News Filter: Blog

Blog: Q&A with Meghan C. Bartholomew of Radian

Blog: Where Housing Legislation Stands in an Election Year

By Brendan Kihn, Senior Government Relations Director of USMI

As the country kicks off primary elections in the mere matter of weeks, policymakers and advocacy groups are already sizing up what can and cannot be accomplished before voters go to the polls on November 8 for the 2022 midterm election. Just over a year ago, the Democrats gained control of the White House, Senate, and House of Representatives – their first trifecta since January 2011 – and Democrats were hopeful that the party could advance a long list of policy priorities related to taxation, healthcare, and housing investments. Following the enactment of the American Rescue Plan Act, which included $10 billion in homeowners assistance and $22 billion in emergency rental assistance, and the Infrastructure Investment and Jobs Act (the “Bipartisan Infrastructure Deal”), Democrats turned their attention to the Build Back Better Act (BBB), which includes more than $150 billion in housing investments.

Status Update on the “Build Back Better” Agenda

Policymakers are acutely aware of the affordability challenges facing homebuyers and there is especially bipartisan support for increasing housing supply. BBB, both the specific bill and the Biden Administration’s general policy theme, represents a broad collection of policy objectives and programs which includes initiatives to promote access to homeownership, fair housing, and affordable rental opportunities. BBB’s historic investment in housing includes:

- $65 billion to preserve and rebuild public housing

- $26 billion to create and preserve affordable and accessible housing

- $24 billion for new Housing Choice Vouchers to support families struggling to afford their rent

- $10 billion in down payment assistance for first-time, first-generation homebuyers

- $500 million for a wealth-building home loan program

- $250 million increase in allocation to Federal Home Loan Bank Affordable Housing Programs (AHP)

- $100 million to increase access to small-dollar mortgages

The U.S. House of Representatives passed BBB on November 19 with a 220-113 vote only for the bill to hit a major roadblock in the Senate exactly one month later. On December 19, Sen. Joe Manchin (D-WV) announced that “[d]espite my best efforts, I cannot explain the sweeping Build Back Better Act in West Virginia and I cannot vote to move forward on this mammoth piece of legislation.” The Democrats’ razor thin majority in the Senate (50 plus Vice President Harris) creates a tenuous “working majority,” whereby a single defection or absence can make or break a piece legislation. In this case, it is crystal clear that BBB as passed by the House is dead.

2022 began with a certain degree of legislative soul searching among Democrats to strategize avenues to pass elements of BBB that can either: (1) garner bipartisan support and pass via regular order with a 60-vote threshold in the Senate; or (2) enjoy support from the entire Democratic caucus for passage via reconciliation. Democrats will face internal and external pressure to pass something in an effort to show voters that they can govern and deliver for the American people who handed them the levers of power in the 2020 election. Housing advocates remain adamant that housing investments should be included in any legislative packages that seek to advance the Biden Administration’s BBB agenda. And, while critics are concerned that BBB will “dramatically reshape our society,” there is an equally strong sentiment among others that such a “reshape” is exactly what is necessary to invest in the American people and expand economic opportunities, including access to affordable homeownership.

Expanding Access to Mortgage Finance

USMI, as articled in its “2022 Policy Priorities for Access, Affordability & Sustainability in the U.S. Housing Finance System,” has consistently supported legislative and regulatory reforms to remove barriers to homeownership and promote an equitable and sustainable housing finance system. As policymakers seek to advance equity in the housing finance system and address significant affordability issues, they must thread the needle of expanding access to homeownership without further driving up housing costs in a very tight market. The country is experiencing an alarming shortage of homes, most notably in the “starter home” segment of the market, with only 1.8 months of supply for existing homes at the end of 2021, according to the National Association of Home Builders (NAHB). This has been one of the primary drivers of strong home price appreciation which came in at 17.5 percent for 2021, according to the Federal Housing Finance Agency’s (FHFA) House Price Index (HPI). While home price appreciation is a boon for existing homeowners who rapidly build up equity that can be tapped for other financial goals, increasing house prices represent a real hurdle for families looking to attain homeownership.

Survey and reports, including USMI’s 2021 National Homeownership Market Survey, routinely identify saving for a down payment as one of the primary challenges that families face when it comes to purchasing. Recent year’s home price appreciation demonstrates the critical need to ensure continued robust access to low down payment mortgages, where borrowers can put as little as 3 percent down with private mortgage insurance (MI) and 3.5 percent down with government-backed insurance. However, for those who are unable to cobble together the funds for a 3 or 3.5 percent down payment, non-profit organizations and governmental entities throughout the country operate thousands of down payment assistance (DPA) programs designed to help these homebuyers. Policymakers have honed in on DPA as a tool to expand homeownership and legislative proposals, most notably House Finance Services Committee (HFSC) Chairwoman Waters’ (D-CA) Downpayment Toward Equity Act (H.R. 4495 / S. 2920). These proposals understand the need to focus these programs to those who need assistance most, targeting first-time, first-generation homebuyers. BBB included $10 billion for such a program and housing advocates had called for that number to be increased to $100 billion. In the wake of BBB stalling in the Senate, policymakers in the House are exploring upcoming legislative vehicles to appropriate funds for targeted DPA.

Housing Tax Provisions

Mortgage Insurance Premium Tax Deduction

At the end of 2021, various temporary tax provisions commonly referred to as “tax extenders” expired, including the deduction for MI premiums. Borrowers who are unable to put down 20 percent for their homes typically finance the purchase transaction with loans that have either private MI of government-backed MI through the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA), or U.S. Department of Agriculture (USDA), and these premiums have been tax deductible for many homeowners since 2007. This deduction has been extremely beneficial for first-time, younger, and minority homebuyers who often rely on low down payment mortgages to purchase homes due to limited access to funds or intergenerational wealth for large down payments.

In December 2021, Reps. Ron Kind (D-WI) and Vern Buchanan (R-FL) introduced H.R. 6109 and earlier this month Sens. Maggie Hassan (D-NH) and Roy Blunt (R-MO) introduced S. 3590 to permanently extend the tax deduction for MI premiums and expand taxpayer eligibility by increasing the income threshold. This bipartisan, bicameral legislation would ensure that millions of homeowners continue to benefit from this tax deduction, which in 2019 amounted to an average deduction of more than $2,000.

State and Local Tax Deduction

One housing-related tax provision that has been extremely important to senators from high-cost states (which often happen to be Democratic states) is addressing the $10,000 limit on state and local tax (SALT) deductions through tax year 2025 imposed by the Tax Cuts and Jobs Act of 2017. In fact, changes to the SALT deduction are so high on the priority list for some members of Congress that they have declared “No SALT, no deal” with regard to supporting a BBB-like package. The House-passed version of BBB raised the SALT deduction cap from $10,000 to $80,000 for tax years 2021 through 2030 but, due to no chance of passage in the Senate, the cap remains unchanged. Outside of the BBB legislative process, lawmakers on both sides of the aisle have introduced standalone bills to address, in various manners, the current SALT cap, including:

- SALT Deductibility Act (R. 613 / S. 85) – repeals the temporary cap for tax years 2021 through 2025.

- SALT Fairness Act (R. 202) – repeals the temporary cap for tax years 2021 through 2025.

- SALT Deduction Fairness Act (804) – increases the cap to $20,000 for joint filers for tax years 2021 through 2025.

- SALT Fairness for Working Families Act (R. 2439) – increases the cap to $15,000 for individual filers and $30,000 for joint filers for tax years 2021 through 2025.

As Democrats look for legislative vehicles to address SALT, including upcoming spending bills and smaller packages that advance targeted portions of BBB, there is a growing sense that modifications should be tailored to help middle class Americans and not amount to a giveaway to millionaires and billionaires.

******

The pressure is on for Democrats to deliver on the Build Back Better agenda that was a pillar of the 2020 Biden campaign. One month in Washington, DC is a long time and eight months can seem like an eternity, but all eyes will be on the White House and congressional Democrats’ internal negotiations to determine what housing policies, if anything, can be passed before voters head to the polls in November.

Blog: Addressing the Increasing Costs of Homeownership

Buying a home is the largest single investment most Americans will make, but during the last few years, that dream has become increasingly unreachable for a significant portion of the population as the housing market experiences strong home price appreciation (HPA) and historically low levels of supply. A recent Wall Street Journal article reported on this rising home price trend, outlining how mortgage payments can become unaffordable as a result. According to the Federal Reserve Bank of Atlanta, the median American household would need 32.1 percent of its income to cover mortgage payments on a median-priced home – the most since November 2008, when the same outlays would require 34.2 percent of income. Moreover, the Federal Housing Finance Agency’s (FHFA) 2021 Q3 House Price Index (HPI®) report indicates that house prices were up 4.2 percent compared to the second quarter of 2021, but the real surprise comes when you look over the one year period during which home prices climbed 18.5 percent.

