In July 2025, Congress reinstated the MI premium tax deduction

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act into law, reinstating and making permanent the mortgage insurance premium tax deduction. This deduction, which was previously claimed more than 44 million times, will help make homeownership more affordable without increasing risk in the housing finance system.

What does this mean for homeowners?

- Middle class homeowners will see meaningful tax relief.

- Beginning in tax year 2026 (the taxes filed in spring 2027), homeowners can once again deduct MI premiums paid to private MI companies and government agencies from their federal income taxes.

The reinstatement of the MI premium tax deduction was supported by a bipartisan group of lawmakers including Reps. Vern Buchanan (R-FL-16) and Jimmy Panetta (D-CA-19), and Sens. Thom Tillis (R-NC) and Maggie Hassan (D-NH), as well as a broad coalition of industry groups, housing advocates, and civil rights organizations.

Click here to read USMI’s full statement about this development.

Tax deductibility of MI premiums benefits homeowners

MI became tax deductible in 2007, but the deduction previously expired after tax year 2021 before Congress reinstated it beginning in tax year 2026. Data through tax year 2021 showed:

- $64.7 Billion: Total MI deductions claimed by homeowners

- 44.5 Million: Number of times the MI deduction has been claimed

- 3.4 Million: Average annual number of homeowners who claim the MI deduction

- $1,454: Average annual MI deduction amount per qualified taxpayer

- $2,346: Average MI deduction amount in tax year 2021, the last year it was available

History of the MI premium tax deduction

Beginning in 2007 through tax year 2021, the tax code allowed qualified homeowners to deduct from their federal income taxes MI premiums paid to private MI companies and government agencies, including the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA), and U.S. Department of Agriculture’s (USDA) Rural Housing Service (RHS).

From 2007 to 2021, an average of 3.4 million homeowners annually claimed the MI premium tax deduction, and a total of $64.7 billion in deductions were claimed. This important tax policy has supported low- and moderate-income homeowners, who on average have received an annual deduction of $1,454. In 2021, the last year the deduction was available, qualifying middle-class homeowners received an average deduction of $2,364, according to IRS data.

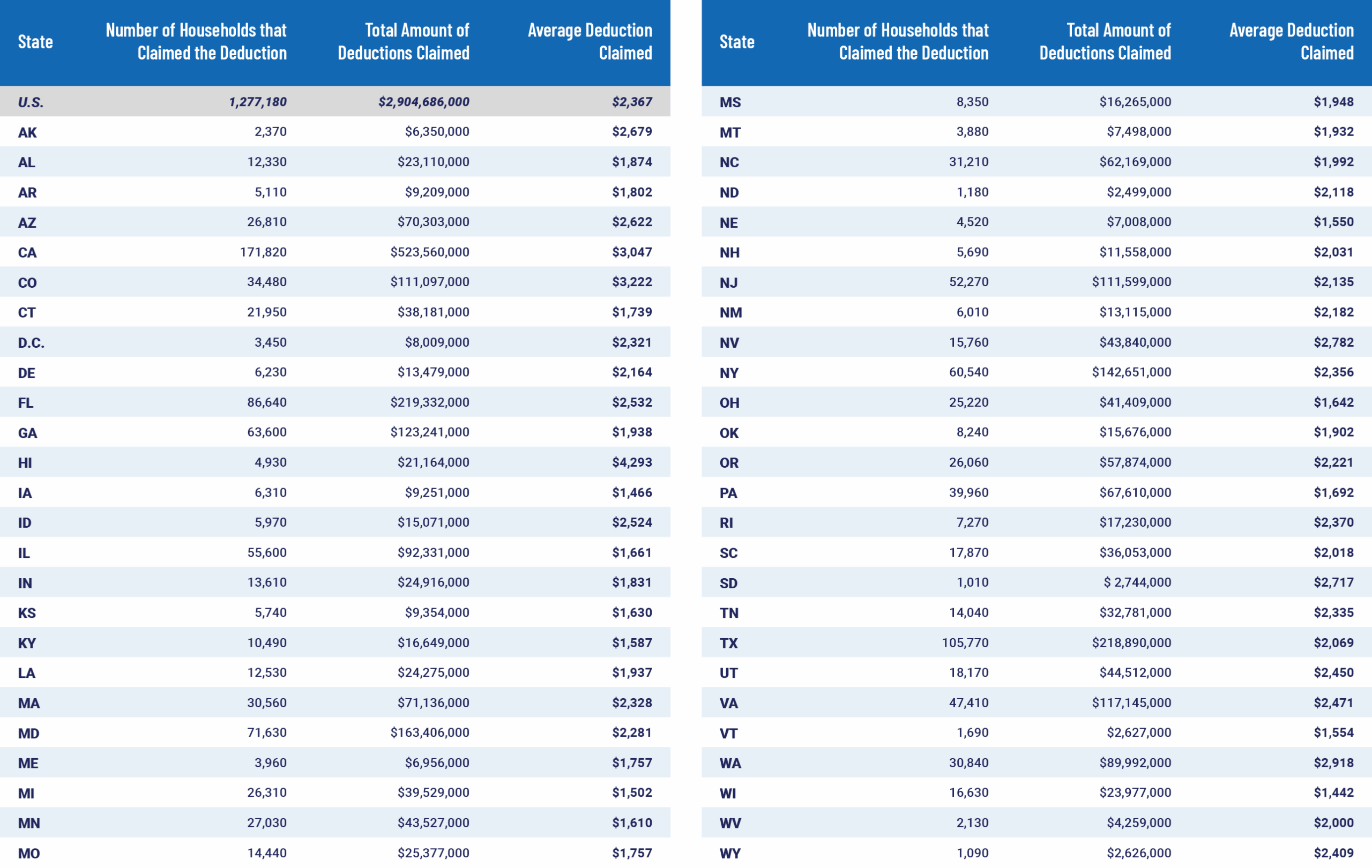

Number of Households That Claimed The MI Tax Deduction in 2021

The table below breaks down at the state level the number of households that claimed the MI tax deduction and the total amount of deductions claimed in 2021, according to the latest data available from the IRS.

Ways to enhance benefits of MI premium deduction

Although the ability of borrowers to deduct MI premiums from federal income taxes has been made permanent, benefitting millions of homeowners, the adjusted gross income (AGI) cap on the MI premium deduction has never been raised since 2007.

In order to expand its reach to more hard-working households, USMI calls on Congress to build upon its work to support homeowners and prospective homebuyers by increasing the existing AGI phaseout.

Interested in understanding MI?

Additional Resources

- Letter: USMI Joins Coalition in Support of Mortgage Insurance Premium Tax Deduction

- Letter: Statement for the Record for U.S. Senate Committee on Finance’s hearing, “Tax Policy’s Role in Increasing Affordable Housing Supply for Working Families.”

- Letter: Joint Trades Letter to Senate Finance Committee in Support of MI Tax Deduction

- Letter: Joint Trades Letter to House Ways and Means Committee in Support of MI Tax Deduction

- Letter: Statement to House Committee on Ways and Means’ Hearing, “Nowhere to Live: Profits, Disinvestment, and the American Housing Crisis”

- Letter: Statement to Senate Finance Committee Hearing, “The Role of Tax Incentives in Affordable Housing”

- Letter: USMI Calls for Senate Finance Committee to Co-Sponsor the Middle Class Mortgage Insurance Premium Act of 2022

- Major Housing Industry Trades and Homeownership Advocates Letter on Tax Treatment of MI Premiums

- USMI Letter to the Joint Committee on Taxation