Blog: New USMI Market Research Reveals Americans’ Perceptions Around Housing

As we start 2025 with a new administration, a new Congress, and new state legislative sessions across the country, housing affordability is poised to be a major topic of discussion. Despite a challenging real estate market in recent years with high home prices, high interest rates, and a lack of housing supply, new market research from U.S. Mortgage Insurers (USMI) confirms that buying and owning a home remains a priority for Americans.

From our 2021 survey to our recent 2024 update, there was a 6% increase in the number of Americans who viewed homeownership as important, according to USMI’s 2024 Homeownership Market Survey. In 2024, nearly 8 in 10 Americans viewed it as an important milestone, despite 58% of respondents answering that it has become harder to purchase a home in the last few years. USMI’s survey contains key insights into the housing market, which can be valuable to policymakers as potential homebuyers look to them to address issues around affordability.

With U.S. housing prices rising 4.5% year-over-year and 30-year mortgage interest rates hovering around 7%, it’s no surprise that a majority of respondents believe it has become more difficult to buy a home. While private mortgage insurance (MI) cannot solve for everything that has contributed to our country’s housing affordability challenges, USMI members can help homebuyers enter into homeownership sooner with the ability to put down as little as 3%. The down payment challenge, which can be the largest cash event in one’s lifetime, can be mitigated thanks to private MI.

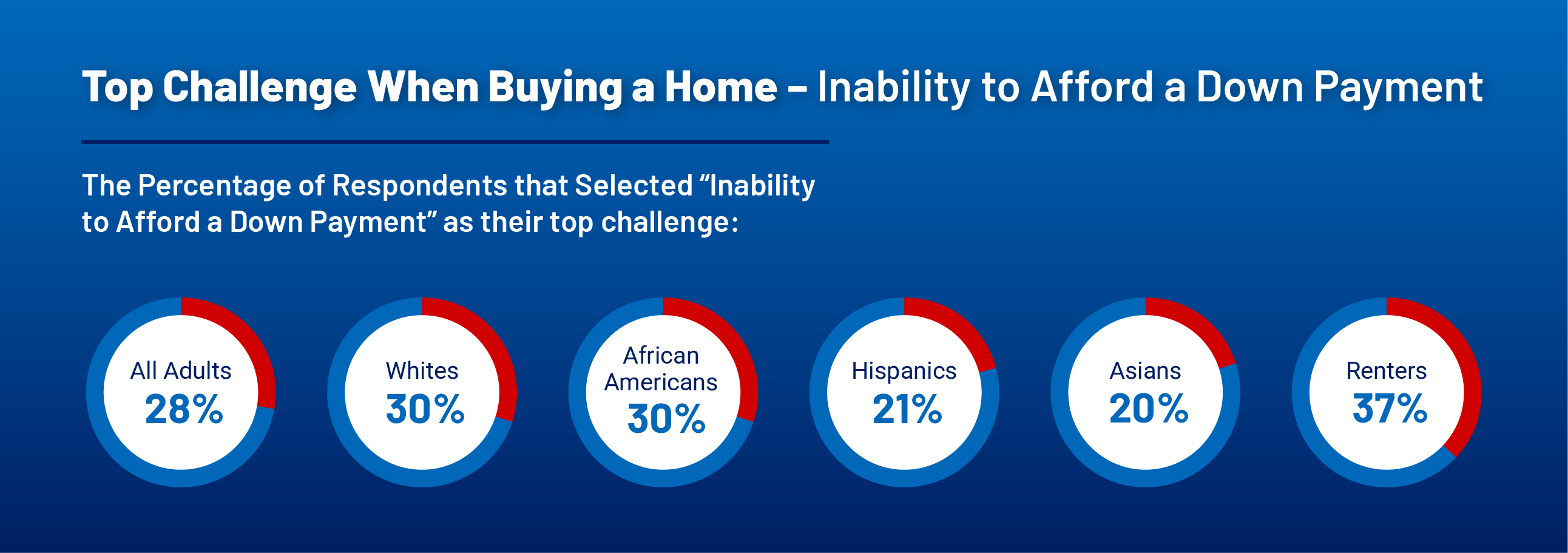

Beyond the broader reasons listed above as to “why” it’s gotten harder to buy a home, when asked to specify what they believe is the largest challenge when buying a home, nearly 30% of respondents chose the inability to afford a down payment – yet most don’t know or are mistaken about down payment requirements. No, 20% is not needed for a down payment, and it can take more than a decade to save that much. Yes, it is very common to qualify for a conventional mortgage with a three or five percent down payment, especially for first-time homebuyers, who on average bring a 9% down payment to closing.

