On June 30, 2020, the Federal Housing Finance Agency (FHFA) published a Notice of Proposed Rulemaking (NPR) on the Enterprise Regulatory Capital Framework (ERCF). On August 31, USMI submitted comments to the NPR, emphasizing the importance of constructing a balanced, transparent, and analytically justified framework. USMI’s full comments can be found here and an executive summary can be found here. In 2018, FHFA issued a prior proposal for changing the risk-based capital framework for the GSEs. USMI also submitted a comment letter, which can be found here.

Category: News

Blog: CFPB Should Increase Safe Harbor Threshold to Mitigate Borrower Impact

One of the main drivers of the 2008 financial crisis was lending to borrowers with inadequate ability to repay their mortgage loans. In response, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act, which created the Consumer Financial Protection Bureau (CFPB) and established an ability-to-repay/qualified mortgage (ATR/QM) standard. Dodd-Frank went beyond previous federal regulations and consumer protections, including the Home Ownership and Equity Protection Act (HOEPA) that had previously defined a class of higher priced mortgage loans (HPMLs).

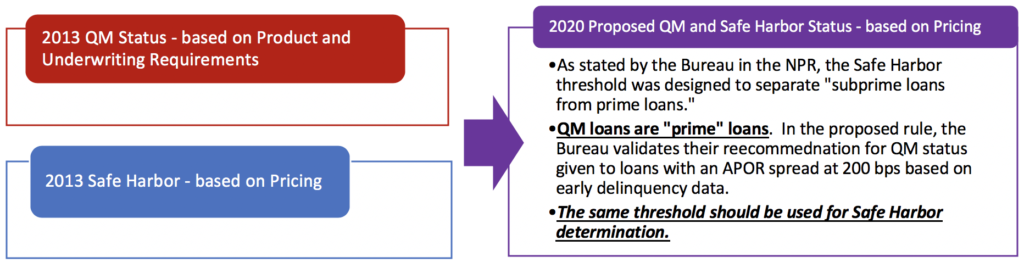

Going beyond HPML to address some of the underwriting concerns in the marketplace, Dodd-Frank created specific mortgage product restrictions and required the CFPB to promulgate a rule defining Qualified Mortgage based on specific underwriting criteria. As promulgated in the 2013 final rule, QM and safe harbor were measuring two separate things so different standards made a certain amount of sense. The QM standard was based on product and underwriting requirements, while safe harbor was based on loan pricing specifically assessing whether the loan was a HPML.

The CFPB is now seeking to update the regulation. In late June, the Bureau issued Notices of Proposed Rulemaking (NPRM) on the general QM definition under the Truth in Lending Act (Regulation Z) and the GSE Patch. The CFPB proposes to change the current QM standard in favor of a pricing threshold based on the difference between the loan’s annual percentage rate (APR) and the average prime offer rate (APOR) for a comparable transaction. The proposed rule would define a QM as a mortgage loan which is priced not more than 200 basis points (bps) above the APOR.

Unlike the 2013 final rule, the QM standard and safe harbor are measured using the same price metric under the new proposed rule. Having two different pricing thresholds to determine QM and safe harbor loan status creates an unlevel playing field that will arbitrarily shift borrowers to mortgages backed by the Federal Housing Administration (FHA) and leave consumers with less access to mortgage finance credit—all based on an arbitrary line.[1]

While USMI will comment on other aspects of the proposed rule, we think that one of the most significant issues within the proposal is the safe harbor pricing threshold. Based on our analysis of mortgage originations, loan performance, market dynamics, and the need to ensure consumer access to affordable mortgage finance, we recommend that this threshold should be pegged to the same threshold as the QM status, which the NPR suggests should be 200 bps. USMI made this recommendation to the CFPB in a September 2019 comment letter in response the CFPB’s Advance NPRM.

In the 2020 proposed rule, the Bureau justifies recommending QM status be based on a pricing threshold to 200 bps using early delinquency data as an indicator of determining a borrower’s ATR, stating in the NPRM:

“…the Bureau tentatively concludes that this threshold would strike an appropriate balance between ensuring that loans receiving QM status may be presumed to comply with the ATR provisions and ensuring that access to responsible, affordable mortgage credit remains available to consumers.”[2]

Should the CFPB move forward to replace the current QM definition with one based on a pricing threshold, then the Bureau can and should increase the spread that is used to delineate safe harbor loans from 150 to 200 bps over APOR to be consistent with the threshold that the Bureau recommends for QM status in its NPRM.

Why moving the safe harbor threshold to 200 bps matters:

- Lenders don’t lend above the safe harbor line in the conventional market.The distinction between safe harbor and rebuttable presumption matters. Market data makes it clear that many lenders avoid making rebuttable presumption QM loans to avoid any risk of legal liability. This is evidenced by the fact that less than five percent of all the conventional market financing in 2019 was done above the safe harbor line. For all intents and purposes, the safe harbor line effectively defines the conventional market and changes to how the Bureau defines QM safe harbor will impact who the conventional market will serve going forward.