With this in mind, it is no surprise that an increasing number of consumers (64 percent) believe it is a bad time for buying a home, according to Fannie Mae’s latest Home Purchase Sentiment Index (HPSI®). This is a dramatic change from a year ago when that rate stood at only 35 percent, a change driven by consumers’ sentiments that home prices (plurality at 45 percent) and mortgage rates (majority at 58 percent) will increase over the next 12 months.

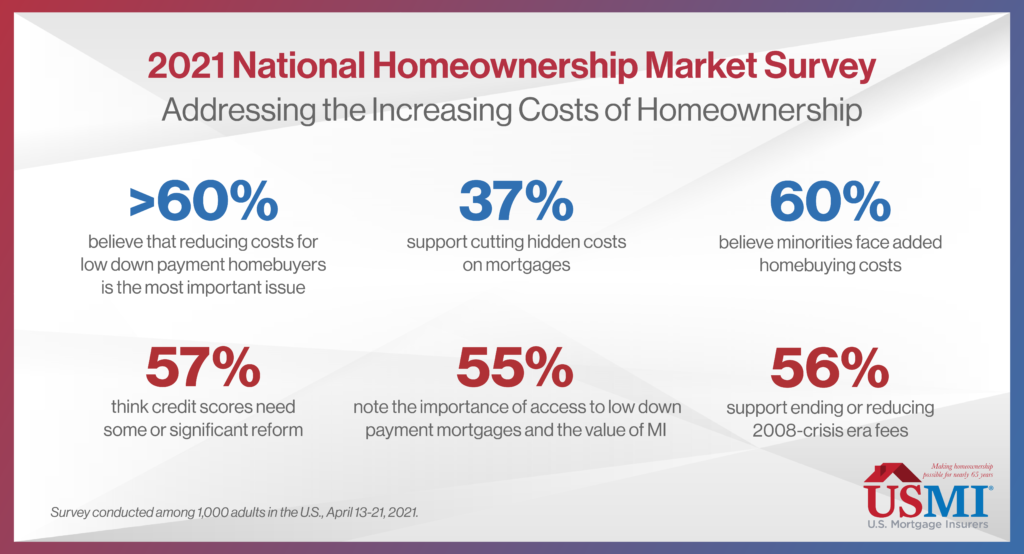

This entire situation only serves to push the goal of owning a home further out of reach for many prospective first-time, minority, and low- to moderate-income (LMI) homebuyers. In addition, there are other fees and charges that potential homebuyers could incur, increasing the cost of homeownership for creditworthy borrowers throughout the country. In fact, USMI’s 2021 National Homeownership Market Survey, which polled 1,000 adults in the U.S., found that 60 percent of respondents believe minorities face added homebuying costs because they tend to have lower credit and higher debt.

Moreover, when asked about the priorities and reforms the housing finance industry should focus on, over 60 percent of respondents believe that reducing costs for low down payment homebuyers is the most important item for the home buying process, and 37 percent support cutting hidden costs on mortgages. Other issues respondents conveyed include:

- Nearly 70 percent of respondents ranked the lack of affordable housing as the number one housing challenge and almost 60 percent stated that low housing supply is another top issue.

- 61 percent of respondents want to eliminate added costs for low down payment homebuyers and 56 percent of respondents specifically support ending Loan-Level Price Adjustments (LLPAs), 2008-crisis era fees that disproportionately affect minority and first-time homebuyers.

- 55 percent of respondents noted the importance of access to low down payment mortgages and the value of mortgage insurance (MI) to help borrowers qualify for mortgage financing.

- 57 percent think credit scores need some or significant reform, driven by respondents’ view that credit score is the underwriting element that most impacts mortgage costs.

Many of the “hidden costs” that borrowers reference when purchasing a mortgage are not really “hidden,” but instead are costs that they may not have anticipated incurring as part of closing the loan. Last week, Fannie Mae released a report titled, “Barriers to Entry: Closing Costs for First-Time and Low-Income Homebuyers,” which finds “[i]n a sample of approximately 1.1 million conventional home purchase loans acquired by Fannie Mae in 2020, median closing costs as a percent of home purchase price were 13 [percent] higher for low-income first-time homebuyers than for all homebuyers, and 19 [percent] higher than for non-low-income repeat homebuyers.” The report also finds that “Black and white Hispanic low-income first-time homebuyers on average paid higher closing costs relative to purchase price than their white non-Hispanic or Asian counterparts […] For some low-income first-time homebuyers, closing costs can be particularly onerous.” Fannie Mae found that some of these “homebuyers had closing costs equal to or exceeding their down payment.”

The FHFA released an Equitable Housing Finance Plans Request for Input (RFI) in September 2021, and the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, are required to submit Equitable Housing Finance Plans to FHFA by December 31, 2021. The plans will be in effect on January 1, 2022. USMI submitted its comment to the RFI in October. Given the private MI industry is one of the only forms of private capital available through market cycles and whose core business is focused on helping people without large down payments achieve affordable and sustainable homeownership, private MIs share the FHFA and GSEs’ view that the two pillars of good mortgage lending are sustainability and affordability. The goal should be a strong housing finance system that ensures equitable access to all mortgage-ready borrowers. USMI strongly supports efforts to remove barriers to homeownership and increase access and affordability, including for historically underserved households, while instilling sustainability for these same borrowers. The MI industry welcomes the opportunity to work with the FHFA, the GSEs, and other housing finance stakeholders to advance these goals.

Blog: Viviendas para los hispanos: Cómo el crecimiento de la población hispana ayuda a impulsar el mercado de la propiedad

El número de hogares hispanos ha crecido por seis años consecutivos, incluso durante la pandemia del COVID-19. Aumentar de manera sostenible el acceso a la propiedad de vivienda a través de políticas como los préstamos para un pago inicial bajo, puede ayudar a cerrar la brecha de la propiedad de vivienda.

El 15 de septiembre marca el inicio del Mes de la Herencia Hispana y es una oportunidad para reconocer las significativas contribuciones y la influencia de los hispanos-americanos a la historia, cultura y logros de los Estados Unidos. También es un momento para reflexionar acerca del mercado de propiedades de viviendas para los hispanos en América. En particular, durante los últimos años, la población hispana ha sido un componente clave para el crecimiento de la propiedad de vivienda en los EE.UU., y se proyecta a ser el grupo demográfico que liderará este segmento de la industria por las siguientes cuatro décadas.

De acuerdo con el reporte de 2020 de la Oficina de Censo de EE.UU., durante los siguientes 40 años los hispanos serán los principales contribuidores al crecimiento de la población estadounidense, representando un 68 por ciento hasta el 2060. El Urban Institute también proyecta que de 2020 a 2040, la mayoría de los nuevos propietarios de viviendas netos serán hispanos, estimando que, de 6,9 millones de nuevos hogares, 70 por ciento serán hispanos. Estas cifras hablan de la importancia de este grupo demográfico a nuestra nación y el impacto que tendrán en el mercado de hipotecas y de propiedades de viviendas durante las siguientes décadas.

El crecimiento de la población hispana también es una razón importante para concentrarse en las barreras que existen para que grupos minoritarios puedan acceder a las viviendas. Retos como barreras económicas y la oferta de viviendas asequibles mantienen el acceso a la propiedad fuera del alcance de muchos de estos potenciales propietarios. La brecha de ingresos entre hispanos y blancos no-hispanos sigue siendo pronunciada, con hogares blancos no-hispanos recibiendo un ingreso medio de hasta 26 por ciento por encima de los hogares hispanos. En 2019, el ingreso medio de un hogar hispano fue de $56.113 (Oficina de Censo de EE.UU.). Además, de acuerdo con el reporte “El Estado de la Propiedad de Viviendas para Hispanos 2020”, de la Asociación Nacional de Profesionales Hispanos de Bienes Raíces (NAHREP por sus siglas en inglés), los hispanos tienden a tener una relación de deuda-ingresos (DTI por sus siglas en inglés) más altos y puntajes de crédito más bajos, y dada la juventud de la comunidad hispana, compradores primerizos impulsan las ganancias en la propiedad de viviendas de hispanos. En 2019, el 56 por ciento de propietarios hispanos indicaron que estaban viviendo en el primer hogar que habían tenido, según reportó la encuesta de “Viviendas Americanas de 2019” de la Oficina de Censo de EE.UU. Por lo tanto, los compradores hispanos son un grupo demográfico importante, quienes son atendidos por productos hipotecarios de pago inicial bajo, los cuales benefician a compradores primerizos y de ingresos moderados, principalmente ayudando a cerrar la brecha del pago inicial.

