USMI’s Thoughts and Recommendations on Chairman Crapo’s Outline for Housing Finance Reform – March 27, 2019

By Lindsey D. Johnson

The year 2019 is already shaping up to be significant for the debate on the future of the housing finance system. With the Administration’s pick for Federal Housing Finance Agency (FHFA) Director Mark Calabria likely to be confirmed in the coming weeks, there has been a renewed focus on the futures of Fannie Mae and Freddie Mac (the GSEs) and the need for reforms. Just last month, Senate Banking Committee Chairman Mike Crapo (R-ID) released an outline on housing finance reform. House Financial Services Committee Chairwoman Maxine Waters (D-CA) has also detailed her legislative priorities, which includes housing reform and a particular focus on affordable housing issues. U.S. Mortgage Insurers (USMI) agrees with Chairman Crapo, Chairwoman Waters, and other policymakers who continue to see the need for meaningful reforms to address structural concerns at the GSEs. While the Administration can take steps to provide the necessary oversight of and enhancements to the GSEs, structural reform must be done by Congress.

This week, I will join other witnesses to testify on behalf of USMI on Chairman Crapo’s outline for housing finance reform and will specifically highlight the important role that private mortgage insurance (MI) plays each day to help middle-income and first-time buyers to become homeowners despite modest down payments. Not only does private MI help to provide access to mortgage credit for American homebuyers, but it also provides important protections for the overall mortgage finance system, which translates to protections for the federal government and taxpayers. Here is why private MI serves a valuable role.

MI Helps Low Down Payment Homebuyers

Private MI is a time-tested way to help borrowers qualify for low down-payment home financing. Research by the National Association of REALTORS® shows that Americans continuously cite saving for a down payment as one of the biggest hurdles for attaining homeownership and first-time homebuyers on average have a down payment of seven percent. Private MI helps bridge the gap for many borrowers to attain homeownership sooner than they otherwise would. In fact, for the past three years, private MI has been the leader in the total insured market to provide borrowers with to access to low down payment mortgage financing. All told, for over 60 years private MI has helped nearly 30 million families nationally purchase or refinance a home, with more than one million borrowers alone in 2018. Of those borrowers, nearly 60 percent of purchase loans went to first-time homebuyers and more than 40 percent of borrowers with MI had annual incomes below $75,000.

MI Protects Taxpayers and Government from Risk

Private MI not only provides affordable access to credit for homebuyers, but it also plays a critical role in protecting U.S. taxpayers from mortgage credit risk in the event of borrower defaults. Private MI serves as the first layer of protection in the conventional mortgage market against defaults that may occur on GSE-purchased mortgages. Private MI attaches to a loan the day that the loan is originated, which means that even before the lender might sell the mortgage into the GSE-backed secondary market, it is protected by private capital and therefore doesn’t directly expose the government. In this regard, when it comes to insuring low down payment mortgages, MI serves as a “second pair of eyes” on that risk. This helps ensure borrowers are placed into sustainable homeownership and adds an additional layer of protection in the mortgage finance system. This loan-level credit enhancement that attaches to the loan at origination is a feature that should be maintained in a future housing finance system.

Mortgage insurers have strong incentives to actively manage this mortgage credit risk because when a conventional-insured mortgage defaults, private MI bears the first layer of financial loss (on average 25 percent of the mortgage value). This structure of MI protection has been effective and, according to the Urban Institute, for GSE “30-year fixed rate, fully documented, fully amortizing mortgages, the loss severity of loans with private MI is 40 percent lower than that without, despite the higher Loan-to-Value of mortgages with private MI.”

It’s been over 10 years since the 2008 financial crisis, which prompted the federal government to place the GSEs into conservatorship. Comprehensive housing finance reform is long overdue and as Congress and the Administration move forward with this important work, private MI looks forward to continuing to play its invaluable role in providing access to credit and unparalleled taxpayer protection.

It is a common misconception that a 20 percent down payment is required to buy a home. Advice to wait and save a large down payment is often based on the theory that the cost of mortgage insurance (MI), which is required when you buy with a smaller down payment, should be avoided. This may not be the best advice and is, in fact, not in line with market trends, considering the median down payment for first-time homebuyers is 7 percent, according to the National Association of Realtors.