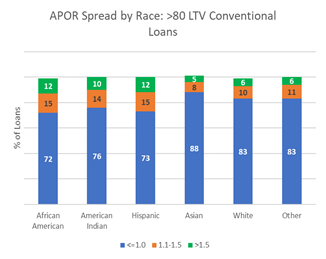

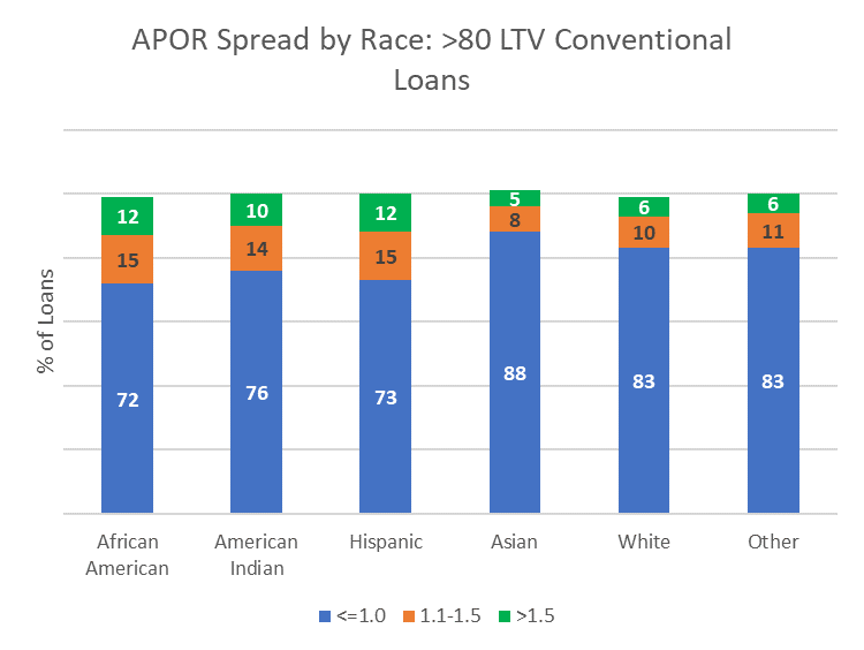

- Current recommended threshold disproportionately impacts Black and Latinx borrowers who are twice as likely as White borrowers to have conventional low down payment purchase loans outside a safe harbor of 150 bps. Under the proposed rule, many of the borrowers who are above the 150 bps threshold will be left only with the option of a FHA loan, which means they have vastly different competitive choices in terms of product offerings and loan terms—as demonstrated by the fact that there were approximately 3,200 HMDA reporting lenders for conventional purchase loans versus only about 1,200 for FHA purchase loans. This arbitrary line affects these borrowers’ credit options and leaves them with significantly fewer competitive options in the marketplace.[3]

- Creates an unlevel playing field. While the percentage of the conventional market above 150 bps is small on a percentage basis, this is not to suggest that there are not good quality loans above this threshold being done. FHA is five times more likely to have loans above the 150 bps simply because FHA calculates the APOR cap and APR calculation differently. HUD defines safe harbor as 115 bps plus the mortgage insurance premium, which is closer to FHA having a safe harbor threshold of approximately 200 bps, or even higher. Due to the discrepancies for how this threshold is calculated between the conventional and FHA markets, leaving the safe harbor threshold for conventional loans at 150 bps will arbitrarily distort the market and shift borrowers to FHA. This will give these borrowers fewer choices and shift borrowers from a market backed by private capital to the 100 percent taxpayer-backed market.

The Solution:

The solution is to increase the safe harbor pricing threshold to 200 bps to be consistent with the proposed QM pricing threshold. This will result not only in a more level playing field, but most importantly, by changing the threshold, the impact to borrowers can be mitigated. The volume of loans that would otherwise be left out of the conventional safe harbor market is reduced by almost 60 percent for the high-LTV market and reduced by over 50 percent for the entire conventional market.[4]

Increasing the safe harbor threshold to 200 bps above APOR will best ensure that we strike an appropriate balance between prudent underwriting, credit risk management, and consumers’ access to sustainable and affordable mortgage credit.

[1] 85 Fed. Reg. 41716 (July 10, 2020).

[2] 85 Fed. Reg. 41735 (July 10, 2020). Underlying and emphasis added.

[3] 2019 HMDA Data.

[4] 2019 HMDA Data.

Newsletter: August 2020

While this summer has posed new and unexpected challenges, policymakers and U.S. Mortgage Insurers (USMI) and our members continue to work hard to make sure the U.S. housing system remains strong as we face unprecedented economic and health challenges resulting from COVID-19. Below are topics we have been following:

USMI Member Company COVID-19 Response

CFPB Kraninger’s Semi-Annual Hearings

USMI Submits Comment Letter to CFPB on GSE Patch Extension

SCOTUS to Hear Arguments on FHFA’s structure

Dana Wade Confirmed as FHA Commissioner

USMI President in Mortgage Professional America

- USMI Member Company COVID-19 Response. USMI updated its COVID-19 resource webpage with its members’ response fact sheet, highlighting many of the important actions that USMI members have taken to support homeowners, servicers, and lenders across the country during the pandemic. Because of the critical role USMI members play in the housing finance system, the mortgage insurance (MI) industry is committed to supporting the federal government’s robust mortgage relief initiatives, including the nationwide forbearance programs implemented by Fannie Mae and Freddie Mac (GSEs). The fact sheet outlines areas of common ground between USMI members and how they have focused their efforts on helping borrowers remain in their homes by supporting their lender customers during these challenging times.

