Press Release: Private Mortgage Insurance Helped More Americans Become Homeowners in 2015

For Immediate Release

June 1, 2016

Media Contacts

Laura Capicotto 202-777-3536 (lcapicotto@clsstrategies.com)

Private Mortgage Insurance Helped More Americans Become Homeowners in 2015

USMI Data Highlights Consumer Benefits During National Homeownership Month

(June 1, 2016) – Private mortgage insurance (MI) helped approximately 740,000 homeowners in 2015, a more than 18 percent increase over 2014, U.S. Mortgage Insurers (USMI) today announced in conjunction with National Homeownership Month. This growth mirrors the positive national trend showing total mortgage borrowing reaching a four-year high.

“As we celebrate Homeownership Month, USMI is proud that private mortgage insurance is an essential part of the mortgage finance system that helped even more borrowers become homeowners last year” said Lindsey Johnson, USMI President and Executive Director. “MI is a great option to help borrowers address high down payment requirements, which can be one of the biggest hurdles to homeownership. Consumers should know about all the options, including the benefits of MI, before making one of the most significant financial decisions of their lives.”

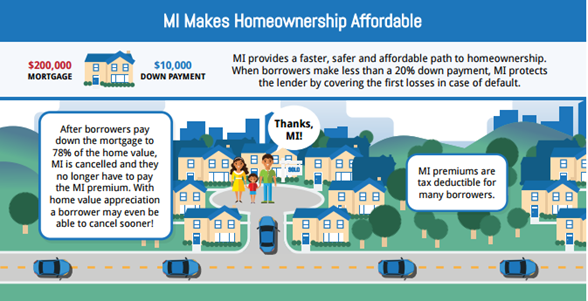

MI has helped millions become homeowners by enhancing their ability to obtain a mortgage in an affordable way.

There are a number of consumer benefits from MI:

- MI Provides Savings to Borrowers – Borrowers with above average credit scores can save as much as $8,000 over five years with private MI compared to FHA insurance, according to WalletHub’s 2016 Mortgage Insurance Report.

- MI Helps First-Time Homebuyers – Nearly 50 percent of loans covered by MI in 2015 were for first-time homebuyers and more than 40 percent were borrowers with incomes below $75,000. In 2015, MI helped approximately 740,000 homeowners purchase or refinance a mortgage. For more data, visit the USMI data-snapshot.

- MI is Cancelable – Private MI paid for by the borrower can be cancelled when the borrower pays down the mortgage to 78 percent of the home value. Because borrowers can stop paying private MI premiums at a certain point, this can lead to real savings over the life of their loan. With home value appreciation, a borrower may be able to cancel MI even sooner. For more information on MI cancelability, visit our comparison of private mortgage insurance and FHA insurance.

- MI is Tax Deductible – MI premiums are treated as “mortgage interest” and are tax deductible for many borrowers. According to the IRS, 4.7 million taxpayers benefited from deductions for MI in 2013, with an average deduction of $1,387. For more data, visit the USMI data-snapshot.

- MI Protects Taxpayers from Another Bailout – Because private MI is backed by private capital, if the borrower defaults, MI covers the first losses thus reducing the risk to government – and ultimately taxpayers – of another bailout. Independent polling shows Americans support reducing taxpayer exposure through greater reliance on private capital.

“Homeownership remains an important goal for most Americans, creating long-term value for individuals and their communities. USMI members are proud to help millions of Americans become homeowners,” said Johnson. “A strong and vibrant private Mortgage Insurance industry plays an important role in facilitating homeownership for millions of Americans, and MI is prepared to do more.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance (MI) offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.