Yes, you can qualify for a conventional mortgage with a down payment as small as 3 percent of the purchase price. It is also true that you can reduce your monthly mortgage payment by paying for discount points at closing, but that can be 5 or 10 percent of the purchase price — not 20. And because every buyer’s situation is unique, it’s important to do the math. In today’s market, it could take a family earning the national median income up to 20 years to save 20 percent, according to calculations by U.S. Mortgage Insurers using a methodology developed by the Center for Responsible Lending; a lot can change during that time, in the family’s personal finances and in overall mortgage market trends.

How can buying now save you money later?

Consider you want to purchase a $255,000 home. A 5 percent down payment is $12,750 versus $51,000 in cash for 20 percent down. With a 740 credit score at today’s MI rates, your monthly MI payment would be about $110, which is added to your monthly mortgage payment until MI cancels. MI typically cancels after five years; therefore, you will only have this added cost for a short period of time versus waiting an average of 20 years to save for 20 percent.

With home price appreciation, today’s $255,000 home will likely cost more in the years ahead and this will also have an impact on the necessary down payment and length of time required to save for it. There are other variables in the equation too, such as interest rates. As federal rates rise from their historic lows, so too will the costs associated with financing a mortgage. The savings a borrower might calculate today could be altogether negated by waiting even a few more years. Another factor is that rents are on the rise across the nation, leading to a reduced capacity for many would-be homebuyers to save for larger down payments.

If you decide to buy today with a low down payment mortgage that has private MI, keep in mind that the monthly MI payments are temporary and go away, lowering the monthly payment over time. Again, private MI typically lasts about five years as it can be cancelled once a homeowner builds approximately 20 percent equity in the home through payments or appreciation and automatically terminates for most borrowers once he or she reaches 22 percent equity. Importantly, the insurance premiums on an FHA mortgage — a 100 percent taxpayer-backed government version of mortgage insurance — cannot be cancelled for the vast majority of borrowers.

So, do the math and let the numbers guide you. There are many online mortgage calculators that can help. Check out lowdownpaymentfacts.org to learn more.

By Lindsey Johnson

2/17/19

Housing finance reform remains a priority in Washington. Earlier this month, Senate Banking Committee Chairman Mike Crapo (R-Idaho) released a proposal to reform the government-sponsored enterprises, Fannie Mae and Freddie Mac.

Like many other proposals, including House Financial Services Committee Chairwoman Maxine Waters’ (D-Calif.) HOME Forward draft legislation, Chairman Crapo’s proposal recognizes the important role that private capital — and specifically private mortgage insurance — serves to facilitate homeownership for low down-payment borrowers and protect taxpayers from mortgage credit risk.

The nominee for director of the Federal Housing Finance Agency (FHFA), Mark Calabria, recently appeared before the Senate Banking Committee as part of his confirmation process. He’s an individual who appreciates the benefits that private mortgage insurance extends beyond protecting the government and taxpayers.

Private mortgage insurance remains the longest serving, time-tested way to help low down-payment borrowers qualify for home financing in the conventional market.

Our nation’s mortgage finance system is one that must balance access to credit for consumers while also shielding taxpayers. Fortunately, private mortgage insurance is uniquely and permanently dedicated to serving both objectives through all economic cycles. As such, it should remain a critical piece of any future, reformed system.

Access to affordable, low down-payment mortgages is understandably top-of-mind for many policymakers. While there is an important role for government and taxpayer-backed programs to play in the broader system, any comprehensive reform should first encourage the greater use of private capital that ensures access to affordable low down-payment mortgages in the conventional market.

Fortunately, there is generally bipartisan agreement around this principle. Facilitating this kind of mortgage lending is precisely the purpose of private mortgage insurance, which has helped more than 30 million families secure home loans over the last six decades — many of whom were first-time or middle-income homebuyers.

Last year, more than 1 million homeowners qualified to purchase or refinance their home thanks to private mortgage insurance. Of these homeowners, nearly 60 percent were first-time homebuyers and more than 40 percent had incomes below $75,000.

Congressional leaders and the Trump administration must reform the housing finance system into one that works for all Americans by protecting taxpayers while also ensuring access to affordable mortgage financing.

The Harvard Joint Center for Housing Studies projected that the U.S. would add 13.6 million households between 2015 and 2025, which means affordable low down-payment options must be part of the equation.

Mortgage insurance companies support the government-sponsored enterprises and mortgage lenders in the origination of low- to moderate- income mortgage programs that address affordable housing needs of local communities.

The private mortgage insurance industry stands ready to continue its role as the solution to enable millions of families to achieve homeownership.