- CFPB Kraninger’s Semi-Annual Hearings. On July 29 and 30, Consumer Financial Protection Bureau (CFPB) Director Kathleen Kraninger testified before the Senate Banking Committee and House Financial Services Committee, respectively. Both hearings focused on the Bureau’s response to the COVID-19 pandemic and on its ongoing rulemakings and supervision activities. In her written testimony submitted to the Senate Banking Committee, Director Kraninger provided an update on the CFPB’s proposed changes to the GSE provision (GSE Patch) of the Bureau’s Ability-to-Repay (ATR)/Qualified Mortgage (QM) Rule, which is set to expire in January 2021. The CFPB is still considering removing the QM loan definition’s 43 percent debt-to-income (DTI) ratio and replacing it with a pricing threshold.

During the Senate Banking hearing, Senator Tim Scott (R-SC) asked Director Kraninger why the QM standard and safe harbor thresholds would be different and stated, “I think we should do all that we can for credit worthy borrowers to become homeowners when it makes sense. By harmonizing the QM and the safe harbor, it might make it easier for financial institutions to not go to the default position of the safe harbor that’s 50 (basis) points lower.” In addition, during the House Financial Services Committee hearing, members from both parties expressed interest in the CFPB’s rulemaking on the General QM definition and its effect on prudent underwriting and consumers’ access to credit. Representatives Bill Foster (D-IL) and French Hill (R-AR) emphasized that any new QM standard should retain robust underwriting standards to ensure ATR and promote sustainable homeownership. Further, Representatives Hill and Steve Stivers (R-OH) noted that there should be a single pricing standard for QM and Safe Harbor since, unlike the 2013 ATR/QM Rule, pricing would be used to measure both under the proposed rule.

- USMI Submits Comment Letter to CFPB on GSE Patch Extension. On August 10, USMI submitted a comment letter to the CFPB in response to the Notice of Proposed Rulemaking (NPR) regarding the extension of the sunset date for the Temporary GSE QM definition, or the “GSE Patch,” under the Qualified Mortgage Definition under the Truth in Lending Act (Regulation Z), which is currently set to expire on January 10, 2021. USMI recommended to Director Kraninger that the CFPB should “set the sunset date for the GSE Patch to be at least six months after the effective date of the finalized General QM definition rule.” Doing so would allow all industry stakeholders sufficient time to fully understand and implement the new rule and afford industry participants an appropriate amount of time to develop, test, and implement new models to facilitate a smooth transition to the new general QM framework. Moreover, as the financial services industry grapples with implications of COVID-19 and works to support market participants, consumers, and the economy, USMI believes a six-month overlap period would promote an orderly implementation of the new General QM definition while offering continued assistance to homeowners across the county.

In June 2020, the CFPB issued a NPR on the General QM definition under the Truth in Lending Act (Regulation Z) and the GSE Patch. The Bureau’s NPR proposes to change the current QM standard in favor of a pricing threshold; specifically, the difference between the loan’s Annual Percentage Rate (APR) and the Average Prime Offer Rate (APOR) for a comparable transaction at 200 basis points (bps) above APOR. The Bureau justifies this threshold using early delinquency data as an indicator of determining consumers’ ATR.

In a September 2019 comment letter to the CFPB, USMI emphasized that, should the Bureau move forward to replace the QM definition with one based on a pricing threshold, it can and should increase the spread that is used to delineate Safe Harbor loans. The previous 2013 ATR/QM Rule created two legal presumptions for QM loans: “Safe Harbor” and “Rebuttal Presumption.” These presumptions have, in turn, created a norm by which lenders will not typically lend above the Safe Harbor line and avoid making Rebuttable Presumption loans as to avoid risk to legal responsibility. This standard has disproportionality impacted Black and Hispanic homebuyers, who were twice as likely as White borrowers to have low down payment conventional purchase loans outside of the Safe Harbor. Under the proposed rule, many of the borrowers who are above the 150 bps threshold will be left only with the option of a Federal Housing Administration (FHA) loan, which means they have vastly different competitive choices in terms of product offerings and loan terms. Further, due to the discrepancies for how this threshold is calculated between the conventional and FHA markets, leaving the Safe Harbor threshold at 150 bps will arbitrarily distort the market and shift borrowers to FHA.

Based on this, USMI and other industry members recommend that the Bureau increase the Safe Harbor threshold to 200 bps above APOR to be consistent with the proposed QM APOR threshold that the Bureau recommended in its June 2020 NPR.

- SCOTUS to Hear Arguments on FHFA’s structure. On July 9, the Supreme Court announced that it would hear Collins v. Mnuchin upon its return in October. The suit questions the constitutionality of the FHFA’s single-director structure. Currently, the FHFA director is appointed to serve a five-year term and can only be removed “for-cause;” he or she cannot be fired at-will by the president. This follows the Court striking down the CFPB’s single-director structure in a 5-4 ruling in Seila Law v. CFPB in June, declaring it unconstitutional and severable from the other provisions of the Dodd-Frank Act.

