for creditworthy borrowers throughout the country. In fact, USMI’s 2021 National Homeownership Market Survey, which polled 1,000 adults in the U.S., found that 60 percent of respondents believe minorities face added homebuying costs because they tend to have lower credit and higher debt.

Moreover, when asked about the priorities and reforms the housing finance industry should focus on, over 60 percent of respondents believe that reducing costs for low down payment homebuyers is the most important item for the home buying process, and 37 percent support cutting hidden costs on mortgages. Other issues respondents conveyed include:

- Nearly 70 percent of respondents ranked the lack of affordable housing as the number one housing challenge and almost 60 percent stated that low housing supply is another top issue.

- 61 percent of respondents want to eliminate added costs for low down payment homebuyers and 56 percent of respondents specifically support ending Loan-Level Price Adjustments (LLPAs), 2008-crisis era fees that disproportionately affect minority and first-time homebuyers.

- 55 percent of respondents noted the importance of access to low down payment mortgages and the value of mortgage insurance (MI) to help borrowers qualify for mortgage financing.

- 57 percent think credit scores need some or significant reform, driven by respondents’ view that credit score is the underwriting element that most impacts mortgage costs.

Many of the “hidden costs” that borrowers reference when purchasing a mortgage are not really “hidden,” but instead are costs that they may not have anticipated incurring as part of closing the loan. Last week, Fannie Mae released a report titled, “Barriers to Entry: Closing Costs for First-Time and Low-Income Homebuyers,” which finds “[i]n a sample of approximately 1.1 million conventional home purchase loans acquired by Fannie Mae in 2020, median closing costs as a percent of home purchase price were 13 [percent] higher for low-income first-time homebuyers than for all homebuyers, and 19 [percent] higher than for non-low-income repeat homebuyers.” The report also finds that “Black and white Hispanic low-income first-time homebuyers on average paid higher closing costs relative to purchase price than their white non-Hispanic or Asian counterparts […] For some low-income first-time homebuyers, closing costs can be particularly onerous.” Fannie Mae found that some of these “homebuyers had closing costs equal to or exceeding their down payment.”

The FHFA released an Equitable Housing Finance Plans Request for Input (RFI) in September 2021, and the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, are required to submit Equitable Housing Finance Plans to FHFA by December 31, 2021. The plans will be in effect on January 1, 2022. USMI submitted its comment to the RFI in October. Given the private MI industry is one of the only forms of private capital available through market cycles and whose core business is focused on helping people without large down payments achieve affordable and sustainable homeownership, private MIs share the FHFA and GSEs’ view that the two pillars of good mortgage lending are sustainability and affordability. The goal should be a strong housing finance system that ensures equitable access to all mortgage-ready borrowers. USMI strongly supports efforts to remove barriers to homeownership and increase access and affordability, including for historically underserved households, while instilling sustainability for these same borrowers. The MI industry welcomes the opportunity to work with the FHFA, the GSEs, and other housing finance stakeholders to advance these goals.

Member Spotlight: Q&A with Mark Casale of Essent

USMI’s member spotlight series focuses on how the private mortgage insurance (MI) industry works to address several critical issues within the housing finance system, including expanding access to affordable mortgage credit for first-time and minority homebuyers, protecting taxpayers from mortgage credit risk, and recommendations on ways to reform and enhance the housing finance system to put it on a more sustainable path for the long-term.

This month we chat with Mark A. Casale, Chairman, President and CEO at Essent Guaranty, and Vice Chairman of USMI’s board. Essent, founded in 2008, offers private MI for single-family mortgage loans in the United States, providing private capital to mitigate mortgage credit risk for lenders and investors, allowing lenders to make additional mortgage financing available to prospective homeowners. To better execute Essent’s core purpose to ensure borrowers have access to sustainable mortgage credit, Essent remains focused on managing mortgage credit risk, enhancing the business model of the private MI industry, and strengthening private MIs as counterparties to the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, lenders, and other stakeholders.

Below, Casale discusses Essent’s views on the housing market as we come out of the COVID-19 pandemic, the continued evolution of the private MI industry and the role of innovation, and how this evolution will better serve borrowers and the housing finance system.

(1) Given the importance of low-down payment financing in the housing finance system and considering the competitive real estate market, what steps do you think the industry should take in the next year or two to better serve first-time buyers?

The 2021 housing environment has been strong as low interest rates continue to boost refinance and purchase market activity. However, a meaningful lack of housing supply has impacted affordability.

Millennials ―around 80 million strong― continue to contribute to the favorable demand dynamics. Driven by significant life events such as marriage and children, an increasing number of millennials are forming households, and continuing to provide strength to first-time homebuyer demand.

Millennials, and especially Hispanics, which represent 20 percent of this important segment of our population, are projected to be the dominant population and primary drivers of new homeownership for years to come; and we can already see the significant impact they are having on the real estate market and demand for housing.

