USMI joined nearly 60 other organizations in supporting a full Senate vote on the nomination of Pam Patenaude as HUD Deputy Secretary. Click below to read the full coalition letter. Click here to download the letter as a PDF.

Category: Comment Letters

Press Release: Comments on FHFA’s Single-Family Credit Risk Transfer Request for Input

For Immediate Release

October 11, 2016

Media Contact: Dan Knight

(202) 777-3547

USMI Submits Comments on FHFA’s Single-Family Credit Risk Transfer Request for Input

Mortgage insurers outline industry’s role in shifting greater risk away from taxpayers in an equitable way for all lenders while expanding access to homeownership

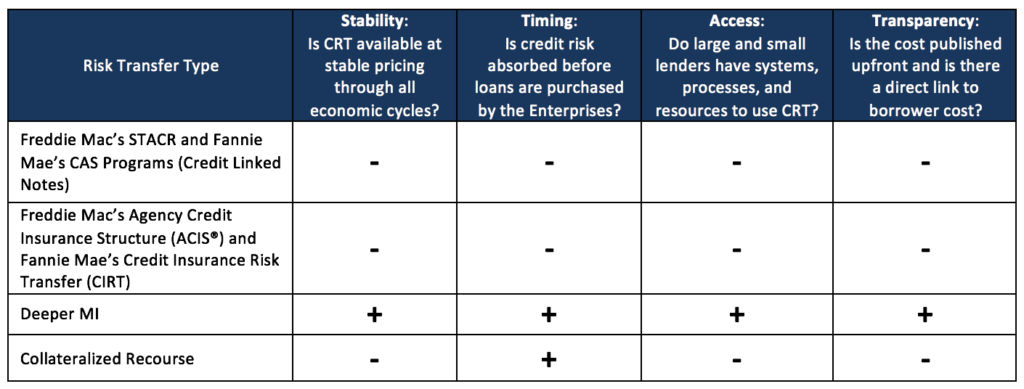

WASHINGTON — U.S. Mortgage Insurers (USMI) submitted comments to the Federal Housing Finance Agency (FHFA) today regarding its Single-Family Credit Risk Transfer (CRT) Request for Input (RFI) and steps to further shield the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, as well as American taxpayers, from losses from mortgage-related risks. In its comments, USMI highlights the distinct advantages of front-end CRT done through expanded use of mortgage insurance (MI) that can address existing shortcomings in the GSEs’ credit risk transfer transactions and that can offer substantial benefits for taxpayers, lenders of all sizes, and borrowers.

USMI notes in its comments that “increasing the proportion of front-end CRT in the Enterprises’ CRT strategy will advance four key objectives of a well-functioning housing finance system by ensuring that: (1) a substantial of private capital loss protection is available in bad times as well as good; (2) such private capital absorbs and deepens protection against first losses before the government and taxpayer; (3) all sizes and types of financial institutions have equitable access to CRT; and (4) CRT costs are transparent, thereby enhancing borrower access to affordable mortgage credit.”

“By design, and as evidenced by the more than $50 billion in claims our industry paid during and since the financial crisis, mortgage insurance provides significant first-loss risk protection for the government and taxpayers against losses on low-down payment loans,” said Lindsey Johnson, President and Executive Director of USMI. “As the government explores ways to further reduce mortgage-related risk while also ensuring that Americans continue to have access to affordable home financing, experience shows that mortgage insurance is the answer, particularly when you consider mortgage insurance protection is at work before the risk even reaches the GSEs’ balance sheets.”

While USMI commends FHFA in its comment letter for establishing principles and risks to evaluate front-end CRT structures, which will enable the GSEs and other market participants to analyze the virtues and shortcomings of each form of CRT using an analytical framework, it urges that “the RFI principles should apply to both existing and proposed CRT activities.”

Among other questions, the RFI inquired about benefits of front-end CRT for small lenders. USMI explains in its letter that “small lenders derive optimal benefits from CRT programs that are familiar, have minimal implementation costs, and are based on lender selection among several market participants. Accordingly, MI works very well for small lenders (and deeper-cover MI similarly would work very well for small lenders) because it is already part of their current credit origination processes, is available with transparent pricing, and is available to lenders of all sizes. On the other hand, small lenders have no access to and derive no direct benefits from back-end forms of CRT.”

“In addition to the specific goal of shifting more risk from Fannie Mae and Freddie Mac, and unlike back-end CRT, mortgage insurance plays a direct role in helping families who have good credit but can’t afford large down payments to qualify for a mortgage. For nearly sixty years, mortgage insurers have been leaders in helping millions of Americans, particularly first-time homebuyers, purchase homes in an affordable way,” Johnson said.