In a statement, the FHFA said it did not believe the Court’s ruling applied to the FHFA. “The Seila Law decision does not directly affect the constitutionality of FHFA, including the for-cause removal provision.” It continued, “FHFA looks forward to the U.S. Supreme Court taking up the Collins case and clarifying these important issues.”

- Dana Wade Confirmed as FHA Commissioner. On July 28, the Senate confirmed Dana Wade in a 57-40 bipartisan vote as commissioner of the FHA. USMI issued a statement praising Wade’s confirmation. USMI President Lindsey Johnson said, “Commissioner Wade has shown commitment to keeping FHA’s core mission of providing affordable housing opportunities to moderate and low-income households, who need the agency’s 100 percent taxpayer-backed loans the most. We are confident that Commissioner Wade will continue to carry out this mission as she understands the important role the agency plays in our housing financial system.” Mortgage Professional America included USMI’s statement in its coverage of Wade’s confirmation.

- USMI President in Mortgage Professional America. Mortgage Professional America published USMI President Lindsey Johnson’s op-ed titled, “Low Down Payments Backed by Mortgage Insurance More Important Than Ever.” Using data from USMI’s 2020 “MI in Your State” report, Johnson explains why low down payment lending will be even more critical for future homeowners as the country endures and recovers from the current COVID-19 pandemic. The report found that it could take the average American homebuyer over 20 years to save for a 20 percent down payment. With private MI, the wait time could drop to just 7 years with a 5 percent down payment. Low down payments with private MI enable more well-qualified borrowers to become homeowners while keeping more cash on hand, a critical aspect during these trying times. Private MI also assumes the first layer of protection against mortgage credit risk protecting the federal government, and thus, American taxpayers. She concludes stating, “right now, more than ever, we are even more aware of the benefits of owning a home—from building wealth to creating stability to the importance of having a safe place to call your own.”

Op-Ed: Low Down Payments Backed by Mortgage Insurance More Important Than Ever

By: Lindsey Johnson

Today, the place you call home matters more than ever. Unfortunately, many Americans continue to believe homeownership is out of reach because they think a 20 percent down payment is needed to qualify for a mortgage.

A recent report by the private mortgage insurance (MI) industry finds that it could take a family earning the national median income over 20 years to save for a 20 percent down payment. But the wait decreases by 67 percent when a five percent down payment is the goal. Fortunately, millions of homebuyers each year qualify for home financing with low down payments.

Given the current economic environment due to COVID-19 and the desire of many people to keep more cash on-hand, low down payment loans are more important than ever. Low down payment mortgages with private mortgage insurance have proven to be a time-tested means for Americans to access affordable homeownership sooner while still providing credit risk protection and stability to the U.S. housing system. It is no wonder why more than 33 million homeowners have used this type of home financing and why its use is on the rise.

The report finds that in 2019, the number of low down payment loans backed by private MI increased 22.9 percent. Over 1.3 million home loans were purchased or refinanced with private MI, up from just over 1 million in 2018. Nearly 60 percent of the borrowers of these loans were first-time homebuyers and 40 percent had annual incomes of less than $75,000.

Why have millions turned to this type home financing?

Let us first take a closer look at a borrower who earns the national median income of $63,179. To save 20 percent, plus closing costs, for a $274,600 home, the median sales price for a single-family home last year, they would need to bring more than $63,000 in cash to the table. It could take up to 21 years to save up this amount based on the national savings rate dedicated towards a mortgage. But if this borrower qualifies using private MI on a five percent down payment mortgage, their wait time drops to just seven years. This type of home financing offers Americans a chance to secure home financing much sooner than previously believed.

Why is 20% the “magic number”?

Data demonstrates that borrowers who make larger down payments are less likely to default on their mortgages than borrowers with lower down payments. Therefore, lenders traditionally require a 20 percent down payment to offer mortgage financing to a borrower. This is where mortgage insurance steps in, providing credit enhancement for the borrower with a lower down payment, and insuring the loan for the lender in the event the borrower stops making their payments. Once the borrower builds 20 percent equity in their mortgage, the insurance can be cancelled, thus lowering the monthly payment. Private MI also helps Americans buy a home without necessarily breaking the bank.

Private mortgage insurance is offered on so-called conventional loans that are backed by the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. When there is private MI on a loan, the risk protection provided to lenders for making a low down payment mortgage possible is extended to the GSEs too. In the event of a default, the private mortgage insurance stands to cover losses first, meaning private MI also protects taxpayers.

Supporting the American Dream

As the report demonstrates, private mortgage insurers’ role in the low down payment market significantly increased over the last five years. Between 2015 and 2019, private mortgage insurers’ market share in the low down payment lending sector increased from 34.8 percent of the insured market in 2015 to 44.7 percent in 2019, helping millions of Americans qualify for home financing.

Private MI offers a reliable path to the American dream of owning a home. Since 1957, private MI has helped more than 33 million Americans become homeowners while protecting taxpayers. And right now, more than ever, we are even more aware of the benefits of owning a home—from building wealth to creating stability to the importance of having a safe place to call your own.

Lindsey Johnson is the president of the U.S. Mortgage Insurers (USMI), the association representing the nation’s leading private mortgage insurance companies.

###

Mortgage Professional America originally published USMI President Lindsey Johnson’s opinion piece, “Low down payments backed by mortgage insurance more important than ever” on August 10, 2020.

