The Consumer Financial Protection Bureau (CFPB) just released an Advanced Notice of Proposed Rulemaking on the “Qualified Mortgage Definition under the Truth in Lending Act.” The CFPB is considering whether to revise the Qualified Mortgage (QM) definition in light of the pending expiration of the provision commonly referred to as the GSE Patch (or Temporary GSE QM loan category) in January 2021. The same statutory product restrictions exist for loans under the Patch as for other QM loans, however these loans are not subject to the 43 percent debt-to-income (DTI) limit—a significant exception that has supported a substantial portion of the overall housing market. Considering a robust market has developed under the GSE Patch, any changes could substantially impact consumers’ access to mortgage finance as well as determine the level of risk within the mortgage finance system, which has implications for homeowners, financial institutions, and taxpayers.

As takers of first-loss mortgage credit risk with more than six decades of expertise and experience underwriting and actively managing that risk, USMI members understand the need to balance prudent underwriting with the need to ensure there is a clear and transparent standard that maintains access to affordable and sustainable mortgage finance credit for home-ready borrowers. As different stakeholders contemplate what to do next with the Patch, USMI offers a few observations and recommendations for replacing the QM Patch.

Observations

DTI is not the best or most predictive factor in assessing consumers’ ability-to-repay. Pre-financial crisis, one of the most egregious lending practices was making loans to individuals without a reasonable consideration of their financial ability-to-repay (ATR) the loan. As policymakers and regulators aimed to ensure consumers had at least some reasonable ATR their mortgages going forward, the 43 percent DTI cap was established as part of the CFPB’s QM rule. While DTI is not necessarily the most predictive measure, historical data (especially for 2004-2007 cohorts of loans) demonstrates that higher DTIs are correlated to higher defaults (and predictive of a consumer’s ATR).[i] Yet, DTI is only one measure.

USMI and others have identified more predictive borrower characteristics, most notably that reserves in a bank account are more indicative of an individual’s ATR than many other factors. According to a recent report by JPMorgan Chase Institute,[ii] when a borrower has three months of reserves (funds to cover mortgage payments) in the bank, these borrowers were five times less likely to default on their mortgage as those who had insufficient cash in the bank to cover one mortgage payment. According to the JPMorgan Chase Institute report, homeowners who had less than one month’s mortgage payment in savings made up 20 percent of the people in their survey but made up 54 percent of the people in the survey who defaulted on their loans.

While DTI is one factor for assessing ATR, by simply limiting the market to a hard 43 percent limit, many home-ready borrowers will be cut out of the market. In fact, roughly 30 percent of the GSEs’ market today is above the 43 percent DTI limit. CoreLogic estimates that the total loan origination volume for 2018 for loans that were above the 43 percent limit was roughly $260 billion out of a $1.6 trillion market in 2018[iii] (though this number could be higher because some banks have chosen to hold loans in their portfolio that are above the 43 percent DTI limit).