Johnson added, “MI is one of the best forms of time-tested credit risk protection for our nation’s mortgage finance system. Mortgage insurers have taken steps to enhance both their claims paying ability—by increased capital and operational standards—and their claims paying process through updated Master Policy Agreements. MI is private capital directly tied to housing. Unlike some other forms of CRT structures, MI is dedicated to a housing finance system in good and bad economic times. By using more MI to provide deeper front-end risk sharing on loans the GSEs guaranty, the GSEs and taxpayers will be at a much more remote risk of losses. Promoting greater front-end risk sharing with MI is a way to help build a strong, stable housing finance system, provide prudent access to affordable mortgage credit, protect taxpayers, and help facilitate the homeownership aspirations for Americans for years to come. ”

USMI’s full comments to FHFA can be found here. A fact sheet on USMI’s comments can be found here.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Letter: USMI Welcomes Effort to Increase Reliance on Private Capital In Housing Finance

USMI delivered the following letter to members of the Senate Banking Committee last night:

The Honorable Richard Shelby

Chairman

U.S. Senate Committee on Banking, Housing, and Urban Affairs

534 Dirksen Senate Office Building

Washington, DC 20510

Dear Chairman Shelby:

U.S. Mortgage Insurers (“USMI”) welcomes the effort to make progress on increasing the reliance on private capital in housing finance as part of consideration by the Senate Banking Committee of the Financial Regulatory Improvement Act of 2015.

Specifically, USMI supports Section 706, which calls on the Government Sponsored Enterprises (“GSEs”) to engage in front-end risk sharing transactions. This directive would make greater use of private capital to “de-risk” the GSEs, lower the exposure and costs for the enterprises and taxpayers and should lower costs to borrowers. USMI supports this effort, and will continue to work with the Committee during the legislative process on clarifications to ensure the legislation has the intended effect of being “transaction neutral” to permit a variety of methods of up front risk sharing, with all risk sharing counterparties held to equivalent standards.

Promotion of greater up front risk sharing will help build a strong, stable housing finance system that provides access to sustainable and affordable mortgage credit while protecting taxpayers. We look forward to favorable action on this important effort.

Sincerely,

U.S. Mortgage Insurers

cc: The Honorable Sherrod Brown, Ranking Member

All members of the Senate Banking Committee

Press Release: USMI Supports Affordable Housing Principles and Calls for Transparency in FHFA Duty to Serve Plans

USMI Supports Affordable Housing Principles and Calls for Transparency in FHFA Duty to Serve Plans

USMI submitted comments on the Federal Housing Finance Agency’s (FHFA’s) proposal for how the government sponsored housing enterprises Fannie Mae and Freddie Mac should serve underserved markets. USMI supports both principles of facilitating the financing of affordable housing for low-to-moderate income families consistent with the Enterprises’ overall public purposes while maintaining a strong financial condition and reasonable economic return. To that end, among other things USMI calls for full transparency into the economics of the Plans to ensure policy aims are met in the most efficient way available. USMI looks forward to working with MI customers, FHFA, the Enterprises, and other market stakeholders to help the Enterprises meet their “Duty to Serve” obligations. The text of the USMI comment letter can be found here.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Letter: Joint Letter on G-fees

USMI Joins Letter on G-fees

In letters to House and Senate Budget Committee leadership, USMI joined a broad group of more than a dozen housing organizations urging Congress to use GSE G-fees for their intended purpose, to support homeownership stability.

“By preventing g-fees to be used as a funding offset, this budget point of order gives lawmakers a vital tool to prevent homeowners from footing the bill for unrelated spending,” the letters said. “We urge you to once again include it in this year’s Budget Resolution.”

Click here for the full text of the House and Senate letters.

Statement: Moore – Stivers Letter to FHFA Director Watt

For Immediate Release

December 4, 2015

Media Contacts

Robert Schwartz 202-207-3665 (rschwartz@rasky.com)

USMI Statement on Moore – Stivers Letter to FHFA Director Watt

“Yesterday’s bipartisan letter from Representatives Gwen Moore (D-WI) and Steve Stivers (R-OH) to Federal Housing Finance Agency (FHFA) Director Watt is further evidence of the growing bipartisan support for de-risking the Government Sponsored Enterprises (GSEs) with additional risk sharing transactions to reduce taxpayer exposure to losses from another housing downturn. USMI commends Representatives Moore and Stivers for urging FHFA to take additional steps to incorporate front end risk sharing, including with MI.

The letter expresses concern ‘about the lack of balance between ‘front-end’ and ‘back-end’ risk sharing. With FHFA having affirmed the importance of using private capital whenever practicable and equitable in credit-risk sharing transactions, we wanted to urge additional exploration and refinement of credit-risk sharing techniques that are consistent with other federal housing goals.’