Statement: Bipartisan Senate Confirmation of Dana Wade as FHA Commissioner

WASHINGTON — Lindsey Johnson, President of the U.S. Mortgage Insurers (USMI), today issued the following statement on the U.S. Senate’s bipartisan confirmation of Dana Wade to serve as Federal Housing Administration (FHA) Commissioner:

“USMI applauds the Senate for its bipartisan vote to confirm Dana Wade to serve as FHA Commissioner. Commissioner Wade is a respected expert with broad experience in financial and housing policy issues, which provide her of the adequate tools to tackle the challenges facing the FHA and housing finance system going forward.

“Commissioner Wade has shown commitment to keeping FHA’s core mission of providing affordable housing opportunities to moderate and low-income households, who need the agency’s 100 percent taxpayer-backed loans the most. We are confident that Commissioner Wade will continue to carry out this mission as she understands the important role the agency plays in our housing financial system.

“The FHA has improved its financial health over the last few years, however it is important that policymakers keep their focus on ensuring that the FHA is not overexposing taxpayers to undue risk. The FHA-insured market and the conventional market should complement one another. For more than 60 years private mortgage insurance has played a leading role in promoting affordable and sustainable homeownership. We look forward to working closely with Commissioner Wade in seeking ways to establish a more complimentary, collaborative, and consistent housing policy that can expand private capital’s role in shouldering more risk in front of taxpayers in the housing market.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Podcast: President Lindsey Johnson on Millennial to Millionaire

USMI President Lindsey Johnson appeared on the Millennial to Millionaire podcast with Paris Grant and discussed how private mortgage insurance helps young people become homeowners sooner.

Newsletter: July 2020

We wish everyone a happy, healthy July 4th holiday and thank those who continue to serve the nation on the front lines of the COVID-19 health crisis. USMI and our members remain committed to supporting the U.S. housing finance system, ensuring homeowners continue to have access to prudent, affordable, low down payment mortgages to keep more cash on hand, especially during these critical and uncertain economic times. Additional information can be found on USMI’s COVID-19 Resource page. Below are updates related to COVID-19 as well as other recent significant policy and regulatory developments.

USMI Releases its Annual State-by-State Report

New Board Chairman at USMI

FHFA and the GSEs Provide Clarity on PMIERs Amid COVID-19

SCOTUS Rules on CFPB’s Single-Director Structure

CFPB Proposes Rules on QM Definition and Extension of the GSE Patch

FHFA Issues Re-Proposed Enterprise Capital Rule

ICYMI: New Video Explains How Private MI Work

- USMI Releases its Annual State-By-State Report. On June 22, USMI released its annual report on low down payment lending at the state level. The report highlights that the number of low down payment loans backed by private mortgage insurance (MI) increased 22.9 percent in 2019; meanwhile saving for a 20 percent down payment could take potential homebuyers 21 years to save — three times the length of time it could take to save a 5 percent down payment. USMI also found that the top five states for low down payment home financing with private MI were Texas, California, Florida, Illinois, and Ohio.

Upon release of the report, USMI President Lindsey Johnson noted that “Given the current economic environment and the desire of many people to keep more cash on-hand, low down payment loans are more important than ever. Loans backed by private MI are a great option as a time-tested means for accessing homeownership sooner while still providing credit risk protection and stability to the U.S. housing system.” See coverage of the report by National Mortgage News, Forbes, and Bankrate.

- New USMI Board Chairman. On July 1, USMI announced that Derek Brummer, President of Mortgage at Radian Group, will serve as the Chairman of USMI’s Board of Directors. Brummer, who was appointed Radian’s President of Mortgage in February, previously served as USMI’s Vice Chairman of the Board and brings extensive experience in housing finance. In the announcement, Brummer stated that he looks “forward to ensuring the industry remains well-positioned to serve as an important source of strength for the housing finance system during all market cycles, so consumers continue to have access to affordable, low down payment, conventional mortgages.”

- FHFA and the GSEs Provide Clarity on PMIERs Amid COVID-19. On June 26,the Federal Housing Finance Agency (FHFA) and the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, provided guidance on the Private Mortgage Insurer Eligibility Requirements (PMIERs), PMIERs 2020-01, effective June 30, 2020. PMIERs are a set of operational and risk-based capital requirements implemented in 2015 and updated in 2018 for private MI companies to be approved to insure loans acquired by Fannie Mae and Freddie Mac. Due to the unprecedented nature of the COVID-19 disaster, including its national scope and the ongoing duration of the health and economic effects, the PMIERs language needed additional clarity, which USMI is pleased FHFA, Fannie Mae and Freddie Mac understood and provided.

USMI President Lindsey Johnson said in a statement, “USMI supports the actions taken by federal policymakers, particularly the FHFA, to stabilize the economy and provide assistance to those who have been impacted by the COVID-19 pandemic. USMI’s member companies are well-positioned to support the FHFA and GSEs’ efforts to ensure that homeowners who have been affected by COVID-19 are able to stay in their homes and maintain a safe and secure environment for their families.”