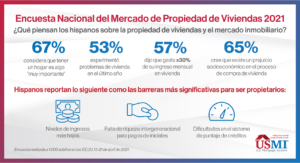

La encuesta del “Mercado de Propiedad de Viviendas Nacional 2021” de USMI, la cual encuestó a 1.000 adultos en los EE.UU., incluyendo una muestra de hispanos, encontró que el 67 por ciento de hispanos considera que ser propietario de un hogar es algo “muy importante”. Además, la encuesta arrojó que 53 por ciento de hispanos reportó haber experimentado problemas de vivienda durante la pandemia del COVID-19, siendo las principales preocupaciones: desalojos y retrasos en el pago de rentas o hipotecas.

Entre los obstáculos que los hispanos enfrentan, 66 por ciento indicó que la escasez de hogares asequibles es el principal problema relacionado a la vivienda. Adicionalmente, el 20 por ciento señaló que uno de los mayores problemas al comprar una casa es la imposibilidad de costear un pago inicial del 20 por ciento, dado que costos mensuales de vivienda consumen una gran parte de los ingresos hispanos; cerca del 60 por ciento indicó que gastan más del 30 por ciento de sus ingresos en vivienda. Finalmente, 65 por ciento de hispanos sugirió que existe un prejuicio socioeconómico en el proceso de compra de viviendas, con la encuesta señalando que niveles bajos de ingreso, falta de riqueza intergeneracional para pagos de iniciales y dificultades en el sistema de puntaje de créditos, están entre las barreras más significativas para incrementar los niveles de propiedad de vivienda entre grupos minoritarios en los EE.UU.

Sin embargo, aunque estas barreras fueron mencionadas, el 90 por ciento de los hispanos también señaló que se sintieron tratados de manera justa durante el proceso de hipoteca. No obstante, mitos y desinformación persisten alrededor de este grupo demográfico. Por una relación de casi 3 a 1 comparado con los encuestados blancos, los hispanos creen que el proceso de aprobación de hipotecas no es asequible e indicaron que no comprenden a plenitud los requisitos para el pago de iniciales. De hecho, el 45 por ciento cree erróneamente que se requiere un pago inicial de 20 por ciento o más cuando en realidad los seguros de hipotecas privados (PMI por sus siglas en inglés) permiten a los compradores adquirir viviendas con pagos de iniciales tan bajos como el 3 por ciento.

Estas cifras y proyecciones dejan claro que, a medida que la población hispana crece rápidamente y tiene un impacto importante sobre el mercado inmobiliario, los responsables de la formulación de políticas no deben perder de vista tanto retos del mercado a corto plazo, como la escasez significativa de viviendas asequibles para compra o renta, como también problemas sistémicos de largo plazo que incrementan innecesariamente los costos o crean barreras para minorías y compradores de menor ingreso. Aun así, a pesar de haber sido particularmente impactados por la pandemia del COVID-19, hispanos-americanos son el único grupo demográfico que ha incrementado su tasa de propiedad de vivienda por seis años consecutivos (incluyendo el 2020) de acuerdo con NAHREP. Retirar las barreras que enfrentan las minorías para acceder a viviendas permitirá que incluso más hogares hispanos gocen de los beneficios de ser propietarios durante las siguientes décadas.

Los seguros de hipotecas privados (PMI) aumentan las posibilidades de compra de viviendas para minorías y hogares de bajos ingresos, al permitirles obtener préstamos de manera asequible y sostenible, ayudándoles así a alcanzar una estabilidad inmobiliaria y generar riqueza, logrando el Sueño Americano. En 2020, casi el 60 por ciento de los prestatarios atendidos por seguros de hipotecas privados eran compradores primerizos y más del 40 por ciento eran prestatarios con ingresos por debajo de los $75.000 anuales. De hecho, la encuesta de USMI encontró que los consumidores ven a este sector privado como una pieza importante dentro del rompecabezas del mercado de propiedad de viviendas, nivelando el campo de juego al ayudar a compradores de bajos y moderados ingresos y primerizos a acceder la financiación de viviendas.

En la medida que celebramos el Mes de la Herencia Hispana, manifestamos nuestro compromiso con el apoyo de políticas sólidas y prudentes que ayuden a expandir la propiedad de viviendas.

Blog: Affordability and Supply Among Top Homebuying Challenges

The lack of affordable housing continues to be a focal point for the mortgage finance community as low- to-moderate income (LMI) and first-time homebuyers continue to report challenges in buying starter homes. In fact, today, the Federal Housing Finance Agency (FHFA) released its Home Price Index and reported that home prices were up 1.7 percent in May, and up an astonishing 18 percent year over year. This significant home price appreciation is largely driven by the lack of housing supply in today’s market and is impacting borrowers’ access to homeownership across the country. Therefore, it is no surprise this topic has become an elevated policy concern, as the “underbuilt” gap has dramatically increased over the last decade, and between 2018 and 2020, the housing stock deficit increased by more than 50 percent according to a recent Freddie Mac report.

The National Association of REALTORS® (NAR) recently released a report that highlights the dire housing supply situation our nation currently faces. “The state of America’s housing stock […] is dire, with a chronic shortage of affordable and available homes [needed to support] the nation’s population,” and adds that “[a] severe lack of new construction and prolonged underinvestment [have led] to an acute shortage of available housing […] to the detriment of the health of the public and the economy.” In addition to finding an underbuilt gap of 5.5 to 6.8 million housing units since 2001, the report notes that unbuilt single-family homes account for 2 million of those units. This shortage of available and affordable homes, coupled with a robust demand, is fueling the rise of housing prices for potential homebuyers, putting the goal of homeownership further out of reach. NAR’s Chief Economist Lawrence Yun stated in the report, “[t]here is a strong desire for homeownership across this country, but the lack of supply is preventing too many Americans from achieving that dream.” In late June, USMI released its 2021 National Homeownership Market Survey, fielded by ClearPath Strategies among 1,000 U.S. adults in the general population, which found that Americans understand the importance of owning a home: more than 7 in 10 respondents see this as important for stability and financial security.

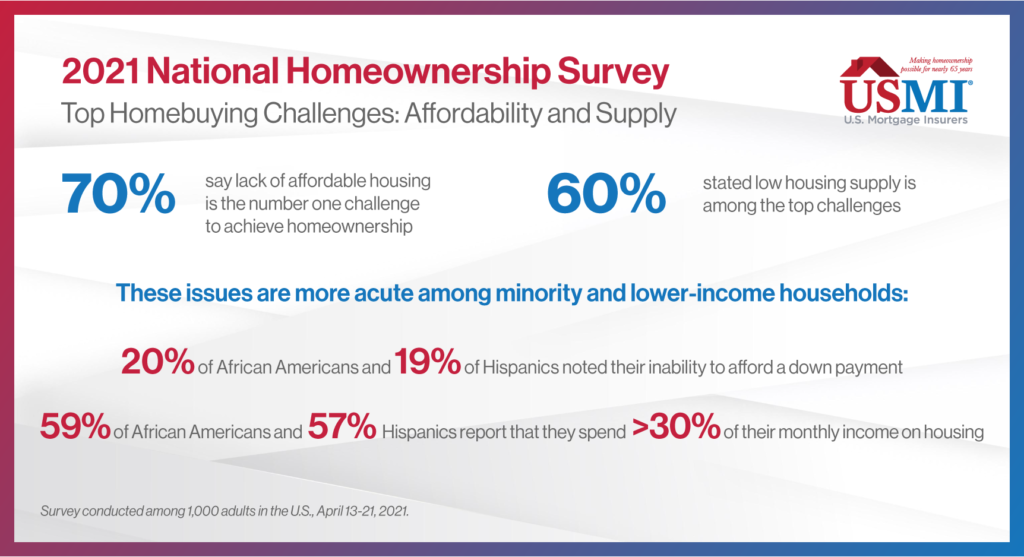

USMI, in representing a sector of the industry that is dedicated to facilitating affordable low down payment lending and promoting sustainable homeownership, explored this topic in our recent survey, which found that lack of affordable housing and low supply of housing ranked among the top homebuying challenges. In fact, nearly 7 in 10 respondents ranked the lack of affordable housing as the number one housing challenge and nearly 6 in 10 stated that low housing supply is another top issue. These issues were more acute among minority and lower income homebuyers as 20 percent of African American and 19 percent of Hispanic respondents note their inability to afford a down payment. Further, more than half of African Americans (59 percent) and Hispanics (57 percent) reported spending over 30 percent of their monthly income on housing, the threshold for a household to be considered “housing-cost burdened.” The complete findings from USMI’s national survey are available here.