A version of this op-ed originally appeared in The Hill on February 17, 2019.

As the 116th Congress settles in, there has already been a lot of housing finance activity. Yesterday, the Senate Banking Committee (SBC) held a hearing on the nomination of Mark Calabria to head the Federal Housing Finance Agency (FHFA); while on Wednesday the House Financial Services Committee (HFSC) held a hearing on housing challenges, most notably homelessness. Recently, the chairs of both of these committees each outlined their priorities for housing finance reform. The FHFA also decided to no longer defend the constitutionality of its structure in court, amid an ongoing lawsuit filed by Fannie Mae and Freddie Mac (the “GSEs”) shareholders. Finally, as this is our first Roundup in 2019, we highlight that at the end of 2018, USMI President Lindsey Johnson testified along with other trade association and nonprofit executives before the HFSC on bipartisan housing finance proposals.

WASHINGTON — Lindsey Johnson, President of U.S. Mortgage Insurers (USMI), today issued the following statement on the outline released today by Senate Banking Committee Chairman Mike Crapo (R-ID) on proposed reforms to Fannie Mae and Freddie Mac (the GSEs) and the housing finance system:

“Today Chairman Crapo released a thoughtful outline to reform the GSEs in order to put the housing finance system on more stable footing. The reform plan covers many areas and USMI is particularly pleased that Chairman Crapo recognizes the importance and value of private mortgage insurance in enabling access to low down payment conventional mortgages while protecting taxpayers at least to the levels that they are protected today. Ten years after conservatorship of the GSEs, it is essential that meaningful reforms be done to better protect taxpayers and to ensure consumers will have access to mortgage finance credit through all market cycles.

“USMI is pleased to see Chairman Crapo provide these ideas for reform and we look forward to working with his office and the Committee on the details of these concepts. We are committed to working with the Senate, House, and the Administration to promote reforms that put more private capital in front of taxpayer risk and to create a more sustainable housing finance system that works for consumers, market participants, and taxpayers.

“For more than 60 years, MI has provided effective credit risk protection for our nation’s mortgage finance system and helped 30 million families become homeowners. This time-tested form of private capital stands ready to continue minimizing taxpayer risk while ensuring that mortgage credit remains accessible and affordable.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

The homebuying process is exciting, but can also seem fraught with added costs, like a home inspection, title insurance and closing costs. And if you can’t afford a full 20 percent down payment on a conventional home loan, then you will most likely pay for private mortgage insurance (MI). Some people consider private MI yet another added cost, but it helps creditworthy middle-income homebuyers qualify for home financing sooner with a low down payment. Is it really an added cost if it saves time and money in the long run?

For most people, low down payment home loan options include conventional loans with private MI and government-backed loans like those offered by the Federal Housing Administration (FHA). While comparable, each of these options has important differences. For example, the minimum down payment for an FHA mortgage is 3.5 percent while it’s only 3 percent on a conventional, privately insured mortgage.

Another key feature of private MI is that it can be canceled when a borrower reaches 20 percent equity in his or her home. Borrowers who purchase a home with private MI can typically cancel it within 5 to 7 years, resulting in their monthly bill going down. Private MI’s cancelability makes it a more affordable option over FHA-backed mortgages, which typically require mortgage insurance premiums for the entirety of the loan term. Both are offered by most mortgage lenders, so it’s smart to ask a loan officer for both options so you can compare and do the math.

The myth that a homebuyer needs 20 percent down to obtain a mortgage is simply not true. Low down payment mortgages are widely available and used every day across the country. In 2018, the National Association of Realtors found that first-time homebuyers typically put down 7 percent, while repeat buyers put down an average of 16 percent. Many homebuyers choose a lower down payment option to preserve some savings for home improvements or save for other goals. The time it could take to save up a 20 percent down payment is significant. On average, it could take up to 20 years to save a full 20 percent, plus closing costs, for a $257,700 house — the national median sales price. With home prices on the rise, the amount of time it takes to save up could only increase. Private MI can mean the difference between getting into the home of your dreams sooner or waiting for years.

For over 60 years, more than 30 million homeowners of all backgrounds have used private MI to successfully buy their homes. In the past year alone, private MI helped more than one million borrowers nationwide purchase or refinance a mortgage. According to a study by U.S. Mortgage Insurers, 56 percent of purchase borrowers were first-time homebuyers and more than 40 percent had incomes below $75,000.

