To conclude our series celebrating Black History Month, USMI caught up with Alanna McCargo, Senior Advisor for Housing Finance at the Department of Housing and Urban Development (HUD). McCargo discusses her work and perspectives on the goal of increasing Black homeownership in America and other key topics in housing finance.

While homeownership has risen over the past few years, so has the growing recognition of the significant racial and economic disparities in mortgage lending and access to affordable mortgage credit, especially in the wake of the COVID-19 pandemic. Of the 2.6 million homeowners that are currently past due on their mortgages, as reported by the Mortgage Bankers Association, over half of them are people of color, according to Census Bureau Household Pulse Survey data from January 20 to February 1, 2021. This situation presents an opportunity for policymakers to correct inequities and better support minority homebuyers.

For more than 60 years, the private mortgage insurance (MI) industry has enabled more than 33 million low- and moderate-income Americans to attain affordable and sustainable homeownership in the conventional market. In the past year alone, nearly 60 percent of borrowers who purchased their home using private MI were first-time homebuyers, and more than 40 percent had incomes of $75,000 or less. It is a goal of the MI industry to work with regulators and lawmakers to increase minority lending within the conventional mortgage market, and Black History Month is a perfect time to advance this conversation.

(1) How does Black History Month intersect with the issue of homeownership?

Black history is American history and deepening the collective knowledge of the nation about the truths of our history shapes who we are as a nation, demonstrates our resilience, strengthens our democracy, and reminds us of the work still ahead. The nation is in the midst of three major national tragedies — a public health crisis, an economic recession with deep unemployment, and a reckoning with racism — all of which have caused disproportionate harm to households and communities of color. Many of these disparities can be directly traced to a long history of racial discrimination that America still reckons with today. When we examine the persistent income inequality and racial wealth gap, and reflect on the legacy of federal, state, and local policies and practices like redlining, exclusionary zoning, and the segregated, disinvested, and devalued communities we have across the country, we are reminded of the hard work that still needs to be done at the intersection of race and housing. Homeownership is a central part of a painful history that has thwarted Black economic progress and we continue to have a racial homeownership gap today that is larger now than it was over 50 years ago at the passage of the Fair Housing Act in 1968. We must continue to work toward strengthening Fair Housing and Fair Lending laws, dismantling discriminatory practices, and building toward better outcomes that recognize the history of inequity and works to restore opportunities to build wealth through homeownership.

(2) What are the top two or three 2021 priorities that lawmakers and the new Administration should focus on related to housing finance?

We began 2021 in a housing crisis that has been exacerbated by the pandemic. In addition to unprecedented illness and loss of life, millions of Americans are experiencing long-term financial hardship and loss of income and are at risk of losing their homes through no fault of their own. In response, the top priority for the federal government is to get relief to homeowners and renters, including housing assistance, forbearance, and foreclosure prevention measures until the effects of the pandemic subside and recovery can begin. Just last week, the Biden Administration announced coordinated policy actions for homeowners with government insured loans to provide forbearance and foreclosure relief. These actions will provide homeowners with urgently needed relief and address the disproportionate impact Black households face from the pandemic. Other priorities for the Administration are the production and preservation of affordable housing to help renters who want to be homeowners find housing inventory that they can afford to buy and expanding access to credit by removing structural barriers that historically disadvantage Blacks when it comes to fully participating in the housing finance system. Foundational to all these 2021 priorities are the goals of improving equity, dismantling discriminatory practices, and reducing the racial homeownership gap.

(3) Can greater homeownership racial equity be achieved in the next 5 to 10 years in America, and what must happen to increase the rate of Black homeownership?

Yes, with intentional policy choices and focus, there can be progress made in increasing the rate of Black homeownership and closing the Black/white homeownership gap. At a minimum, the following three things are important:

- remove the barriers to homeownership that keep creditworthy Black households from becoming first time home buyers – supporting down payment and savings, reforming and expanding credit.

- promote new construction and production of affordable housing types for homeownership (condo’s, townhomes, factory-built, etc.) and repair of existing affordable housing to support the next generation of buyers.

- prioritize homeowner sustainability and ensure existing homeowners know their options for keeping their homes and their equity and where to get help during the coronavirus national emergency.

During the last housing crisis, Black homeownership saw enormous losses and Black households did not recover as rapidly as other racial/ethnic groups. We cannot let this devastating history repeat itself.

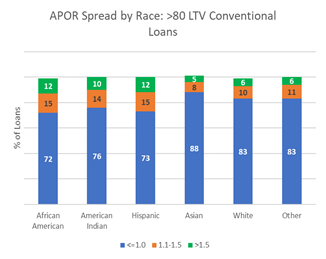

To accomplish this, we’ll need enhanced mechanisms to support down payment for households that do not have generational wealth to rely on. In addition, steps that move toward reducing costs of ownership, rationalizing pricing, enforcing fair housing, removing bias from credit scoring and appraisal systems, and ensuring Black households have equitable access to mortgages, housing counseling, and related services that help to create sustainable homeownership opportunities that build wealth.

Alanna McCargo’s Biography

Alanna McCargo recently joined the Biden Administration as Senior Advisor for Housing Finance to the Secretary of U.S. Department of Housing and Urban Development. She was previously Vice President for the Housing Finance Policy Center at the Urban Institute, where she led development of research programming and strategy with a focus on reducing racial homeownership gaps, removing barriers to homeownership, and building wealth equity. She held previous leadership roles with JP Morgan Chase, CoreLogic Government Solutions, and Fannie Mae and worked alongside the U.S. Treasury Department to implement housing recovery programs and policy during the Great Recession. She has a BA in communications from the University of Houston and an MBA from the University of Maryland.