These challenges are front and center of the nation’s housing agencies, FHFA and the Federal Housing Administration (FHA). Last month, President Biden appointed Sandra L. Thompson as FHFA’s Acting Director, having previously served as the Deputy Director of the Division of Housing Mission and Goals since 2013. In her accepting remarks, Thompson stated that “[t]here is a widespread lack of affordable housing and access to credit, especially in communities of color,” adding that “[i]t is FHFA’s duty through our regulated entities to ensure that all Americans have equal access to safe, decent, and affordable housing.” President Biden also recently nominated Julia Gordon to be the Assistant Secretary for Housing and FHA Commissioner.

USMI continues to urge policymakers and the housing finance industry to focus on addressing this historic shortage of affordable homes to help balance housing prices and ensure access to homeownership. In a letter directed to the Department of Housing and Urban Development (HUD) Secretary Marcia Fudge, USMI urged HUD to avoid policies that would stoke more demand in the marketplace without addressing the supply issues, as not doing so will only worsen the affordability challenges. And while addressing supply and the shortage of affordable homes is imperative, policymakers must also not lose sight of addressing the issues that unnecessarily increase costs or create barriers for minority and lower income homebuyers. Importantly, expanding homeownership opportunities for these borrowers does not have to be at the expense of reforms made over the last decade that have strengthened the system to reduce risk, protect borrowers, and avoid another housing market collapse.

We appreciate that policymakers recognize the role of low down payment mortgage options in facilitating homeownership. USMI’s survey found that consumers view mortgage insurance (MI) as an important piece of the homeownership puzzle, specifically because MI levels the playing field by helping LMI and first-time buyers access home financing. In fact, 73 percent of all respondents view MI as needed and positive to obtaining homeownership, and nearly 70 percent of respondents citing that it is important to have access to these low down payment loans through both the conventional market backed by private MI and government-backed loans through FHA.

Blog: Washington Focuses on Infrastructure and Equity with an Eye Toward Homeownership

At the midpoint of the first session of the 117th Congress, policymakers are shifting their focus from the COVID-19 recovery to other priorities on the horizon, chiefly infrastructure, and proposed changes to the tax code to fund investments.

Congressional Democrats are rallying around President Biden’s infrastructure proposals, the American Jobs Plan and American Families Plan, which take a holistic view of infrastructure by including traditional infrastructure projects like roads, bridges, railways, and housing as well as non-traditional infrastructure concepts like universal preschool and childcare. Specifically, Democrats are championing housing policies intended to promote equitable communities and give traditionally underserved Americans a stake in those communities. This includes increasing access to homeownership and wealth-building opportunities.

While both parties agree on the need to upgrade the nation’s roads and bridges, and increase broadband access, Republicans and some Democrats have expressed concerns about the expansive scope of the proposed infrastructure projects, along with certain “pay for” provisions.

Housing and Homeownership in America

There is also growing bipartisan attention to the state of housing in the U.S. Even while a record number of first-time homebuyers entered the market in 2020, longstanding concerns about housing access and affordability have been amplified due to rapidly rising home prices. While homeowners have experienced significant equity gains over the past several years, including nearly 11 percent in 2020, strong home price appreciation (HPA) and severely limited supply has locked some borrowers out of the market. This situation has raised concerns from both Republicans and Democrats, as some of the strongest HPA has occurred in rural states.

These trends have garnered nationwide attention as the effects of COVID-19 reinforced the importance of stable housing, and the value of homeownership and wealth building among Americans. Simultaneously, Millennials aspire to enter the home purchase market in larger numbers. Today, interest rates are low but as interest in homeownership has risen among first-time buyers, so has its cost. Additionally, in a tight purchase market, affordability—and the 20 percent down payment that 45 percent of Americans believe is required to obtain a mortgage, as reported in USMI’s 2021 National Homeownership Market Survey—is farther out of reach, particularly for those who do not have intergenerational wealth or equity from a previous/current home.

Not only policymakers are eyeing solutions to these challenges. As employers look to attract and retain younger workers, some companies have introduced innovative ways to help employees bridge the down payment gap, or other ways to sustainably increase housing affordability. Redwood Trust has introduced a benefit—the Redwood Employee Home Access Program—that covers the cost of mortgage insurance (MI) for employees. When the program launched in April 2021, Redwood CEO Chris Abate noted that “homeownership is the bedrock of our communities. It builds family wealth and contributes to a sense of inclusion, security, and wellbeing,” and added that Redwood seeks to put homeownership within reach of all its employees. Abate encouraged other employers to offer this benefit, similar to subsidizing health insurance. This type of incentive increases affordability, while also maintaining sustainability, as MI will remain in place and offer protection against the risk of higher loan-to-value loans.

Housing Supply is Critical

In Washington, the conversations around housing access and affordability have recognized the impact of limited housing supply on house prices as a primary driver of around affordability issues. Strong demand over the past twelve months has exacerbated the dearth of supply of such homes, construction of which has lagged pre-2008 levels. Congress has already introduced a variety of bipartisan legislation focused on increasing the supply of housing for low- and middle-income Americans, including the “Yes in My Backyard Act” (HR 3198/S 1614) and the “Housing Supply and Affordability Act” (HR 2126/S 902). Further, President Biden’s proposed budget for fiscal year 2022 contains tax incentives for the construction of low-income housing units for both renters and owner-occupants. Democratic infrastructure proposals aim to further increase supply by dedicating funding for affordable housing development.

Bridging the Down Payment Gap

USMI’s 2021 National Homeownership Market Survey noted that the inability to save for a down payment is among the biggest challenges Americans face when it comes to buying a home. The Biden administration and Congressional Democrats are also aware of this, and how it particularly affects those who lack intergenerational wealth to bridge the down payment gap and first-time homebuyers facing a historically competitive housing market. A number of legislative proposals have been put forward related to down payment assistance (DPA) and supporting homeownership. However, policymakers remain cognizant that the housing market does not need additional demand pushed into the market—the key will be increasing homeownership, particularly among traditionally underserved groups, without further decreasing affordability in the housing market.

First-Time/First-Generation DPA Proposals:

“Housing Is Infrastructure Act of 2021”: Released on April 14, House Financial Services Committee (HFSC) Chairwoman Maxine Waters (D-CA) introduced a bill including legislative text (Section 116) for targeted DPA which also exists as a standalone bill, the “Down Payment Toward Equity Act of 2021”. Chairwoman Waters’ proposal appropriates up to $10 billion for targeted DPA that is limited to first-time, first-generation homebuyers (although those who have lost homes due to foreclosure, deed-in-lieu or short sale also are eligible). Further, income for qualified recipients is limited to 120 percent of area median income (AMI), except in areas with high costs of housing, in which case income limit rises to 180 percent of AMI. Down payment grants are limited to $20,000 (or $25,000 in the case of a qualified homebuyer who is a socially and economically disadvantaged individual). The bill also includes conditional repayment terms for recipients who sell their home within five years.

“American Housing and Economic Mobility Act of 2021”: Introduced on April 22 by Rep. Emanuel Cleaver (D-MO) and Sen. Elizabeth Warren (D-MA), the American Housing and Mobility Act aims to increase housing supply and mitigate the historical effects of discriminatory lending. It provides for DPA grants for first-time homebuyers with incomes <120 percent of AMI and who have resided at least four years in a geographic area that was historically denied access to mortgage finance due to official government policy. The bill also proposes investing $445 billion over 10 years in the Housing Trust Fund, and $25 billion over 10 years in the Capital Magnet Fund.

“First-Time Homebuyer Act”: Introduced on April 26 by Reps. Earl Blumenauer (D-OR) and Jimmy Panetta (D-CA), the First-Time Homebuyer Act would provide a tax credit for first-time homebuyers for the lesser of 10 percent of the purchase price of the property acquired or $15,000 for joint tax filers.Assistance would be restricted to homebuyers with incomes ≤160 percent of AMI purchasing homes for ≤110 percent of their area’s median purchase price. This legislation is similar to President Biden’s campaign proposal to provide $15,000 tax credits to homebuyers.