For decades, millions of homeowners and prospective homebuyers have relied on private MI to help them affordably and responsibly purchase their homes — in turn helping them build personal wealth. Today’s historically low mortgage interest rates are a good reason to buy a home now. It is estimated that in 2019, the average rate for a 30-year fixed-rate mortgage will be around 5 percent. Borrowers should take advantage of these historically low mortgage interest rates because experts forecast that primary mortgage rates are on the rise.

Getting a mortgage with private MI and keeping more of your hard-earned money in the bank can be a very smart way to invest in your future. Check out lowdownpaymentfacts.orgto learn more.

By Lindsey Johnson

A myth about homeownership that discourages many prospective homeowners is that they need a 20 percent down payment to obtain a home loan. Not true! What many borrowers do not realize is that they can qualify for a mortgage with significantly less than 20 percent down. This is particularly true when it comes to first-time homebuyers.

A recent survey from the National Association of REALTORS® found that among first-time homebuyers who obtained a mortgage, more than 70 percent made a down payment of less than 20 percent. What’s more, according to Genworth Mortgage Insurance’s August 2018 “First-Time Homebuyer Market Report,” 66 percent of all homebuyers using low down payment mortgages were first-time buyers, and 79 percent of all first-time homebuyers used some form of low down payment mortgages.

As first-time homebuyers consider taking the exciting leap into homeownership, it’s important for them to fully understand all the home loan options available in the market. Of the variety of home loans available, conventional loans with private mortgage insurance (MI) stand out as one of the most competitive and affordable paths to homeownership.

U.S. Mortgage Insurers (USMI) recently released a report highlighting how MI helps bridge the down payment gap in the United States and promotes homeownership. Importantly, the report confirmed what has long been known: MI makes it easier for creditworthy borrowers with limited down payments to access conventional mortgage credit. Specifically, the report found:

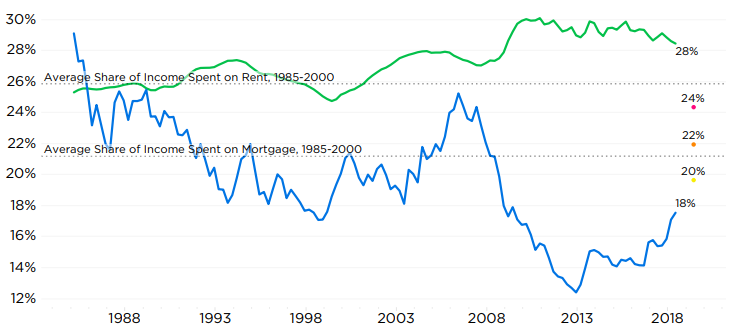

Data show that today many Americans are spending more of their income on rent than they are on mortgage payments. From 1985 to 2000, the share of income spent on mortgage payments was 21 percent; in Q2 2018 it was 18 percent. Conversely, from 1985 to 2000 the share of income spent on rent was slightly higher at 26 percent and has risen to 28 percent as of Q2 2018. As many individuals and families look to make the step from renting to owning their own home to create greater stability and build long-term equity, it’s essential that these individuals have prudent low down payment options – such as private MI – available for their future homeownership needs.