- SCOTUS Rules on CFPB’s Single-Director Structure. On June 29, the Supreme Court ruled in a 5-4 decision in Seila Law v. CFPB that the single-director structure of the Consumer Financial Protection Bureau (CFPB), where the leadership by a single director that is removable only “for cause” (inefficiency, neglect, or malfeasance), violates the Constitution. However, the Court did not invalidate the agency in its entirety. The majority held that the removal protection of the CFPB Director is severable from the other provisions of the Dodd-Frank Act that created the CFPB and defined its authorities and responsibilities. The CFPB did not challenge the decision and the White House released a statement saying the Supreme Court’s “decision represents an important victory for the fundamental principle that government officials should be accountable to the American people.” Given the FHFA has a similar structure, it is likely the legal conclusion may be applied to the FHFA. The Court’s decision opens the door for any future new administration to usher in new leadership of these two independent agencies.

- CFPB Proposes Rules on QM Definition and Temporary Extension of the GSE Patch. With the temporary QM category, also known as the “GSE Patch,” set to expire on January 10, 2021, the CFPB released Notices of Proposed Rulemakings (NPRMs) on a new QM definition and to temporarily extend the GSE Patch on June 22, 2020. Comments for the general QM definition are due 60 days after the rule is published in the Federal Register. In a statement after the release of the NPRMs, USMI President Lindsey Johnson stated, “USMI members, as takers of first-loss mortgage credit, emphasized the need to balance prudent underwriting with a clear standard that maintains access to mortgage finance for home-ready borrowers.”

The CFPB previously released an Advanced NPRM on the QM definition over a year ago, after which USMI submitted a comment letter that among other things, recommended replacing the current GSE Patch by establishing a single transparent and consistent QM definition that balances access to mortgage finance credit and proper underwriting guardrails to ensure consumers’ ability to repay (ATR). USMI specifically recommended that the Bureau establish a list of transparent mitigating underwriting criteria (compensating factors) for loans with a debt-to-income ratios above 45 percent and up to 50 percent. USMI also recommended that, to provide a more level playing field between the Federal Housing Administration (FHA) and the conventional market, the QM Safe Harbor annual percentage rate (APR) cap of the Average Prime Offer Rate (APOR) + 150bps needs to be increased to not arbitrarily shift the market to FHA, or leave some home-ready borrowers without access to mortgage finance credit. Setting the cap at APOR + 200bps would limit this arbitrary shift in the market, preserve greater private capital participation in the pricing of risk, and promote better taxpayer protection.

The Bureau’s June 2020 NPRM on the QM definition largely proposes an approach that would rely on a pricing spread between APR and APOR to determine QM status. While it is notable that the Bureau retained a QM Safe Harbor and QM Rebuttable Presumption, it is critical that the Safe Harbor threshold be increased from 150bps to 200bps above APOR, as it has been demonstrated that few loans are done outside of Safe Harbor. As USMI commented in its 2019 comment letter, it is essential that the Safe Harbor threshold be moved from 150bps to 200bps to ensure that creditworthy borrowers are not arbitrarily left only with the option of an FHA mortgage or left out of the market entirely, and to promote greater private capital participation in the pricing of risk and better taxpayer protection.

- FHFA Issues Re-Proposed Rule on Enterprise Capital. Another very significant rule recently released is the re-proposed Enterprise Regulatory Capital Framework (ERCF), which was published in the Federal Register this week, starting the 60-day clock for comments to be submitted. FHFA noted that one of the key reasons for the re-proposed rule is that establishing robust capital standards is a key step in the process to end the GSEs conservatorships, which was “a departure from the expectations of interested parties at the time of the 2018 proposal.” FHFA also noted that the re-proposed rule increases the quantity and quality of the regulatory capital at the GSEs to ensure their safety and soundness—with the overall capital required under the 2020 proposal being roughly $240 billion in loss absorbing capital—nearly $100 billion more than the 2018 proposal. FHFA officials believe that the re-proposed rule puts the GSEs on track to begin raising capital as soon as next year.

USMI submitted a comment letter to the FHFA in 2018 when the ERCF was originally proposed. On May 21, USMI issued a statement in response to the re-proposed rule, sharing its support for “meaningful capital requirements” and recognizing the ERCF’s importance in determining the future role of the GSEs, how private capital, such as private MI, will be able to continue to support the conventional market to protect taxpayers, and importantly, determine consumers’ access to and cost of mortgage finance credit.

- ICYMI: New Video Explains How Private MI Works. As part of June’s National Homeownership month, USMI released a new video helping first-time homebuyers understand whether they are mortgage ready. The video explores low down payment financing options to future homeowners and explains the benefits of private mortgage insurance.

Press Release: USMI Names Radian’s President Of Mortgage Derek Brummer as Chairman

WASHINGTON — U.S. Mortgage Insurers (USMI) today announced that Derek Brummer will serve as the association’s new Chairman of the Board. Brummer is the President of Mortgage at Radian Group Inc. (NYSE: RDN). He succeeds Bradley Shuster, Executive Chairman of NMI Holdings, Inc. (Nasdaq: NMIH). Brummer’s appointment comes at a significant time as the Administration continues to take steps to reshape the government sponsored enterprises (GSEs), and the housing finance system responds to the current economic environment and the needs of homeownership during the novel coronavirus (COVID-19).