Comparison of DPA Legislation

| Down Payment Toward Equity Act | American Housing and Economic Mobility Act | First-Time Homebuyer Act | |

| Lead Sponsor | Rep. Waters (D-CA) | Rep. Cleaver (D-MO) & Sen. Warren (D-MA) | Rep. Blumenauer (D-OR) |

| Structure | Grant with 5-year occupancy requirement (5-year repayment schedule in the event homeowner sells the property) | Grant | Tax credit with a 4-year recapture period |

| Maximum Assistance | $20k and $25k for homebuyers who are socially and economically disadvantaged individuals | ≤3.5% of the appraised value of the property (or ≤3.5% of maximum principal obligation if the appraised value exceeds the principal obligation amount) | Lower of 10% of the purchase price or $15k (for married tax filers) subject to inflation |

| Targeting | |||

| First-time Homebuyer requirement | Yes and first-generation | Yes and have lived for 4 years prior to enactment in a geographic area historically subject to discrimination or official segregation | Yes |

| Income Restriction | ≤120% of AMI and ≤180% of AMI for properties located in high-cost areas | <120% of AMI | Modified AGI ≤160% of AMI |

| Purchase Price Restriction | N/A | N/A | ≤110% of area median purchase price for full tax credit amount |

| Housing Counselling Required | Yes | Not required | Not required |

Tax Incentives to Support Homeownership:

“American Dream Down Payment Act”: Introduced in February by Reps. Gregory Meeks (D-NY), Joyce Beatty (D-OH), and Al Green (D-TX), the American Dream Down Payment Act would establish qualified down payment savings programs to open tax-advantaged accounts (similar to 529 accounts for educational expenses) to save for a down payment, including closing costs, for the purchase of a principal residence. There is no “first-time homebuyer” requirement for the use of the funds in the account, and the maximum account balance would be $102,080 subject to annual increase based on inflation.

Building Home Equity Among Underserved Borrowers:

In an effort to enable first-generation homeowners to build home equity more rapidly, Sen. Mark Warner (D-VA) has also proposed subsidized 20-year mortgages for first-generation homebuyers. Using a one-time federal subsidy to lower the interest rate, the monthly payments on such a mortgage would be comparable in gross terms to 30-year mortgages for the same property.

More details about these proposals and efforts to increase the housing supply are expected to emerge as Congressional negotiations over infrastructure continue this Summer and Fall.

Blog: Key Takeaways from National Homeownership Market Survey

On June 22, USMI released the results of its 2021 National Homeownership Market Survey. ClearPath Strategies fielded the national survey among 1,000 U.S. adults in the general population from April 13-21. Quotas were set to ensure a cross sample of age, gender, race, region, and education as well as homeowners, first-time homebuyers, and prospective homebuyers. The purpose was to understand the perceptions around homeownership, the mortgage process, and the challenges people face when trying to purchase a home.

This blog is the first in a series that will explore the findings from this comprehensive survey around the housing and mortgage markets in the United States. We kick off the series with the seven key takeaways from the national survey. The complete findings from USMI’s national survey are available here.

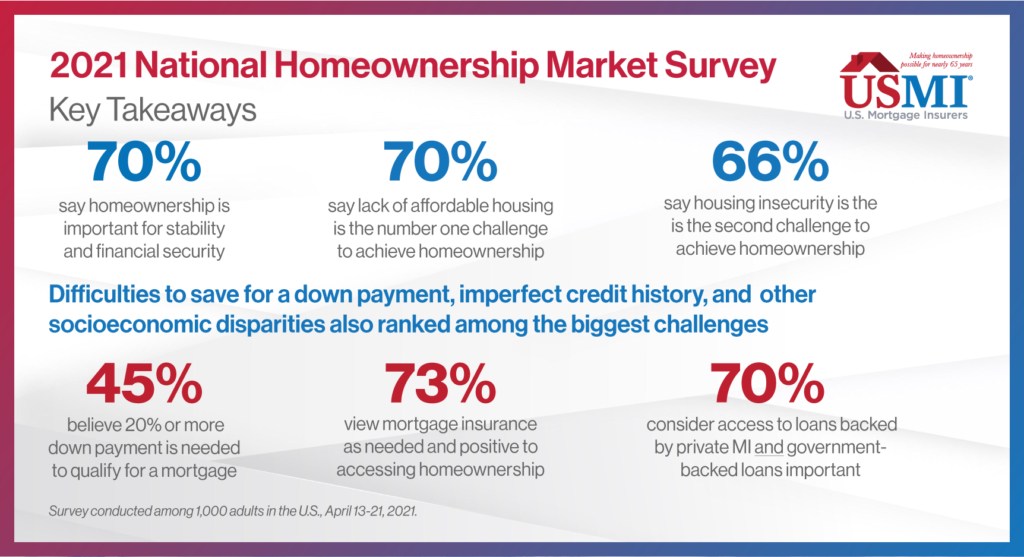

- Owning a home matters. More than 7 in 10 respondents see owning a home as important for stability and financial security. However, as we dig into the other key findings, economic and access gaps lead to challenges to buying a home.

- Lack of affordable housing and low supply of housing ranked among the top homebuying challenges. In fact, nearly 7 in 10 respondents ranked the lack of affordable housing as the number one housing challenge and nearly 6 in 10 stated that low housing supply is another top issue. This is contextualized by the current historically low housing supply, which is most acute in the “starter home” segment of the market.

- Housing insecurity during the pandemic was also a significant concern for Americans, particularly among minorities. Sixty-six percent of all respondents ranked housing insecurity, including concerns about the ability to make mortgage and rental payments, as the second highest housing challenge. A further dive into the survey findings underscores these economic concerns are particularly acute among minorities. African Americans and Hispanics said that falling behind on rent or mortgage payments was their number one concern. Twice the number of African American respondents (20 percent) and more than one-half times the number of Hispanic respondents (16 percent) reported this concern compared to white respondents (10 percent).

- The inability to save for a down payment and imperfect credit history also ranked among the biggest challenges to buying a home. African American (74 percent) and Hispanic (66 percent) respondents reported that in addition to the lack of affordable homes or lack of supply on the market, the inability to save for a down payment (39 percent of all minorities) and imperfect credit history (37 percent of all minorities) are the biggest challenges they face when it comes to buying a home. Of all adults surveyed, 60 percent view “credit score” as having the most impact on the cost of a mortgage, while 81 percent said they understand the factors that impact one’s credit score and 79 percent view credit scores as being fair.

- Socioeconomic disparities – such as lower income, lack of intergenerational wealth, limited savings, and the percentage of monthly income dedicated to housing costs – only add to the challenges to buying a home. These factors can lead to lower credit scores and higher overall debt loads to manage, which all can contribute to greater challenges to achieving homeownership. African American and Hispanic respondents rank these issues as more significant challenges compared to white respondents.

- Many Americans still do not realize that low down payment mortgages are widely available. Up to 45 percent of all respondents mistakenly believe that you need a down payment of 20 percent or more to qualify for a mortgage. Thirty percent of all adults surveyed indicate that they are not familiar with down payment requirements. In truth, homebuyers can qualify with a down payment as low as 3 percent with private mortgage insurance, and as low as 3.5 percent with a loan backed by the Federal Housing Administration (FHA).

- While down payments continue to be a significant challenge, mortgage insurance (MI) is seen as leveling the playing field and respondents express strong support for access to mortgages with MI in both the conventional and government-backed markets. Seventy-three percent of all respondents view mortgage insurance as needed and positive to accessing homeownership. MI provides access to home financing for those who might not otherwise be able to purchase a home due to limited funds for a down payment. Nearly 70 percent of respondents cited that it was important to have access to loans through the conventional market backed by private MI and government-backed loans through the FHA.

Blog: Interview with National MI CEO Claudia Merkle on Record-Setting Year for Private MI

The private mortgage insurance (MI) industry helped over 2 million low down payment borrowers secure mortgage financing in 2020, a 53 percent increase from the previous year. The industry also supported $600 billion in mortgage originations. USMI President Lindsey Johnson sat down with National MI CEO Claudia Merkle to discuss the record-setting year. Also, in honor of Women’s History Month in March, the two talked about ways women can seek a long, successful career in housing finance. Watch the full interview below and click here to read more about the record high private MI volume. (Please note the interview was recorded before the final volume numbers were finalized, so there are slight variations between the video and press release. The press release has the most up-to-date numbers for 2020.)

Below is a complete transcript of the above video.

Lindsey Johnson: We are here to talk about the private mortgage insurance industry and the industry’s performance through 2020, a year that was full of new challenges and opportunities. 2020 was a record year for the mortgage industry, and a year where the private mortgage insurers helped a new record number of borrowers achieve homeownership. To help talk us through the numbers, Claudia Merkle, CEO of National MI, is with us. Claudia has extensive experience in the mortgage insurance and mortgage banking industries. As CEO of National MI, Claudia is responsible for the company’s day-to-day management, financial performance, and long-term growth strategy.