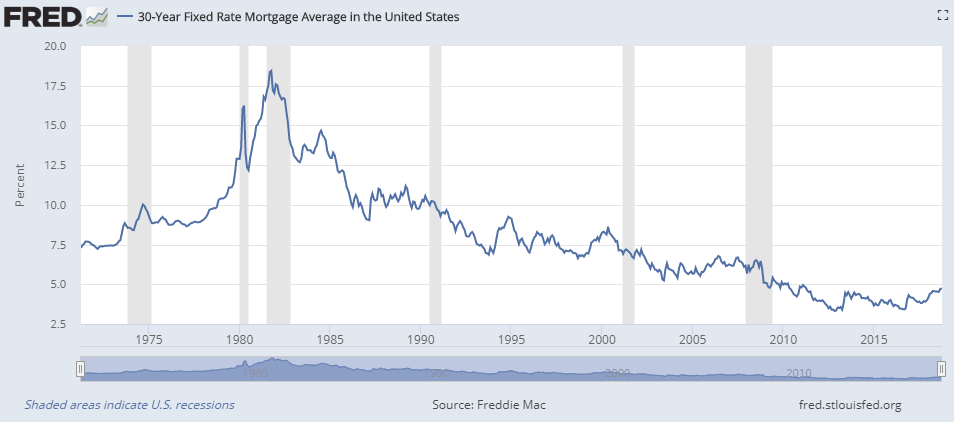

In addition to the wealth creation that homeownership fosters, today’s historically low mortgage interest rates are a good reason to buy a home now. Over the course of nearly 35 years, the housing market has experienced an extraordinary decline in mortgage interest rates. In 1981, the average rate for a 30-year fixed-rate mortgage stood at over 18 percent; it stood at approximately 4.72 percent at the end of September 2018. Borrowers should take advantage of these historically low mortgage interest rates because housing finance experts forecast that this interest rate decline is over, and primary mortgage rates are on the rise.

Homebuyers shouldn’t sit on the sidelines and put off buying the home of their dreams simply because they aren’t in the position to put 20 percent down. Since 1957, MI has helped millions of Americans – particularly first-time homebuyers – become successful homeowners, and it will continue to be a foundation of the housing market and a resource for borrowers in the years to come.

September marked the 10th anniversary of the GSEs being placed into conservatorship and there is growing recognition that Congress may not be able to tackle the complex issue of housing reform until 2019 or perhaps even later. But not all aspects of housing reform need to wait for action by Congress. USMI has produced the following white paper to assist the Trump Administration, particularly the Department of Treasury and the independent Federal Housing Finance Agency (FHFA), in identifying the key areas where the Administration should focus its efforts and specific steps the Administration can take to put the housing finance system on a more sustainable path. USMI provides specific recommendations to:

While reforming the GSEs and putting the housing finance system on a more stable, sustainable path is the primary focus of this paper, it is essential that reform is not done in a vacuum. True housing finance reform should also address the Federal Housing Administration (FHA) and dynamics between private and government-insured lending channels to balance taxpayer protection with access to mortgage finance. Actions taken under Administrative reform could further reduce taxpayer risk, level the playing field between the GSEs and private market participants, and provide greater transparency regarding GSE pricing and practices. Further, Administrative reforms could be the catalyst needed to break the legislative logjam and enable Congress to enact comprehensive housing reform legislation.

The full paper can be downloaded here. Below, USMI has outlined 11 key takeaways for policymakers to consider when contemplating the future of housing finance. A PDF of these recommendations can be downloaded here.

WASHINGTON — Lindsey Johnson, President of U.S. Mortgage Insurers (USMI), today published the following blog on USMI.org in response to today’s U.S. House Financial Services Committee hearing entitled “A Failure to Act: How a Decade Without GSE Reform Has Once Again Put Taxpayers at Risk”:

“Today’s hearing on the GSE’s (Fannie Mae and Freddie Mac) 10 years in government conservatorship—after U.S. taxpayers provided a $187 billion bailout during the financial crisis—serves as an important reminder that the housing finance system still needs serious reform. While Fannie and Freddie are healthier today thanks to a prolonged period of favorable economic and housing conditions, and new safeguards that have improved the stability of the overall mortgage finance system, we must work to ensure the system is put on a stable footing for the long term. Policymakers should consider reaffirming boundaries for the GSEs in the secondary mortgage markets, reducing their duopolistic market power to level the playing field for competitive private capital opportunities, and increasing transparency in the GSEs’ operations so that all participants in the housing finance system have the clarity they need to foster and support a healthy and accessible mortgage market.

“Since the GSEs were placed into conservatorship, their footprint, market dominance, and reach into the mortgage finance system has expanded. USMI continues to be concerned with the GSEs’ mission creep and the lack of transparency in certain GSE expanded activities. For example, the financing of mortgage servicing rights for a select group of non-bank lenders; new credit enhancement mechanisms, like Freddie Mac’s IMAGIN and Fannie Mae’s EPMI pilot programs, that seek to disintermediate private capital; and participating in single-family rental pilot programs, among others. Many of these new products and activities raise alarms about the GSEs’ expanding roles in the housing finance system without a clear rational or need as they represent a significant blurring of the bright line separation between primary market and secondary market activities, as well as greater vertical integration of private sector activities into the GSEs.

“The Federal Housing Finance Agency recently announced it is ending the GSEs’ single-family rental pilot programs, which it said it was doing on a ‘test and learn basis,’ citing that it has since learned the market can function without the GSEs. FHFA needs to end other GSE pilots and programs that encroach on private market functions, including the IMAGIN and EPMI products introduced earlier this year.