“For more than 60 years, the MI industry has helped American families become homeowners and has stood in front of mortgage credit risk that the government and taxpayers may otherwise have to bear. As sophisticated managers of mortgage credit risk and sources of dedicated private capital, MI companies serve a critical role in the U.S. housing finance system. As USMI’s Chairman, I look forward to ensuring the industry remains well-positioned to serve as an important source of strength for the housing finance system during all market cycles, so consumers continue to have access to affordable, low down payment, conventional mortgages,” said Brummer. “Over the last several years, more than 80 percent of first-time homebuyers have used low down payment mortgages. Today, these loans backed by private MI are more important than ever to enable borrowers to keep more cash on-hand, enabling those borrowers to purchase homes sooner than they otherwise could and begin to build the long-term wealth and stability that can come with homeownership.”

Brummer previously served as USMI’s Board Vice Chair. He was named Radian Group Inc.’s President of Mortgage in February and brings extensive experience in the housing industry to USMI’s chairmanship. Brummer joined Radian in 2002, serving as Chief Risk Officer since 2013 and as head of Mortgage Insurance and Risk Services since 2018. Prior to that, he was Chief Risk Officer and General Counsel for Radian’s financial guaranty company. Before joining Radian, Brummer was a corporate associate at Allen & Overy LLP as well as Cravath, Swaine & Moore LLP in New York.

“Derek’s experience and leadership in the mortgage insurance industry are invaluable assets to our industry association. We are excited to welcome and work with him as USMI’s new Chairman,” said Lindsey Johnson, President of USMI. “I want to also offer my deep gratitude to Bradley Shuster for his dedication and commitment to USMI as Chairman for the past two years. We greatly appreciate Brad’s efforts, which have been critical to the industry, and we value his continued role on our board of directors.”

Mark Casale, who is the President and CEO of Essent Guaranty, will take over as Vice Chairman of the Board of USMI, and Rohit Gupta, President and CEO of Genworth MI, will serve as USMI’s Treasurer and Secretary of the Board.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: Updates to Private Mortgage Insurer Eligibility Requirements (PMIers)

WASHINGTON—U.S. Mortgage Insurers (USMI) President Lindsey Johnson today issued the following statement on guidance provided by the Federal Housing Finance Agency (FHFA) and the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, to the Private Mortgage Insurer Eligibility Requirements (PMIERs), PMIERs 2020-01, effective June 30, 2020. PMIERs are a set of operational and risk-based capital requirements implemented in 2015 and updated in 2018 for private mortgage insurance (MI) companies to be approved to insure loans acquired by Fannie Mae and Freddie Mac.

“USMI supports the actions taken by federal policymakers, particularly the FHFA, to stabilize the economy and provide assistance to those who have been impacted by the COVID-19 pandemic,” said USMI President Lindsey Johnson. “USMI’s member companies are well-positioned to support the FHFA and GSEs’ efforts to ensure that homeowners who have been affected by COVID-19 are able to stay in their homes and maintain a safe and secure environment for their families.”

Today, USMI member companies are well capitalized, collectively holding more than $4.6 billion in excess of the minimum required assets as of March 31, 2020. The private MI industry provides dedicated entity-based capital support to the U.S. housing market and is uniquely positioned to continue serving as strong credit risk protection for the GSEs and taxpayers, and as a source of low down payment lending during COVID-19 and through the recovery.

The new PMIERs 2020-01 guidance provides, among other changes, additional clarity and special consideration for the risk-based treatment of loans affected by COVID-19. Under the 2018 update, a capital factor was introduced to differentiate mortgages subject to a GSE forbearance plan done in response to a Major Disaster Declaration from the Federal Emergency Management Agency (FEMA) due to natural disasters. This type of forbearance is often used for natural disasters such as hurricanes or other shorter-term disasters that occur in a specific geographic area, and generally have a definite period for the event. However, due to the unprecedented nature of the COVID-19 disaster, including its national scope and the ongoing duration of the health and economic effects, the PMIERs language needed additional clarity, which we are pleased FHFA, Fannie Mae, and Freddie Mac understood and provided.

“Through the combination of the industry’s entity-based equity capital, use of credit risk transfer, and strong underwriting and risk management, the private MI industry is well positioned to continue to serve as a source of strength in the housing finance system during this pandemic and the ensuing recovery,” continued Johnson.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: CFPB’s Proposed Rules on The General QM Loan Definition and Extension of the GSE Patch

WASHINGTON — U.S. Mortgage Insurers (USMI) President Lindsey Johnson issued the following statement on the Consumer Financial Protection Bureau’s (CFPB) Notices of Proposed Rulemaking (NPRM) on the general qualified mortgage (QM) definition under the Truth in Lending Act (Regulation Z) and the extension of the government sponsored enterprises (GSEs) Patch:

“USMI appreciates the CFPB assessing what has happened in the marketplace since the general QM loan definition and temporary QM category (“GSE Patch”) were first implemented in 2014. Since then, market participants have originated mortgage loans with far greater diligence to ensure consumers have a reasonable ability-to-repay (ATR) and with more robust underwriting standards that have resulted in a much stronger housing finance system. The GSE Patch has also played a critical role in maintaining credit availability in the conventional market. As takers of first-loss mortgage credit risk with more than six decades of expertise and experience underwriting and actively managing that risk, USMI members understand the need to balance prudent underwriting with a clear and transparent standard that maintains access to affordable and sustainable mortgage finance credit for home-ready borrowers. USMI looks forward to reviewing and submitting comments on both rules.”