As we celebrate Women’s History Month, USMI wanted to highlight Claudia’s impressive experience and important contributions to the housing and mortgage industries, and we look forward to hearing some of Claudia’s thoughts on some of the most pressing issues facing the industry today. So, Claudia, thank you for being here. I did want to just start off by talking about 2020, and despite the uncertainty and the incredible challenges that were presented by the 2020 global pandemic, the real estate market was very strong this past year and the data shows record high volume. Can you peel back some of these numbers and just share your thoughts on 2020’s market, particularly for low down payment borrowers?

Claudia Merkle: Sure, Lindsey. Great to be here. So, 2020 certainly was a year of remarkable challenge, resiliency, and reward for the housing market. Based on industry and federal agency data that has been released today, 2020 mortgage lending activity broke records. First lien originations totaled just over $4 trillion in 2020. The private mortgage insurance industry also produced record volume in 2020. As background, private mortgage insurance companies, such as National MI, enable borrowers to gain access to the housing market more quickly by allowing down payments with as little as 3 percent. The private MI industry directly serves and supports low down payment borrowers in the housing market while protecting lenders against default. The MI industry helped at least 1.75 million families either purchase a home or refinance an existing mortgage.

I mentioned the strength of the broad origination of market in 2020, but we have seen even stronger growth in the private MI market. In 2020, private MIs supported $600 billion in originations, and that traces to several factors. First, there are more and more first-time homebuyers coming into the market. They have good credit, but struggle to put 20 percent down on their first house. Private MI is a great fit for them. Here’s some additional important statistics. Nearly 60 percent of purchase loans with MI are first-time homebuyers, and more than 40 percent of borrowers with MI mortgages have annual incomes below $75,000. This fundamentally underscores the point that MI serves a key demographic of borrowers needing a low down payment mortgage.

A second factor attributed to this large MI market is low interest rates. Rates helped fuel the strong mortgage market momentum in 2020 for both the purchase segment and also for refinances. We have seen private MI penetration of refinancing more than double, with a 65/35 split between purchase and refinance transactions. The combination of these various factors contributed to a really strong production in 2020.

Johnson: It’s such a great overview of some of the borrowers that we helped through 2020 and the critical role that the industry really played in helping millions of people access affordable mortgage credit when rates were really at historic lows. Can you speak to how the industry managed the COVID crisis while also meeting that incredible demand?

Merkle: Sure. Yeah, importantly over the past year the MI industry has worked closely with federal policymakers, industry groups, and consumer organizations to support homeowners experiencing financial hardship due to the COVID-19 pandemic. Mortgage insurers have routinely updated their guides and processes to align with the GSE policies in order to implement nationwide forbearance programs. One key element of the industry’s success and ability to scale up for record volume is the industry’s transformation since the 2008 financial crisis into sophisticated managers of mortgage credit risk.

Additionally, it’s important to note that the MI industry as a whole entered into the COVID crisis with a tremendous amount of financial strength. Today, mortgage insurers are well capitalized, and USMI members currently hold more than $6.3 billion in excess of PMIERs requirements, a sufficiency ratio of 149 percent. All USMI members were able to raise capital in the debt and equity markets throughout 2020 in order to scale up and support the increased volume. It’s terrific to see that the capital markets have shown confidence in our MI industry, which furthers our ability to pursue new business and support lenders and borrowers in the current market.

Johnson: So, it’s really great to hear how the strength of the industry and that transformation supported that ability for the industry to really enable access for millions of borrowers and support that volume. So, we’ve talked a lot about the volume for 2020. What are your expectations for the housing market, and in particular, the low payment market for 2021?

Merkle: Yeah, the housing market continues to be a really bright spot during the challenge of the pandemic. So, we expect home price appreciation will continue as demand continues to outstrip the supply. Forecasts indicate the 2021 originations will be approximately 3.5 trillion, which is less than the record breaking 2020 volume, but still very high based on historical trends.

As we begin to see mortgage interest rates start to rise modestly. Fewer homeowners will be in the money to refinance. The purchase-refi breakdown could likely trend back to normal shares of the market. That split is traditionally around an 85 percent purchase and a 15 percent refinance mix. But the 2020 refi boom shifted that mix of new business to 65/35.

We’re also closely monitoring extensions of the GSE’s single-family forbearance programs and trends concerning loan modification for homeowners with COVID-19 financial hardships. We believe that the government’s support is crucial to assist impacted homeowners by providing an adequate runway to recover from financial hardships triggered by COVID. Broadly speaking, the housing industry has been a strong economic driver in the wake of the pandemic and a way to expand access to all the benefits that homeownership provides, which include a safe environment to shelter from the virus, an ability to establish community identity, and an equitable opportunity for long-term wealth creation.

It’s important to note that COVID has brought into sharp focus the important role that the private MI sector and industry plays in supporting a healthy and functioning housing finance system. We foresee that MI will continue to work for borrowers, lenders, and taxpayers in 2021 and beyond, across all markets cycles.

Johnson: So, you highlighted the importance of having a place to call home, especially during this pandemic. Considering your extensive experience in the mortgage industry and the key roles you’ve played, both on the lending side and on the mortgage insurance side as well as an executive of National MI, what is your message to Washington lawmakers and regulators about how the private mortgage insurance industry can better serve low- to moderate-income borrowers?

Merkle: Yeah, very important question. Thanks, Lindsey. So first and foremost, members of USMI commend the swift actions that Washington lawmakers have made to support borrowers during times of hardship through COVID. The first and most impactful priority has been providing continuing support to the housing market, and we were pleased to see the extension of forbearance that was announced in February.

The MI sector understands how crucial it is to participate in policy discussions that define and shape the mortgage industry, and to ensure we are adequately serving the needs of low- to moderate-income borrowers. When thinking about affordability and serving low- to moderate-income families, it is important to consider two things: one, access to credit, and two, supply. With access to credit, the MI industry has the capacity and the desire to help even more low- and moderate-income families become homeowners and to do it in a sustainable way that sets borrowers up for success.

Policymakers need to be mindful, however, of the impact federal regulations can have on the mortgage market with tilting the scales in favor of particular lending programs. Policymakers should ensure a level playing field to avoid a bifurcated market, such that minority borrowers are arbitrarily directed to lending programs with fewer lender and product options. These borrowers shouldn’t be left with the only option of a loan insured by the Federal Housing Administration (FHA), especially since there are nearly three times the number of HMDA (Home Mortgage Disclosure Act) reporting lenders originating conventional purchase loans compared to FHA purchase loans.

As it relates to supply, access to credit is a critical part of our industry, but policymakers must also consider the severe lack of affordable housing supply. Housing supply is at the lowest level this century, with just 1.9 months of supply as of January 2021. The shortage is especially acute in the lower end of the market, where many first-time buyers are looking for starter homes. The lack of supply in turn has led to record year-over-year home price appreciation, which was 10.8 percent last year according to the Federal Housing Finance Agency (FHFA). Strong home price appreciation is great for current homeowners but creates a moving target for those looking to transition from renting to owning.

Johnson: So, you touched on supply and access. From an access to mortgage credit perspective, we know that private mortgage insurance facilitates low down payment home financing in the conventional market because executives like you and others are in the market every single day, in the trenches, really making that possible. Can you elaborate on the importance of low down payment lending?

Merkle: Sure. Yeah, with mortgage insurance we’re in the dream of homeownership business. I’m really proud of that. Low down payment mortgages are critical to enable first-time, lower wealth, and minority homebuyers achieve this dream of purchasing a home. For many borrowers, the need to accumulate a large amount of cash for down payment, usually 20 percent of the property’s value, is the biggest hurdle in the homebuying process. Eighty percent of first-time homebuyers utilizing financing do so with low down payment mortgages. Conventional mortgages with private MI have been the number one way in recent years for these borrowers to become homeowners.

Between rising rent, student loan payments and strong home price appreciation, it could take a family on average of more than 20 years to save for a 20 percent down payment to purchase a home. There are many creditworthy borrowers who do not have 20 percent who deserve to have options to enable them to get into homes and to enjoy the benefits of homeownership. With MI, it is important that these families have access to mortgages with 3 percent, 5 percent or 10 percent down payments, so they can purchase homes sooner and begin to build the long-term wealth and pride that comes with homeownership.

