Blog: Private Mortgage Insurance Is Helping First-Time Homebuyers Become Homeowners

By Lindsey Johnson

A myth about homeownership that discourages many prospective homeowners is that they need a 20 percent down payment to obtain a home loan. Not true! What many borrowers do not realize is that they can qualify for a mortgage with significantly less than 20 percent down. This is particularly true when it comes to first-time homebuyers.

A recent survey from the National Association of REALTORS® found that among first-time homebuyers who obtained a mortgage, more than 70 percent made a down payment of less than 20 percent. What’s more, according to Genworth Mortgage Insurance’s August 2018 “First-Time Homebuyer Market Report,” 66 percent of all homebuyers using low down payment mortgages were first-time buyers, and 79 percent of all first-time homebuyers used some form of low down payment mortgages.

As first-time homebuyers consider taking the exciting leap into homeownership, it’s important for them to fully understand all the home loan options available in the market. Of the variety of home loans available, conventional loans with private mortgage insurance (MI) stand out as one of the most competitive and affordable paths to homeownership.

U.S. Mortgage Insurers (USMI) recently released a report highlighting how MI helps bridge the down payment gap in the United States and promotes homeownership. Importantly, the report confirmed what has long been known: MI makes it easier for creditworthy borrowers with limited down payments to access conventional mortgage credit. Specifically, the report found:

- MI has helped nearly 30 million families nationally purchase or refinance a home over the last 60 years

- In 2017 alone, MI helped more than one million borrowers purchase or refinance a home

- Of the total 2017 number, 56 percent of purchase loans went to first-time homebuyers and more than 40 percent of those borrowers had annual incomes below $75,000, which further demonstrates that MI serves middle-income households

- At the state level, Texas ranks first in terms of the number of homeowners (79,030) who were able to purchase or refinance a home with MI in 2017. This was followed by California (72,938), Florida (69,827), Illinois (47,866), and Michigan (41,810)

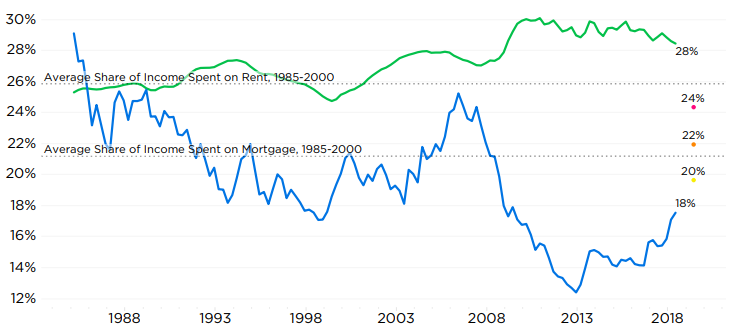

Data show that today many Americans are spending more of their income on rent than they are on mortgage payments. From 1985 to 2000, the share of income spent on mortgage payments was 21 percent; in Q2 2018 it was 18 percent. Conversely, from 1985 to 2000 the share of income spent on rent was slightly higher at 26 percent and has risen to 28 percent as of Q2 2018. As many individuals and families look to make the step from renting to owning their own home to create greater stability and build long-term equity, it’s essential that these individuals have prudent low down payment options – such as private MI – available for their future homeownership needs.

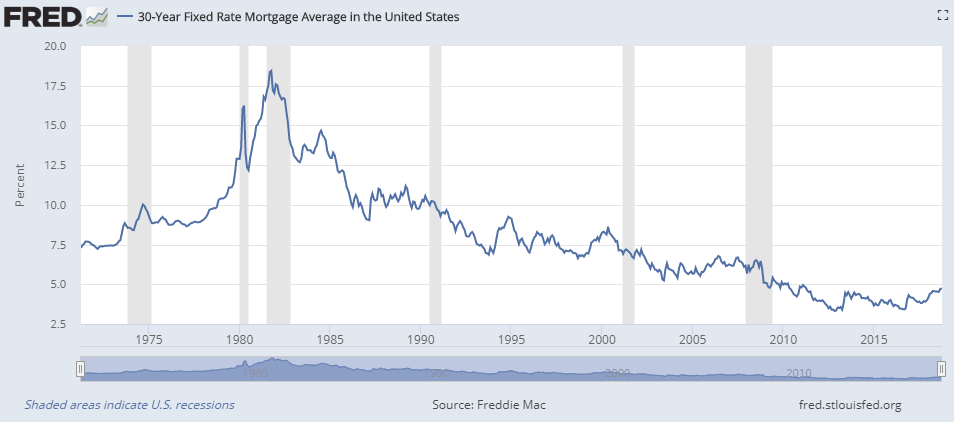

In addition to the wealth creation that homeownership fosters, today’s historically low mortgage interest rates are a good reason to buy a home now. Over the course of nearly 35 years, the housing market has experienced an extraordinary decline in mortgage interest rates. In 1981, the average rate for a 30-year fixed-rate mortgage stood at over 18 percent; it stood at approximately 4.72 percent at the end of September 2018. Borrowers should take advantage of these historically low mortgage interest rates because housing finance experts forecast that this interest rate decline is over, and primary mortgage rates are on the rise.

Homebuyers shouldn’t sit on the sidelines and put off buying the home of their dreams simply because they aren’t in the position to put 20 percent down. Since 1957, MI has helped millions of Americans – particularly first-time homebuyers – become successful homeowners, and it will continue to be a foundation of the housing market and a resource for borrowers in the years to come.