Given this context, as more millennial homebuyers enter the market, it will be critical for the industry to improve consumer access to affordable credit, especially to first-time, younger and minority homebuyers, who may not have the resources or intergenerational wealth to afford the standard 20 percent down. Private MI companies are an important supporter of affordable, low down payment mortgages, helping more homebuyers get into homes and on a path to building the long-term wealth associated with homeownership.

(2) Private MI has provided credit risk protection to lenders and the GSEs for nearly 65 years, but our industry has also evolved to become stronger and more resilient. How does Essent describe its approach to risk management and credit risk transfer (CRT)?

Risk management has always been a key tenet for mortgage insurers because of the nature of our business of taking first loss credit risk on high loan to value loans. Post the Great Financial Crisis, risk management continues to evolve through new data sources, enhanced analytic tools and techniques, as well as the importance of quality control of the loan manufacturing process.

The ability to transfer credit risk to third parties in CRT transactions is an integral component of risk management for MI companies. The industry traditionally relied on reinsurance transactions and has completed over 30 transactions reducing loss exposure and making more capital available to support additional lending. Innovative leadership by the GSEs and the Federal Housing Finance Agency (FHFA) in the CRT market helped create a broader credit risk transfer market for mortgage insurers through the advent of Insurance Linked Notes (ILN). The MIs began utilizing ILN transactions beginning in 2015 and ILNs have since become a programmatic execution for MIs as a risk management hedging tool and a reliable source of capital. The industry has completed over 43 ILN transactions to date. The MI industry has transferred over $50 billion of risk in force via CRT.

CRT has transformed Essent and our industry from an old business model of “Buy and Hold” risk to a new business model of “Buy, Manage and Distribute” risk. We have approximately 85 percent of our $200+ billion insurance portfolio hedged via CRT as of 2021Q2. This model will make Essent, and our industry, more resilient during times of crisis, enhancing our ability to insure loans during all cycles while serving as strong counterparties to our customers and the GSEs.

(3) How will MI need to innovate and evolve as an industry in order to ensure future generations have access to affordable housing?

A competitive mortgage insurance industry backed by private capital serves the housing finance system very well. Today, over $1.3 trillion of mortgages are financed by loans with private MI. However, mortgage insurers have and will continue to evolve, particularly as technology enables key connection points with loan origination systems and our lenders. In the past 2 years, more refined risk assessment and pricing of risk has been an important evolution in the MI space. Currently, over 95 percent of lenders now get MI quotes from a proprietary risk-based pricing engine vs a legacy rate card. Essent expects more granular risk assessment and pricing to continue to improve by prudently leveraging machine learning and artificial intelligence with existing and new sources of data. We believe these approaches enable us to more accurately assess the risk of the loan and make more affordable credit available to borrowers that traditional approaches might have turned away. Fannie Mae recently announced a change to include rental payment history in Desktop Underwriter, a great demonstration of how incremental data can assist in improving the overall risk assessment of a transaction.

We strongly believe that the inclusion of more data to evaluate loans will be a differentiator that expands access to credit for qualified borrowers and delivers the best MI price available to prospective homeowners. These types of innovations align with FHFA’s stated goals of improving access and affordability as well as reducing racial inequality in homeownership. The MI industry will continue to be a valuable business partner to lenders and the GSEs in improving access and maintaining responsible lending standards so that our housing finance system provides sustainable homeownership.

Mark A. Casale’s Biography

Mark A. Casale is the founder, Chief Executive Officer and Chairman of the Board of Directors of Essent Group Ltd. (NYSE: ESNT). Mr. Casale has more than 25 years of financial services experience, which includes senior roles in mortgage banking, mortgage insurance, bond insurance and capital markets.

Founded in 2008 by Mr. Casale with $500 million of equity funding, Essent Group Ltd. has grown to a market capitalization of approximately $5 billion and manages more than $200 billion of insurance in force. Under Mr. Casale’s leadership, Essent has become a leading mortgage insurer and reinsurer serving as a trusted and strong counterparty to lenders and GSEs and has enabled over two million borrowers to become homeowners. Mr. Casale continues to evolve the franchise using risk-based pricing and AI-driven analytics to support his core mission of prudently growing shareholder value and promoting affordable and sustainable homeownership.

Mr. Casale also champions Essent’s philanthropic mission, supporting local and national organizations centered around children, housing, health, and education. He currently serves as a member of the Board of Trustees for St. Joseph’s University, La Salle College High School, and the Academy of Notre Dame de Namur.

A native of the Philadelphia region, Mr. Casale holds a BS in accounting from St. Joseph’s University and an MBA in finance from New York University.