Johnson: So as with most things, there’s always a balancing act. And the conversation, especially in DC, is constantly kind of around this access to mortgage finance credit, but sustainability and making sure that you’re not exposing taxpayers to undue mortgage credit risk. So, can access to low down payment programs be expanded without increasing that risk to government or taxpayers, and if so, then how do we do that most effectively?

Merkle: Sure. So private capital plays an essential role in a strong functioning housing market. For nearly 65 years, the private MI industry has played a critical role in facilitating access to affordable low down payment mortgages, while also protecting the GSEs, lenders, and American taxpayers from mortgage credit risk. MIs have stood in the first loss position, all while helping more than 34 million families secure low down payment mortgages and financing.

As an industry that is fully committed to the U.S. housing finance system, and one that has never stopped writing new business, insuring loans or paying claims, private mortgage insurers are an important source of private capital. We are stronger and more resilient than ever, with well-capitalized balance sheets and the capacity to serve all borrowers that don’t have 20 percent down needed to purchase a home.

A key development over the past several years has been the industry’s programmatic use of credit risk transfer, CRT transactions, in order to access the global capital and reinsurance markets to disperse risk. Since 2015, the industry has issued 35 insurance link notes deals, ILNs, transferring $14.3 billion of risk on nearly $1.4 trillion of insurance in force. USMI members have also executed 29 reinsurance deals since 2015, transferring nearly $34 billion of risk on approximately 700 billion of insurance in force.

Johnson: So kind of continuing on the theme of that balance, there has been this long standing debate about the appropriate balance between government- and taxpayer-backed FHA, and then utilizing MI. In one, the government backs a 100 percent of the risk, and in the other, the industry and private capital is standing in the first loss position, as you mentioned. How should policymakers be thinking about these two markets and the important role that they each play? And as some call for an expansion of FHA, why is it important for lawmakers and regulators to take equivalent steps to ensure access to the conventional market?

Merkle: Yeah, an important topic. So conventional loans with MI and mortgages insured by the FHA are the two primary methods for American families to attain homeownership with down payments of less than 20 percent. Policymakers should consider that both private MI and FHA have a critical place in a functioning housing finance system, critical that there be a coordinated federal housing policy to ensure that the FHA and conventional mortgage markets complement one another rather than purely compete against each other.

There is an appropriate balance between the two entities and the role that they each serve. We need to stress the importance of private capital in the housing industry and the need to lessen the current burden placed on FHA, which is directly connected to taxpayers. Plus for some borrowers, conventional execution with private MI is much more attractive than an FHA loan.

It’s also important that policymakers calibrate housing finance regulations, including the qualified mortgage standards and GSE capital requirements, to make sure borrowers aren’t arbitrarily driven to a specific program. FHFA should revisit loan level price adjustments (LLPAs), and either eliminate across the board, or at a minimum, exempt mortgages with MI since low down payment borrowers, many of them who are minority, lower-income and/or first-time homebuyers, are double charged for risk protection.

Additionally, home ready borrowers should have access to a wide variety of mortgage lenders and products across the conventional and FHA markets. I’d also comment that FHA should focus on its core mission of supporting borrowers who do not have access to traditional financing and have policies in place to ensure it can play its designed countercyclical role. The conventional market, including the private mortgage insurance industry, is backed by private capital and is well positioned to play a larger role in facilitating access to affordable credit. So, we should strive to secure the appropriate balance between the private and public sectors.

Johnson: Claudia, this has been fantastic. I would be completely remiss if I did not acknowledge that it is Women’s History Month, and as the mortgage industry generally has been historically led by men, I think it’s important to appreciate perspective, experience, and the expertise that women can bring to the table. What’s your message for young ladies in the industry who seek a long and successful career?

Merkle: Yeah, and congratulations to you as well for Women’s History Month, Lindsey. Yeah. One of my passions is finding ways to help other women in the mortgage insurance, mortgage industry in general succeed. And that includes mentoring and giving advice and certainly leading by example. Women bring a diverse skill set to the table, and while there are many messages to share with young women in our industry, I’d offer out two important messages. One, I’d say, take the initiative. Take the risk. Raise your hand for that project and lead it. Don’t wait. Don’t be too polite. Two, I’d say maintain a high organizational awareness. Who are the leaders you need to connect with? What’s happening throughout your company, and how do you lock arms with those leaders to move the organization forward?

And I’ll leave you with one final thought, Lindsey. As women, we have the unique ability to know how things are shifting, whether it’s good or bad. We were born empathetic leaders. If you have a sense that something is shifting in your organization, think about what you need to do to either change the course or further the course; then set the pace by taking action.

Johnson: That is fantastic advice. And I just want to thank you again, Claudia, for the updates on the private mortgage insurance industry and how it’s really aided the efforts and supported the efforts of the GSEs, of lenders and policymakers, through COVID-19. But also how the industry has facilitated homeownership for a record number of borrowers this year, and it continues to do so while shielding the government and taxpayers from risk. We are super grateful for your leadership and also just your insights as we had this conversation today. Thank you.

Merkle: Thank you so much, Lindsey. It was great to be here. Really appreciate it.

Blog: Celebrating Black History Month – Q&A with Alanna McCargo, Senior Advisor at HUD

To conclude our series celebrating Black History Month, USMI caught up with Alanna McCargo, Senior Advisor for Housing Finance at the Department of Housing and Urban Development (HUD). McCargo discusses her work and perspectives on the goal of increasing Black homeownership in America and other key topics in housing finance.

While homeownership has risen over the past few years, so has the growing recognition of the significant racial and economic disparities in mortgage lending and access to affordable mortgage credit, especially in the wake of the COVID-19 pandemic. Of the 2.6 million homeowners that are currently past due on their mortgages, as reported by the Mortgage Bankers Association, over half of them are people of color, according to Census Bureau Household Pulse Survey data from January 20 to February 1, 2021. This situation presents an opportunity for policymakers to correct inequities and better support minority homebuyers.

For more than 60 years, the private mortgage insurance (MI) industry has enabled more than 33 million low- and moderate-income Americans to attain affordable and sustainable homeownership in the conventional market. In the past year alone, nearly 60 percent of borrowers who purchased their home using private MI were first-time homebuyers, and more than 40 percent had incomes of $75,000 or less. It is a goal of the MI industry to work with regulators and lawmakers to increase minority lending within the conventional mortgage market, and Black History Month is a perfect time to advance this conversation.

(1) How does Black History Month intersect with the issue of homeownership?

Black history is American history and deepening the collective knowledge of the nation about the truths of our history shapes who we are as a nation, demonstrates our resilience, strengthens our democracy, and reminds us of the work still ahead. The nation is in the midst of three major national tragedies — a public health crisis, an economic recession with deep unemployment, and a reckoning with racism — all of which have caused disproportionate harm to households and communities of color. Many of these disparities can be directly traced to a long history of racial discrimination that America still reckons with today. When we examine the persistent income inequality and racial wealth gap, and reflect on the legacy of federal, state, and local policies and practices like redlining, exclusionary zoning, and the segregated, disinvested, and devalued communities we have across the country, we are reminded of the hard work that still needs to be done at the intersection of race and housing. Homeownership is a central part of a painful history that has thwarted Black economic progress and we continue to have a racial homeownership gap today that is larger now than it was over 50 years ago at the passage of the Fair Housing Act in 1968. We must continue to work toward strengthening Fair Housing and Fair Lending laws, dismantling discriminatory practices, and building toward better outcomes that recognize the history of inequity and works to restore opportunities to build wealth through homeownership.

(2) What are the top two or three 2021 priorities that lawmakers and the new Administration should focus on related to housing finance?

We began 2021 in a housing crisis that has been exacerbated by the pandemic. In addition to unprecedented illness and loss of life, millions of Americans are experiencing long-term financial hardship and loss of income and are at risk of losing their homes through no fault of their own. In response, the top priority for the federal government is to get relief to homeowners and renters, including housing assistance, forbearance, and foreclosure prevention measures until the effects of the pandemic subside and recovery can begin. Just last week, the Biden Administration announced coordinated policy actions for homeowners with government insured loans to provide forbearance and foreclosure relief. These actions will provide homeowners with urgently needed relief and address the disproportionate impact Black households face from the pandemic. Other priorities for the Administration are the production and preservation of affordable housing to help renters who want to be homeowners find housing inventory that they can afford to buy and expanding access to credit by removing structural barriers that historically disadvantage Blacks when it comes to fully participating in the housing finance system. Foundational to all these 2021 priorities are the goals of improving equity, dismantling discriminatory practices, and reducing the racial homeownership gap.

(3) Can greater homeownership racial equity be achieved in the next 5 to 10 years in America, and what must happen to increase the rate of Black homeownership?