“There is a robust and healthy private mortgage insurance market that is meeting the market’s needs and it is unnecessary for the GSEs to compete directly with the private sector. The GSEs should not be allowed to create programs that crowd out a time-tested, robustly regulated, and highly capitalized industry that facilitates prudent access to low down payment mortgage financing across the country and on a permanent basis through various economic cycles.

“To achieve comprehensive reform, USMI believes certain principles must be met that will guarantee a robust housing finance system that promotes successful and affordable homeownership. These principles include establishing a coordinated housing policy that promotes private capital ahead of taxpayer exposure, enabling access to homeownership and affordable mortgage credit with private mortgage insurance, and deepening the level of mortgage insurance currently used with conventional low down payment loans. It is long overdue that we strike the right balance for taxpayers in establishing complementary roles for the Federal Housing Administration and the conventional low down payment mortgage market, which is predominately guaranteed by private mortgage insurance.

“Since 1957, mortgage insurers have supported the U.S. housing market, enabling homeownership opportunities for nearly 30 million Americans by providing insurance on mortgage loans where borrowers cannot afford a 20 percent down payment. USMI will continue to work with Congress and the administration to create a more coordinated, consistent, and transparent housing system—a system that can expand private capital’s role in shouldering more risk in front of taxpayers.”

On September 5, USMI joined 28 other organizations on a letter to Congress and the Administration calling for GSE reform.

It’s been an action-packed summer for housing finance. The Washington Post reported on down payments being the chief hurdle for homebuyers across the country, citing USMI’s recent report on private mortgage insurance’s role in homeownership. There have also been substantive conversations about Fannie Mae and Freddie Mac’s (the GSEs) footprint and future. American Enterprise Institute (AEI) held a conference on the GSEs’ market activities, while Politico published an in-depth article on their market expansion. U.S. Treasury Secretary Steven Mnuchin and Federal Reserve Chair Jerome Powell also testified before Congress and both fielded questions on GSE-related matters. These GSE-related developments come as Fannie Mae CEO Timothy Mayopoulos announced his retirement by year’s end and, as National Mortgage News reported, when stakeholders and influencers are keenly focused on the Administration’s pick for the next Federal Housing Finance Agency (FHFA) Director. In other news, the U.S. Senate held a nomination hearing for Michael Bright to become President of Ginnie Mae, and Federal Housing Administration (FHA) Commissioner Brian Montgomery discussed his priorities.

WASHINGTON—U.S. Mortgage Insurers (USMI) today announced that Bradley Shuster will serve as the association’s new Chairman of the Board. Shuster is the Chairman and CEO of National Mortgage Insurance Corporation (National MI) and its parent, NMI Holdings, Inc. (Nasdaq: NMIH). He succeeds Patrick Sinks, CEO of Mortgage Guaranty Insurance Corporation (MGIC). Shuster’s appointment comes at a significant time in the housing finance system, which remains at the center of national policy debates.

“The housing finance system continues to strengthen and make enhancements to safety and soundness that make it more resilient, and the private mortgage insurance industry has played a significant role in these improvements. As policymakers consider how to put the housing finance system on a sustainable, long-term path for the future, I am excited to serve as USMI’s Chairman to continue to champion the important role private mortgage insurance plays – and will continue to play – in facilitating responsible low down payment lending while protecting the government and taxpayers against mortgage credit risk,” said Shuster.

Shuster previously served as USMI’s Vice Chair. He has served as National MI’s Chairman and CEO since April 2012, and brings more than 30 years of experience in the housing finance industry to USMI’s chairmanship. He previously served in the leadership team of The PMI Group, Inc. for over a decade and was a partner at Deloitte LLP where he served as the Partner-In-Charge of the firm’s Northern California Insurance Practice and Mortgage Banking Practice. Shuster also held several consulting positions assisting private investors in the insurance industry.

“We are excited to welcome Brad as USMI’s new Chairman. His leadership and tenure in the mortgage insurance industry will be invaluable as we continue our important work of promoting homeownership and providing Americans with access to affordable and safe mortgage financing,” said Lindsey Johnson, President of USMI. “I want to also offer my profound thanks to Pat Sinks for his commitment to USMI and tireless work as Chairman for the last two years. Pat’s efforts have been vital to USMI and the mortgage insurance industry, and we are grateful that he will continue to serve on our board of directors.”

Richard Thornberry, who is the CEO of Radian Group Inc., will become Vice Chair for USMI.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.