Even with the belief that it’s too difficult to make a large cash down payment, only one-third of survey respondents were aware that it’s possible to qualify for mortgage financing with 3%-5% down. Private MI has helped over 700,000 households purchase homes over the past year, and approximately 65% of those homeowners were first-time buyers. In addition to helping buyers who don’t have a 20% down payment, if a borrower experiences financial hardship, private MI companies work with servicers to help borrowers avoid foreclosure through loan modifications and other loss mitigation solutions.

Gathering a large down payment can be a huge hurdle for prospective homebuyers, especially those who are first-time buyers. USMI’s 2024 State Report found that it could take 27 years for a household earning the median income to save for a 20% down payment plus closing costs on the median-priced home.

The average dollar amount for 20% plus closing costs is $90,643. That wait time and dollar amount goes down by two-thirds when homebuyers put down 5% and take advantage of low down payment mortgages backed by private MI. Over 8 in 10 survey respondents answered that owning a home was important to them – and low down payment mortgages help homebuyers across the country achieve that goal.

Americans value private mortgage insurance

Survey respondents answered that among the benefits of private MI, the most important were that it levels the playing field by allowing down payments as low as 3% and that it increases lower-income families’ access to homeownership. Helping those with imperfect credit histories enter into homeownership despite a small down payment, and leveling the playing field so people with less savings can purchase a home also ranked highly among the survey respondents.

Private MI is also a temporary cost: it can be cancelled when a borrower establishes 20% equity and it automatically terminates when the mortgage is scheduled to reach 78% of the original value of the property and the borrower is current on payments. Additionally, as opposed to other expenses associated with homeownership, the cost of private MI is relatively low, representing around 1%-3% of the total costs of homeownership according to Fannie Mae. The cost of private MI has also declined in the last few years, with Bankrate noting that “average premiums charged by one large carrier have fallen from more than 0.5%, or 50 basis points (bps), to 0.38%, or 38 bps.”

Not only does private MI help borrowers access homeownership sooner, it simultaneously protects lenders, Fannie Mae and Freddie Mac (the GSEs), the government, and taxpayers against risk by serving as first-loss credit protection in the event that a borrower can’t make their mortgage payments. Private MI also creates stability in the housing finance system by making greater use of private capital to lower risk for the GSEs, and lowering the exposure and costs of credit risk to both the government and taxpayers. Private mortgage insurers have covered nearly $60 billion in claims for losses since 2008 when the GSEs entered the conservatorship. Every claim dollar paid by private MI is often a claim dollar that the GSEs, and the taxpayers who stand behind them, do not have to pay.

With housing affordability a top issue for Americans, USMI has long supported that the deduction of MI premiums from federal income taxes be made permanent, as MI premiums are economically equivalent to mortgage interest payments and should therefore be treated the same for tax purposes. From 2007 through 2021, qualifying homeowners were able to deduct premiums for private MI and government insurance/guaranty programs on their taxes.

When the deduction expired, data showed on average 3.4 million homeowners claimed the deduction annually, or 44.5 million over the course of the 15 years while it was available, with the average household saving $1,454 by claiming the deduction. This targeted tax policy put money back in the pockets of hardworking, everyday Americans.

Unfortunately, the effectiveness of the deduction was diminished by its adjusted gross income (AGI) cap, which has never been raised. To help as many borrowers as possible, the AGI phaseout should be increased or eliminated since the MI premium deduction is the only itemized deduction subject to such a cap.

Despite the challenging market, USMI hopes that by dispelling the myth that future homebuyers must put 20% down when purchasing a home, more people can access homeownership sooner and begin building equity.

Over the past 68 years, private MI has helped 40 million borrowers access low down payment home financing. USMI will continue to advocate for affordable, accessible, and sustainable homeownership, backed by private capital and we look forward to working with the new administration to increase the availability of low down payment mortgages supported by private MI.