Yes, with intentional policy choices and focus, there can be progress made in increasing the rate of Black homeownership and closing the Black/white homeownership gap. At a minimum, the following three things are important:

- remove the barriers to homeownership that keep creditworthy Black households from becoming first time home buyers – supporting down payment and savings, reforming and expanding credit.

- promote new construction and production of affordable housing types for homeownership (condo’s, townhomes, factory-built, etc.) and repair of existing affordable housing to support the next generation of buyers.

- prioritize homeowner sustainability and ensure existing homeowners know their options for keeping their homes and their equity and where to get help during the coronavirus national emergency.

During the last housing crisis, Black homeownership saw enormous losses and Black households did not recover as rapidly as other racial/ethnic groups. We cannot let this devastating history repeat itself.

To accomplish this, we’ll need enhanced mechanisms to support down payment for households that do not have generational wealth to rely on. In addition, steps that move toward reducing costs of ownership, rationalizing pricing, enforcing fair housing, removing bias from credit scoring and appraisal systems, and ensuring Black households have equitable access to mortgages, housing counseling, and related services that help to create sustainable homeownership opportunities that build wealth.

Alanna McCargo’s Biography

Alanna McCargo recently joined the Biden Administration as Senior Advisor for Housing Finance to the Secretary of U.S. Department of Housing and Urban Development. She was previously Vice President for the Housing Finance Policy Center at the Urban Institute, where she led development of research programming and strategy with a focus on reducing racial homeownership gaps, removing barriers to homeownership, and building wealth equity. She held previous leadership roles with JP Morgan Chase, CoreLogic Government Solutions, and Fannie Mae and worked alongside the U.S. Treasury Department to implement housing recovery programs and policy during the Great Recession. She has a BA in communications from the University of Houston and an MBA from the University of Maryland.

Blog: Celebrating Black History Month – Q&A with Congressman Emanuel Cleaver

In our series celebrating Black History Month, USMI had the honor to speak with Congressman Emanuel Cleaver (D-MO), a member of the U.S. House of Representatives since 2005 who serves on the House Financial Services Committee and chairs the Subcommittee on Housing, Community Development, and Insurance. Congressman Cleaver shared with USMI his thoughts on increasing Black homeownership in the United States and other topics related to the mortgage finance sector in 2021 and beyond.

While homeownership has risen over the past few years, so has the growing recognition of the significant racial and economic disparities in mortgage lending and access to affordable mortgage credit, especially in the wake of the COVID-19 pandemic. Of the 2.6 million homeowners that are currently past due on their mortgages, as reported by the Mortgage Bankers Association, over half of them are people of color, according to Census Bureau Household Pulse Survey data from January 20 to February 1, 2021. This situation presents an opportunity for policymakers to correct inequities and better support minority homebuyers.

For more than 60 years, the private mortgage insurance (MI) industry has enabled more than 33 million low- and moderate-income Americans to attain affordable and sustainable homeownership in the conventional market. In the past year alone, nearly 60 percent of borrowers who purchased their home using private MI were first-time homebuyers, and more than 40 percent had incomes of $75,000 or less. It is a goal of the MI industry to work with regulators and lawmakers to increase minority lending within the conventional mortgage market, and Black History Month is a perfect time to advance this conversation.

The below Q&A with Congressman Cleaver is part of a USMI series during the month of February to highlight prominent Black leaders in the housing finance and mortgage industries to discuss their work and perspectives on the goal of increasing Black homeownership in America and other key topics in housing finance.

(1) How does Black History Month intersect with the issue of homeownership?

Black History Month is a time for the nation to celebrate and reflect on the legacy of African Americans — our contributions to American culture and how far we’ve come as a community. So when I think of the intersection between homeownership and Black History Month, I think about just how much work we still have to do as a society. In 1960, the Black homeownership rate in the United States was 38 percent and white homeownership was 65 percent. In 2015, less than 38 percent of Black families in Kansas City owned a home and the racial homeownership gap has only widened across the country. While we look back and celebrate the contributions of the Black community during Black History Month, we also must look forward and take action on the remaining challenges in front of us. Closing the racial homeownership gap is certainly one of the biggest mountains we still have to climb.

(2)What are the top two or three 2021 priorities that lawmakers and the new Administration should focus on related to housing finance?

I know President Biden has looked at this issue with the seriousness it deserves because I’ve spoken with him about it directly. If you look at the Administration’s plans, it will help strengthen underserved communities by investing in them through housing — and a major component of that is through housing finance. Lawmakers must move with urgency to end modern day redlining by strengthening the Community Reinvestment Act. We cannot allow lenders to discriminate against individuals based on where they live, and we must ensure that fintechs and other non-bank lenders are held to as strong of standard. The administration must also make it a high priority to hold discriminatory financial institutions accountable. Not only must the administration vigorously investigate discriminatory lending from financial institutions big and small, but when allegations of discrimination or unfair lending practices are found, they must take substantive action to rectify them.

(3) Can greater homeownership racial equity be achieved in the next 5 to 10 years in America, and what must happen to increase the rate of Black homeownership?

There is no question that we can achieve greater racial equity in terms of homeownership, but elected officials—from the President to Congress to Governors to Mayors—must make a concerted effort to address the inequity that still plagues our nation. Homeownership has long been considered the gateway to the middle class, which is why I believe it is where we should focus our attention if we are seeking to make our economy more equitable. There are a lot of policy actions that can get the ball rolling, such as reforms to the housing finance system, enforcement of fair housing laws, and increasing the supply of affordable housing stock, but one great place to start would be increasing funding and access to governmental down payment assistance programs. Because communities of color simply haven’t been afforded the same opportunities to build up generational wealth, it makes it difficult to afford the down payment on a house that opens the door to the middle class.

Congressman Cleaver’s Biography

Emanuel Cleaver, II is now serving his ninth term representing Missouri’s Fifth Congressional District, the home district of President Harry Truman. He is a member of the House Committee on Financial Services; Chair of the Subcommittee on Housing, Community Development, and Insurance; member of the Subcommittee on Oversight and Investigations; member of Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets; member of the House Committee on Homeland Security; and member of the Subcommittee on Border Security, Facilitation, and Operations.

Having served for twelve years on the city council of Missouri’s largest municipality, Kansas City, Cleaver was elected as the city’s first African American Mayor in 1991.

During his eight-year stint in the Office of the Mayor, Cleaver distinguished himself as an economic development activist and an unapologetic redevelopment craftsman. He and the City Council brought a number of major corporations to the city, including TransAmerica, Harley Davidson, and Citi Corp. Cleaver also led the effort, after a forty-year delay, to build the South Midtown Roadway. Upon completion of this major thoroughfare, he proposed a new name: The Bruce R. Watkins Roadway. Additionally, his municipal stewardship includes the 18th and Vine Redevelopment, a new American Royal, the establishment of a Family Division of the Municipal Court, and the reconstruction and beautification of Brush Creek.

Cleaver has received five honorary Doctoral Degrees augmented by a bachelor’s degree from Prairie View A&M, and a master’s from St. Paul’s School of Theology of Kansas City.

In 2009, Cleaver, with a multitude of accomplishments both locally and Congressionally, introduced the most ambitious project of his political career—the creation of a Green Impact Zone. This zone, consisting of 150 blocks of declining urban core, has received approximately $125 million dollars in American Recovery and Reinvestment funds. The Green Impact Zone is aimed at making this high crime area the environmentally greenest piece of urban geography in the world. This project includes rebuilding Troost Avenue, rehabbing bridges, curbs and sidewalks, home weatherization, smart grid technology in hundreds of homes, and most importantly, hundreds of badly needed jobs for Green Zone residents.

During the 112th Congress, Cleaver was unanimously elected the 20th chair of the Congressional Black Caucus.

In 2016, as Ranking Member of the Housing and Insurance Subcommittee, Cleaver successfully co-authored the largest sweeping reform bill on housing programs in 20 years, the Housing Opportunity Through Modernization Act, a bipartisan comprehensive housing bill that passed into law with a unanimous vote.

In 2018, Congressman Cleaver received the Harry S. Truman Good Neighbor Award, the highest honor bestowed by the Harry S. Truman Good Neighbor Award Foundation. Past honorees include President Bill Clinton, the late Senator John McCain, and Justice Sandra Day O’Connor.

Cleaver, a native of Texas, is married to the former Dianne Donaldson. They have made Kansas City home for themselves and their four children, and grandchildren.

Blog: Celebrating Black History Month – Q&A with Lisa Rice, President and CEO of the National Fair Housing Alliance