Blog: Hispanic Homeownership: How Hispanic Population Growth Helps Drive the Homeownership Market

Hispanic homeownership has grown for six consecutive years, even during the COVID-19 pandemic. Sustainably increasing homeownership access through policy tools such as low down payment lending can help bridge the homeownership gap

September 15 marks the beginning of Hispanic Heritage Month, and it is an opportunity to recognize the significant contributions and influence of Hispanic Americans to the history, culture, and achievements of the United States. It is also a moment to reflect on Hispanic homeownership in America. In particular, over the last few years, the Hispanic population has been a key component of the growth in homeownership in the U.S., and it is projected to be the demographic group leading this segment of the industry for the next four decades.

According to the 2020 U.S. Census Bureau report, over the next 40 years Hispanics will be the primary contributors to the U.S. population growth, accounting for 68 percent between now and 2060. The Urban Institute also projects that from 2020 to 2040, most net new homeowners will be Hispanics – estimating that of the 6.9 million new homeowner households, 70 percent will be Hispanic. These figures speak to the importance of this demographic group to our nation and the impact they will have on mortgage markets and the face of homeownership over the next few decades.

Hispanic population growth is also a significant reason to be focused on the barriers to homeownership for all minorities. Economic barriers and housing supply challenges for this population continue to keep homeownership out of reach for many of these potential homeowners. The income gap between Hispanics and non-Hispanic Whites remains steep, with non-Hispanic White households having a median income 26 percent higher than that of Hispanic households. In 2019, the median Hispanic household income was $56,113 (U.S. Census Bureau). Additionally, according to the National Association of Hispanic Real Estate Professional’s (NAHREP) 2020 State of Hispanic Homeownership Report, Hispanics also tend to have higher debt-to-income (DTI) ratios and lower credit scores, and given the youth in the Hispanic community, first-time homebuyers drive Hispanic homeownership gains. In 2019, 56 percent of Hispanic homeowners indicated that they were living in the first home they had ever owned, as reported by the U.S. Census Bureau’s 2019 American Housing Survey. Therefore, Hispanic homebuyers are an important demographic served by low down payment mortgage products, which benefit first-time and low- to moderate-income homebuyers primarily by bridging the down payment gap.

USMI’s 2021 National Homeownership Market Survey, which polled 1,000 adults in the U.S., including an oversample of Hispanics, found that 67 percent of Hispanics consider owning a home as “very important.” Further, the survey found that 53 percent of Hispanic respondents reported having experienced housing problems during the COVID-19 pandemic, with the primary cited concerns including evictions and falling behind rent or mortgage payments.

Among the obstacles Hispanics face, 66 percent indicated that the lack of affordable homes is the biggest housing-related issue. Additionally, 20 percent said that one of the biggest challenges they face when buying a home is the inability to afford a 20 percent down payment, as monthly housing costs consume a large amount of Hispanics’ income – nearly 60 percent said they spend 30+ percent of their monthly household income on housing. Lastly, 65 percent of Hispanics suggested there is socioeconomic bias in the homebuying process, with the survey finding that lower levels of income, lack of intergenerational wealth for down payments, and difficulties in the credit scoring system are the most significant barriers for increasing minority homeownership in the U.S.

However, while these barriers were cited, 90 percent of Hispanics also conveyed that they felt treated fairly during the mortgage process. Nonetheless, myths and misinformation persist around this demographic. By a nearly 3 to 1 ratio compared to White respondents, Hispanics believe the mortgage approval process is not affordable, and stated that they do not fully understand down payment requirements. In fact, 45 percent mistakenly believe a 20+ percent down payment is required, and another 21 percent report they do not know what amount of a down payment is required. In reality, private mortgage insurance (MI) enables homebuyers to purchase homes with down payments as low as 3 percent.

These figures and projections make very clear that as the Hispanic population rapidly grows and has a significant impact on the housing market, policymakers must not lose sight of addressing both near term market challenges, such as the significant lack of affordable homes for purchase or rent, as well as longer-term systemic issues that unnecessarily increase costs or create barriers for minority and lower income homebuyers. Notably, despite having been acutely impacted by the COVID-19 pandemic, Hispanic Americans are the only demographic group to have increased their homeownership rate for six consecutive years (including 2020) according to NAHREP. Removing barriers to minority homeownership will enable even more Hispanic households to benefit from sustainable homeownership in the decades to come.

Private MI enhances the ability of minority and lower income homebuyers to borrow in an affordable and sustainable way, enabling them to achieve housing stability and build wealth—and realize the American Dream. In 2020, nearly 60 percent of borrowers served by private MI were first-time homebuyers and more than 40 percent were borrowers with incomes below $75,000. In fact, USMI’s national survey found that consumers view MI as an important piece of the homeownership puzzle, leveling the playing field by helping low- to moderate-income and first-time homebuyers access home financing.

As we celebrate Hispanic Heritage Month, we are committed to supporting sound and prudent policies that help expand homeownership.

See here for a Spanish version of this blog post.