In September 2019, USMI submitted comments on the CFPB’s advance NPRM on the QM definition, offering specific recommendations for replacing the current GSE Patch to establish a single transparent and consistent QM definition in a way that balances access to mortgage finance credit and proper underwriting guardrails to ensure consumers’ ATR.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org

Press Release: New Report Finds Low Down Payment Mortgage Lending Increased in 2019, Meanwhile Saving for a 20 Percent Down Payment Could Take 21 Years

WASHINGTON — U.S. Mortgage Insurers (USMI), the association representing the nation’s leading private mortgage insurance (MI) companies, today released its annual state-by-state report on low down payment mortgage lending. The report finds the number of low down payment loans backed by private MI increased 22.9 percent in 2019; meanwhile saving for a 20 percent down payment may take potential homebuyers 21 years to save — three times the length of time it could take to save a 5 percent down payment. USMI also found that the top five states for low down payment home financing with private MI were Texas, California, Florida, Illinois, and Ohio.

“Last year, over 1.3 million homeowners purchased a home or refinanced an existing mortgage with less than a 20 percent down payment using private mortgage insurance,” said Lindsey Johnson, president of USMI. “Given the current economic environment and the desire of many people to keep more cash on-hand, low down payment loans are more important than ever. Loans backed by private MI are a great option as a time-tested means for accessing homeownership sooner while still providing credit risk protection and stability to the U.S. housing system.”

The report examines the number of borrowers helped, the percentage of borrowers who were first-time homebuyers, average loan amounts, and average FICO credit scores. USMI also calculates the number of years to save a 20 percent versus a 5 percent down payment for each state plus the District of Columbia.

Key findings from the report:

- It could take 21 years on average for a household earning the national median income of $63,179 to save for a 20 percent down payment (plus closing costs), for a $274,600 single-family home, the national median sales price.

- The wait time decreases to 7 years with a 5 percent down payment insured mortgage — a nearly 67 percent shorter wait time at the national level.

- In 2019, the number of homeowners who qualified for a mortgage because of private MI reached over 1.3 million, nearly 60 percent of purchase mortgages went to first-time homebuyers, and more than 40 percent had annual incomes below $75,000. The average loan amount purchased or refinanced with MI was $269,072.

- Over the last five years, the role of private MI in the low down payment sector increased from 34.8 percent of the insured market in 2015 to 44.7 percent in 2019.

The below table shows the top five states in which MI was used by borrowers to purchase or refinance homes in 2019.

| State | Number of Borrowers Helped with Private MI | First-Time Homebuyers |

| Texas | 105,158 | 56 percent |

| California | 103,120 | 68 percent |

| Florida | 88,360 | 55 percent |

| Illinois | 58,654 | 64 percent |

| Ohio | 51,167 | 59 percent |

Private MI serves as a bridge for creditworthy homebuyers to qualify for home financing despite a low down payment. It provides protection against mortgage default credit risk and is structured to protect the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, in the conventional mortgage market.

The complete report is available here, along with fact sheets for all 50 states and the District of Columbia.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: FHFA’s Re-Proposed Enterprise Capital Rule

WASHINGTON — Lindsey Johnson, President of U.S. Mortgage Insurers (USMI), today issued the following statement on the Federal Housing Finance Agency’s (FHFA) Re-Proposed Rule on Enterprise Capital:

“USMI supports meaningful and appropriate capital requirements for Fannie Mae and Freddie Mac (the GSEs) and appreciates the FHFA re-proposing a rule to achieve that goal. The Rule on Enterprise Capital is one of the most significant rules that FHFA will issue. The rule will determine the future role of the GSEs, how private capital will be able to continue to support the conventional market to protect taxpayers, and importantly, the level of access and affordability of mortgage finance credit for consumers.

“It is critical for the FHFA to create a capital framework for the GSEs that strikes an appropriate balance between maintaining borrowers’ access to affordable mortgage credit and ensuring the GSEs and taxpayers are protected from mortgage credit risk. To better shield taxpayers from mortgage credit risk, it is critical that capital requirements be tailored to the GSEs’ business operations, be counter-cyclical to withstand future downturns, and fully recognize the risk reduction associated with private mortgage insurance and equivalent forms of loan-level credit enhancement.

“In our 2018 comment letter on the original proposed capital rule, we also detailed a post-conservatorship capital regime for the GSEs to supersede the 2017 Conservatorship Capital Framework (CCF) that was then in effect. USMI specifically addressed three overarching areas within the proposed rule: 1) the Process and Transparency of the Development of the Proposed Framework; 2) the Overall Appropriateness of the Proposed Capital Requirements; and 3) the Treatment of Counterparties.

“USMI looks forward in reviewing this new re-proposed Enterprise Capital Rule that is very significant for our members, other participants in the housing finance industry, and the American public.”

The FHFA originally introduced the Rule on Enterprise Capital in 2018. USMI submitted a comment letter stating that its members support the goal of developing and implementing appropriate capital requirements for the GSEs that are clear, deliberative, and analytically justified.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.