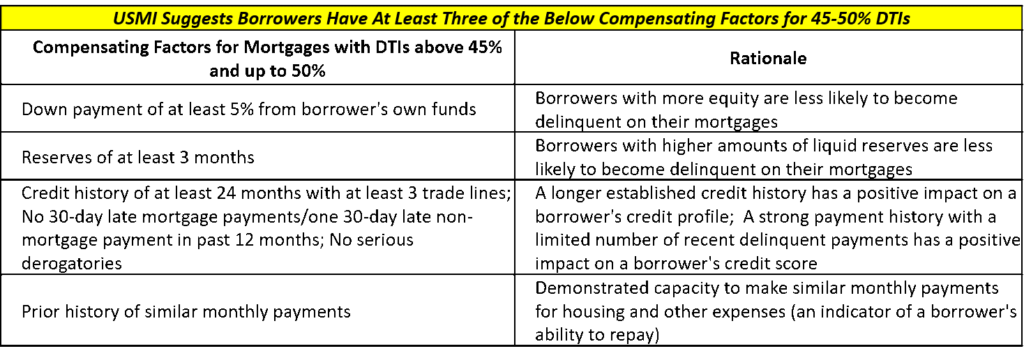

The need for transparency and input on compensating factors. Since the implementation of the QM Rule and the GSE Patch, the market has seen that many good quality loans have been above the 43 percent DTI limit. For loans with higher DTI under the Patch, the market has adapted and relied on compensating factors to adjust for and mitigate the additional risk. These compensating factors are done as part of the GSEs’ automated underwriting systems (AUSs). The current AUSs and the compensating factors used within them are not transparent to stakeholders or the public. However, as mortgage insurers and others analyze GSE loans with higher DTIs, we can begin to back-in to what the compensating factors are and when they come into play for higher DTI GSE loans.

Recommendations

ATR and product restrictions should remain as part of any updates to the QM rule. USMI believes the requirements for assessing a borrower’s ATR that require the lender to underwrite the consumer using credit, income and asset documentation should remain as critical components to any enhancements to the rule. It is also essential that the QM statutory product restrictions remain intact to maintain discipline in the lending community as well as to protect consumers.

A single, transparent underwriting standard for defining QM criteria should be established. USMI recommends a list of transparent mitigating underwriting criteria (compensating factors) for loans with DTIs between 45 and 50 percent for defining QM (in addition to the existing statutorily defined product features and ATR underwriting criteria) be established. While USMI has developed a list of proposed criteria (see below), the list of criteria could ultimately be set by a non-profit membership organization or standard-setting body.

A transparent and easy-to-understand and use set of underwriting criteria can be programmed to allow for manual underwriting or automatic underwriting engines. Further, any private market participant could publish or code these criteria in their investor requirements. For the GSEs, it would remain in the purview of the Federal Housing Finance Agency (FHFA) Director to determine whether the GSEs could guarantee high DTI loans. If not, the loans would simply receive an “Approve/Ineligible” or “Accept/Ineligible” AUS decision. This approach would level the playing field between market participants, allow for continued innovation around documentation, verification, and other underwriting standards, and force the GSEs’ AUSs to become more transparent.

Proposed Set of Compensating Factors

Importantly, USMI believes that there should be one industry standard with complete transparency into the credit decisioning factors used for underwriting mortgage credit risk and that input from industry should be allowed on updates to the underwriting criteria. Further, any changes related to maximum DTIs should be consistent across different lending channels (e.g., FHA and GSEs) to ensure there is not market arbitrage to achieve QM status.

Appendix Q needs to be addressed. All proposals to assess and define an ATR will have challenges or shortcomings. For any proposal that includes DTI, there is still the challenge of addressing the acknowledged limitations of Appendix Q, including to allow lenders to document and verify borrower income and assets utilizing new innovations in the industry. A possible permanent fix to address Appendix Q could be to allow for the GSEs’ guides to be maintained by a regulatory body outside of the GSEs and updated as necessary. Legislation is needed if Appendix Q is to allow for the use of guides or handbooks of the GSEs or other agencies.

APOR could remain the determinant for the Safe Harbor protection but should not be the replacement for DTI requirement and Underwriting Criteria. Further, to provide a more level playing field between the Federal Housing Administration (FHA) and the conventional market, the annual percentage rate (APR) cap of Average Prime Offer Rate (APOR) + 150 bps needs to be increased to account for GSE LLPAs and private mortgage insurance. Setting the cap for QM Safe Harbor protection at 200 bps over APOR + 200 bps will limit the shift of riskier, high-LTV business to FHA, preserve greater private capital participation in the pricing of risk, and promote better taxpayer protection.

[i] https://www.fhfa.gov/PolicyProgramsResearch/Research/Pages/wp1902.aspx

[ii] JPMorgan Chase Institute: Trading Equity for Liquidity: Bank Data on the Relationship Between Liquidity and Mortgage Default. June 2019.

[iii] https://www.corelogic.com/blog/2019/07/expiration-of-the-cfpbs-qualified-mortgage-gse-patch-part-1.aspx