Front-end risk share transactions transfer the risk of loans before they ever reach the GSE’s balance sheets. The letter by Reps. Moore and Stivers joins a bipartisan letter in the U.S. Senate by Sens. Mark Warner (D-VA), Bob Corker (R-TN), Heidi Heitkamp (D-ND), Mike Crapo (R-ID), Jon Tester (D-MT) and Dean Heller (R-NV) which also encourages FHFA to expand and better define the development of credit risk transfer programs.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: Luetkemeyer – McHenry Letter to FHFA Director Watt

For Immediate Release

December 2, 2015

Media Contacts

Robert Schwartz 202-207-3665 (rschwartz@rasky.com)

USMI Statement on Luetkemeyer – McHenry Letter to FHFA Director Watt

Statement by Lindsey Johnson, President and Executive Director of USMI

“Today, Representatives Blaine Luetkemeyer and Patrick McHenry sent a letter to Federal Housing Finance Agency Director Watt ‘regarding the transactions that Fannie Mae and Freddie Mac (the Enterprises) enter in order to share mortgage credit risk with private market participants.’ According to the letter, ‘[w]hile we strongly support these transactions as a mechanism for mitigating credit risk to the Enterprises and U.S. taxpayers, we are concerned that the focus for these transactions has been too heavily concentrated on back-end credit risk sharing. Accordingly, in order to expand the scope of risk sharing and to avoid favoring one approach to risk sharing over another, we believe that the Federal Housing Finance Agency (FHFA) should require the Enterprises to also explore and engage in diverse forms of front-end credit risk sharing.’

USMI members applaud Representatives Luetkemeyer and McHenry, Chair of the House Financial Services Committee’s Housing and Insurance Subcommittee and House Financial Services Committee Vice Chairman, respectively, for their leadership and advocacy on this important issue.

In advance of the upcoming release of FHFA’s 2016 Scorecard, taxpayers still face significant exposure to losses from another housing downturn. Front-end risk share transactions transfer the risk of loans before they ever reach the GSE’s balance sheets. As outlined in the letter, the benefits of front end risk sharing are clear. USMI agrees that there should be a greater balance between front and back end credit risk transfers. Of the several ways that the GSEs can conduct front-end risk share transactions, using MI on the front end is one of the easiest, most readily available forms that would be accessible to a vast majority of lenders today.

Momentum is growing to expand front end risk sharing with MI, and USMI members are ready to do more to de-risk the housing finance system while enhancing homeowners’ ability to borrow in an affordable way.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Comment Letter: USMI Joins Coalition on Highway Bill Funding

(November 10, 2015) In a letter to conferees on the pending highway bill, USMI joined a broad coalition of 27 housing organizations in urging conferees to draw funds from the Federal Reserve’s surplus, rather than using GSE G-fees, to pay for the extension of the Highway Trust Fund.

The full text of the letter can be found here

Letter: Opposition Builds Against Using Mortgage G-Fees to Fund Highway Bill

(September 17, 2015) This week, in a joint letter to the bipartisan Congressional leadership, USMI and a diverse coalition of thirty-two housing organizations reiterated their opposition to using the mortgage credit risk guarantee fees (g-fees) charged by the housing finance enterprises, Fannie Mae and Freddie Mac, as a source to finance extension of federal highway programs. The letter states: “increasing g-fees for other purposes… imposes an unjustified burden on the housing finance system.” “Adding an additional fee to mortgages for unrelated expenses would only increase the hurdles these families already face in achieving the American dream of homeownership”, it continues.

The full text of the letter can be found here

Letter: USMI Joins Broad Coalition Opposing Use of G-Fees To Fund Highway Bill

(July 23, 2015) This week, USMI joined a broad coalition of nine other housing groups to send a letter to Senate leadership opposing the use of the credit risk guarantee fees (g-fees) charged by the housing finance enterprises, Fannie Mae and Freddie Mac, as a source of funding for the extension of federal transportation programs. The letter states: “whenever Congress has considered using g-fees to cover the cost of programs unrelated to housing, our members have united to emphatically let Congress know that homeownership cannot, and must not, be used as the nation’s piggybank.”

The full text of the letter can be found here.

Letter: Bipartisan Senators Urge Release of Plan for Transferring Credit Risk to Private Sector

(June 10, 2015) A group of Senate Banking Committee members sent a letter today to FHFA urging them to expand and better define the development of the credit risk transfer programs at the GSEs.

The letter and press release can be found here.

Letter: USMI Welcomes Effort to Increase Reliance on Private Capital In Housing Finance

USMI delivered the following letter to members of the Senate Banking Committee last night:

Chairman

U.S. Senate Committee on Banking, Housing, and Urban Affairs

534 Dirksen Senate Office Building

Washington, DC 20510

Dear Chairman Shelby:

U.S. Mortgage Insurers (“USMI”) welcomes the effort to make progress on increasing the reliance on private capital in housing finance as part of consideration by the Senate Banking Committee of the Financial Regulatory Improvement Act of 2015.

Specifically, USMI supports Section 706, which calls on the Government Sponsored Enterprises (“GSEs”) to engage in front-end risk sharing transactions. This directive would make greater use of private capital to “de-risk” the GSEs, lower the exposure and costs for the enterprises and taxpayers and should lower costs to borrowers. USMI supports this effort, and will continue to work with the Committee during the legislative process on clarifications to ensure the legislation has the intended effect of being “transaction neutral” to permit a variety of methods of up front risk sharing, with all risk sharing counterparties held to equivalent standards.

Promotion of greater up front risk sharing will help build a strong, stable housing finance system that provides access to sustainable and affordable mortgage credit while protecting taxpayers. We look forward to favorable action on this important effort.

Sincerely,

U.S. Mortgage Insurers

cc: The Honorable Sherrod Brown, Ranking Member

All members of the Senate Banking Committee